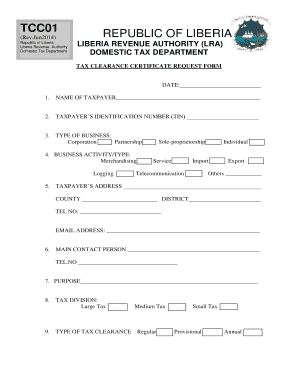

Liberia Revenue Authority Tax Clearance Form

What is the Liberia Revenue Authority Tax Clearance

The Liberia Revenue Authority Tax Clearance is a formal document issued by the Liberia Revenue Authority (LRA) that certifies an individual or business's compliance with tax obligations. This certificate is essential for various transactions, including securing government contracts, applying for loans, or conducting business with other entities. It serves as proof that the taxpayer has settled all tax dues and is in good standing with the LRA.

How to obtain the Liberia Revenue Authority Tax Clearance

To obtain the Liberia Revenue Authority Tax Clearance, individuals or businesses must first ensure that all tax obligations are met. This includes filing all necessary tax returns and paying any outstanding taxes. Once compliance is confirmed, the applicant can submit a request to the LRA. This process can often be initiated online through the Liberia Revenue Authority website or by visiting their offices in person. Required documentation may include identification, tax returns, and proof of payment.

Steps to complete the Liberia Revenue Authority Tax Clearance

Completing the Liberia Revenue Authority Tax Clearance involves several key steps:

- Ensure all tax returns are filed and taxes paid.

- Gather necessary documents, such as identification and proof of tax payments.

- Access the LRA website or visit their office to initiate the clearance request.

- Submit the required documents and any additional information requested by the LRA.

- Wait for processing and follow up if necessary.

Legal use of the Liberia Revenue Authority Tax Clearance

The Liberia Revenue Authority Tax Clearance is legally binding and is often required for various official transactions. It can be used to demonstrate tax compliance when applying for loans, bidding on government contracts, or engaging in business partnerships. Failure to provide a valid tax clearance can result in penalties or disqualification from certain business opportunities.

Required Documents

When applying for the Liberia Revenue Authority Tax Clearance, several documents may be required, including:

- Proof of identity (e.g., national ID or passport).

- Completed tax returns for the relevant periods.

- Receipts or proof of payment for any outstanding taxes.

- Any additional documentation as specified by the LRA.

Application Process & Approval Time

The application process for the Liberia Revenue Authority Tax Clearance typically involves submitting the required documents online or in person. The approval time can vary based on the LRA's workload and the completeness of the submitted application. Generally, applicants can expect a response within a few business days to a couple of weeks, depending on the specific circumstances.

Quick guide on how to complete liberia revenue authority tax clearance

Complete Liberia Revenue Authority Tax Clearance effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without hindrances. Manage Liberia Revenue Authority Tax Clearance on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Liberia Revenue Authority Tax Clearance without any hassle

- Find Liberia Revenue Authority Tax Clearance and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a standard ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Edit and eSign Liberia Revenue Authority Tax Clearance and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the liberia revenue authority tax clearance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining a Liberia Revenue Authority tax clearance?

To obtain a Liberia Revenue Authority tax clearance, you need to file your tax returns and ensure all due taxes are paid. Once your tax obligations are met, you can request the clearance certificate through the Liberia Revenue Authority's official channels. This document will confirm your compliance with tax laws, which is essential for various business transactions.

-

How does airSlate SignNow help with tax clearance documentation?

airSlate SignNow allows you to quickly digitize and eSign documents required for the Liberia Revenue Authority tax clearance process. Our platform streamlines the preparation and submission of tax-related documents, saving you time and ensuring compliance. Using our solution, you can easily manage your documents, making the tax clearance process more efficient.

-

What are the costs associated with the Liberia Revenue Authority tax clearance?

The costs for obtaining a Liberia Revenue Authority tax clearance typically involve any outstanding tax payments you may owe. Additional fees could apply based on the specific services required by the Liberia Revenue Authority. By ensuring your tax submissions are accurate, you can avoid extra costs related to penalties or late fees.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features like eSigning, document templates, and secure cloud storage to manage your tax documents effectively. Our platform ensures that all your documents are legally compliant and easily accessible when applying for Liberia Revenue Authority tax clearance. Utilizing these features can signNowly reduce administrative burden and enhance your document workflow.

-

Can airSlate SignNow integrate with other applications for tax filing?

Yes, airSlate SignNow offers integration with various accounting and tax software to help you streamline your tax filing process. This connectivity allows seamless sharing of data and documents, making it easier to ensure compliance with Liberia Revenue Authority tax clearance requirements. Leveraging integrations reduces the risk of errors and speeds up your workflow.

-

What are the benefits of using airSlate SignNow for tax clearance?

Using airSlate SignNow for tax clearance simplifies the documentation process and enhances overall efficiency. You can quickly prepare and eSign necessary documents for Liberia Revenue Authority tax clearance, reducing the time from submission to approval. Our platform also ensures you maintain compliance with tax regulations, ultimately bolstering your business credibility.

-

Is it necessary to have a physical presence to obtain Liberia Revenue Authority tax clearance?

No, it is not necessary to have a physical presence to obtain Liberia Revenue Authority tax clearance, as many processes can be completed online. Utilizing airSlate SignNow, you can manage your documents remotely, ensuring that you meet all requirements without the need for in-person visits. This convenience makes the tax clearance process more accessible for businesses.

Get more for Liberia Revenue Authority Tax Clearance

- Academic forgiveness form stark state college starkstate

- Form use while depositig assignmeny to study centre of ignou

- Nsf cover sheet 5718757 form

- Form oel dv hm

- Prelude to programming 6th edition pdf form

- Affidavit of military service cook county form

- Sc1040tc3913 pdf form

- Case management agreement template form

Find out other Liberia Revenue Authority Tax Clearance

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile