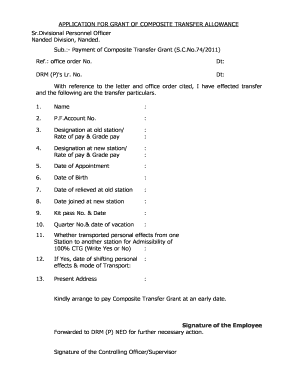

Grant Composite Transfer Form

What is the Grant Composite Transfer

The Grant Composite Transfer refers to a formal process that allows individuals to apply for a transfer of grant funds or allowances within specific guidelines. This process is often utilized in various sectors, including education and government, to ensure that resources are allocated effectively. The composite transfer grant format typically includes necessary details such as the applicant's information, the purpose of the transfer, and the amount being requested. Understanding this form is crucial for applicants to navigate the complexities of grant management.

Steps to Complete the Grant Composite Transfer

Completing the Grant Composite Transfer involves several key steps to ensure accuracy and compliance with regulations. Here is a structured approach:

- Gather Required Information: Collect all necessary documentation, including identification and any previous grant records.

- Fill Out the Form: Carefully complete the composite transfer grant format, ensuring all fields are filled out accurately.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid delays.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, based on the guidelines provided.

- Follow Up: After submission, monitor the status of your application to address any issues that may arise.

Legal Use of the Grant Composite Transfer

The legal use of the Grant Composite Transfer is governed by specific regulations that ensure the integrity of the process. Compliance with applicable laws, such as the ESIGN Act and UETA, is essential for the electronic submission of the form. These laws validate eSignatures and ensure that electronic documents are legally recognized. Additionally, understanding the legal requirements helps protect the rights of both the applicant and the granting agency, ensuring that all parties adhere to established protocols.

Eligibility Criteria

Eligibility for the Grant Composite Transfer typically varies depending on the specific program or agency involved. Common criteria may include:

- Residency requirements within the jurisdiction of the grant.

- Demonstrated need for the transfer of funds.

- Compliance with any previous grant conditions.

- Submission of all required documentation within specified deadlines.

It is important for applicants to review the eligibility criteria carefully to ensure they meet all requirements before applying.

Required Documents

When applying for the Grant Composite Transfer, certain documents are typically required to support the application. These may include:

- Proof of identity, such as a government-issued ID.

- Previous grant documentation, if applicable.

- Financial statements or records demonstrating the need for transfer.

- Any additional forms or certifications as specified by the granting agency.

Having these documents ready can streamline the application process and reduce the likelihood of delays.

Form Submission Methods

The Grant Composite Transfer can be submitted through various methods, depending on the guidelines set by the issuing agency. Common submission options include:

- Online Submission: Many agencies allow for electronic submission through their official websites, providing a quick and efficient way to apply.

- Mail: Applicants may choose to print the completed form and send it via postal service, ensuring it is sent to the correct address.

- In-Person: Some agencies may require or allow applicants to submit the form in person, providing an opportunity to ask questions directly.

Choosing the appropriate method based on personal circumstances and agency preferences can enhance the application experience.

Quick guide on how to complete grant composite transfer

Effortlessly Prepare Grant Composite Transfer on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Grant Composite Transfer on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest method to edit and eSign Grant Composite Transfer effortlessly

- Find Grant Composite Transfer and click on Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Select pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Decide how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Grant Composite Transfer and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the grant composite transfer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the composite grant format and how can it be used in digital signing?

The composite grant format is a structured method for presenting grant proposals in a clear and concise manner. airSlate SignNow supports this format, allowing users to create, send, and eSign documents efficiently. Utilizing this format enhances the clarity of your proposals, ensuring that all necessary information is laid out for better understanding and review.

-

How does airSlate SignNow simplify the use of the composite grant format?

airSlate SignNow provides customizable templates that include the composite grant format, making it easy to fill out and send proposals. The platform’s intuitive interface allows users to seamlessly incorporate this format into their documents. This simplifies the grant application process and helps users stay organized.

-

Is there a cost associated with using the composite grant format in airSlate SignNow?

airSlate SignNow offers various pricing plans, many of which allow users to utilize the composite grant format at no additional cost. The subscription includes access to templates and advanced features that support efficient document management. Visit our pricing page for more details on what’s available.

-

What features does airSlate SignNow offer for enhancing the composite grant format?

airSlate SignNow includes features such as automated workflows, collaboration tools, and advanced eSigning capabilities that optimize the composite grant format. Users can track document statuses in real-time and receive notifications, ensuring that grant proposals are processed quickly. These features streamline the entire grant application process.

-

Can I integrate airSlate SignNow with other applications while working with the composite grant format?

Yes, airSlate SignNow offers integrations with a variety of applications, such as Google Drive, Salesforce, and Microsoft Office. This interoperability enhances the usability of the composite grant format by allowing users to import data and documents from other platforms easily. Integrating these tools can signNowly reduce the time spent on grant applications.

-

What are the benefits of using airSlate SignNow for the composite grant format?

Using airSlate SignNow for the composite grant format helps streamline the proposal creation and approval process. Benefits include faster document turnaround, enhanced collaboration among team members, and the ability to track document progress easily. These advantages make airSlate SignNow a cost-effective solution for managing grant applications.

-

How secure is the information I share when using the composite grant format with airSlate SignNow?

airSlate SignNow prioritizes user security, employing advanced encryption and compliance with leading security standards. When using the composite grant format, all data is securely stored, protecting sensitive information throughout the signing process. Users can feel confident that their grant proposals are safe.

Get more for Grant Composite Transfer

Find out other Grant Composite Transfer

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors