Franklin County Area Tax Bureau Form

What is the Franklin County Area Tax Bureau

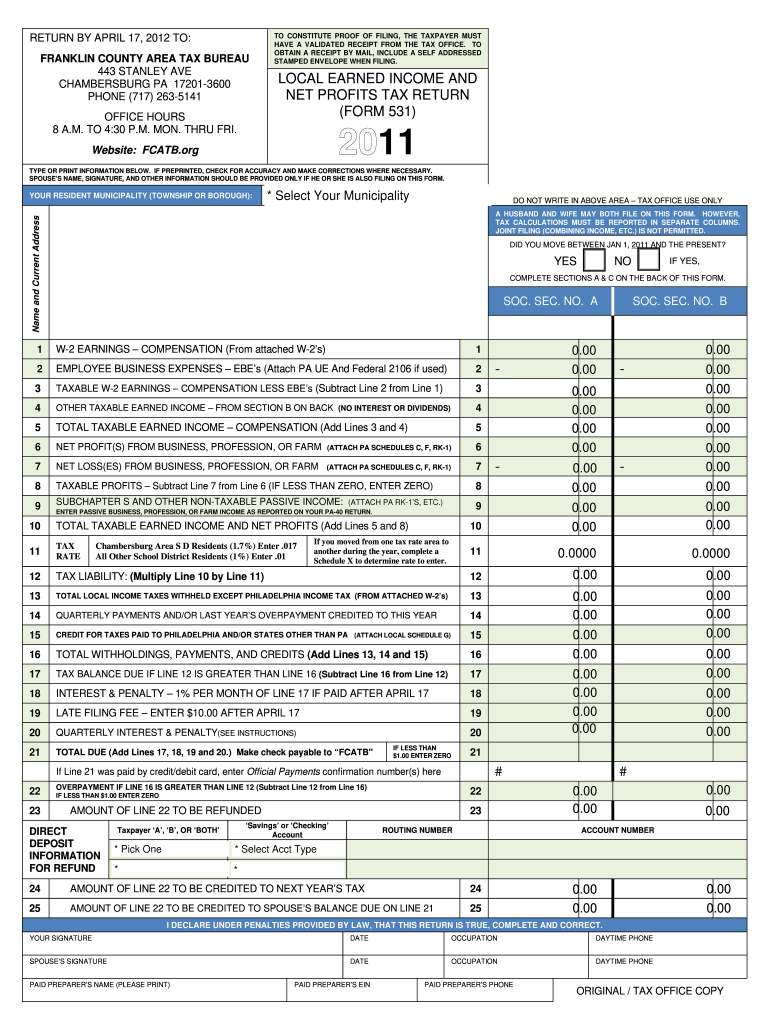

The Franklin County Area Tax Bureau (FCATB) is the governing body responsible for the administration and collection of local taxes in Franklin County, Pennsylvania. This includes various types of taxes such as earned income tax, local services tax, and other related levies. The bureau ensures compliance with state laws and local ordinances, providing services to residents and businesses within the county.

Steps to Complete the Franklin County Area Tax Bureau Form 531

Filling out the Franklin County Area Tax 531 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your personal identification details and income records. Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form completely, ensuring all sections are addressed. Once completed, review the form for any errors or omissions, and then proceed to submit it according to the guidelines provided.

Legal Use of the Franklin County Area Tax Bureau Form 531

The Franklin County Area Tax 531 form is legally binding when completed and submitted in accordance with applicable laws. To ensure its validity, it is essential to meet specific requirements, such as providing accurate information and obtaining the necessary signatures. Utilizing a secure platform for electronic submission can enhance the legal standing of the form, as it ensures compliance with eSignature regulations, such as the ESIGN Act and UETA.

Form Submission Methods

There are several methods available for submitting the Franklin County Area Tax 531 form. Taxpayers can choose to submit the form online through the Franklin County Area Tax Bureau's official website, ensuring a quick and efficient process. Alternatively, individuals may opt to mail the completed form to the bureau's office or deliver it in person during business hours. Each method has its own guidelines, so it is important to follow the instructions provided to avoid delays.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Franklin County Area Tax 531 form is crucial for compliance. Typically, the form must be submitted by April 15 of the tax year. However, it is advisable to check for any updates or changes to deadlines, as local regulations may vary. Missing the deadline can result in penalties or interest on unpaid taxes, making timely submission essential for all taxpayers.

Required Documents

When completing the Franklin County Area Tax 531 form, certain documents are required to support your submission. These may include proof of income, such as W-2 forms or 1099 statements, identification documents, and any prior tax returns if applicable. Having these documents ready will facilitate the completion process and ensure that all necessary information is provided.

Who Issues the Form

The Franklin County Area Tax Bureau is responsible for issuing the Franklin County Area Tax 531 form. This bureau manages the collection of local taxes and provides the necessary forms and resources for taxpayers. Residents can obtain the form directly from the bureau's office or through their official website, where additional guidance and support are also available.

Quick guide on how to complete franklin county area tax bureau 100032708

Effortlessly Create Franklin County Area Tax Bureau on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a wonderful eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Franklin County Area Tax Bureau across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to alter and electronically sign Franklin County Area Tax Bureau with ease

- Obtain Franklin County Area Tax Bureau and click on Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Emphasize signNow sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this task.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting documents. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Franklin County Area Tax Bureau ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the franklin county area tax bureau 100032708

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franklin county area tax 531 form used for?

The franklin county area tax 531 form is used for reporting local tax information specific to residents and businesses within Franklin County. It is essential to ensure compliance with local tax regulations and helps in calculating your local tax liability accurately.

-

How can airSlate SignNow assist with the franklin county area tax 531 form?

airSlate SignNow streamlines the process of completing and signing the franklin county area tax 531 form. With our eSignature solution, you can fill out, sign, and send this form electronically, saving time and reducing the complexity of paperwork.

-

Is there a fee for using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans depending on your needs, including options tailored for individuals and businesses. By using our platform for the franklin county area tax 531 form, you gain access to a cost-effective solution that enhances efficiency.

-

Can I track the status of my franklin county area tax 531 form using airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your franklin county area tax 531 form in real-time. This ensures that you can confirm when the document has been viewed, signed, and completed.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers a range of features including customizable templates, secure cloud storage, and collaboration tools. These features make managing the franklin county area tax 531 form and other tax-related documents efficient and user-friendly.

-

Is it easy to integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow easily integrates with various applications and services, allowing you to enhance your workflow. Whether you’re using accounting software or customer relationship management (CRM) tools, integrating them can help streamline the completion of the franklin county area tax 531 form.

-

What benefits can I expect from using airSlate SignNow for signing the franklin county area tax 531 form?

Using airSlate SignNow for the franklin county area tax 531 form provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. You also minimize the risk of errors typically associated with traditional paper forms.

Get more for Franklin County Area Tax Bureau

Find out other Franklin County Area Tax Bureau

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF