F Form in Vat

What is the F Form in VAT

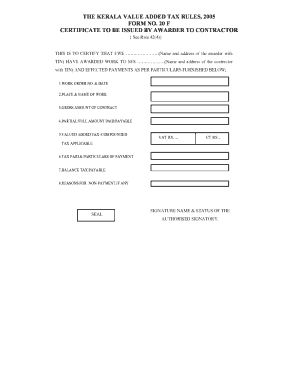

The F Form in VAT, specifically known as Form 20 F Kerala VAT, is a crucial document used for the declaration of purchases made by registered dealers in Kerala. This form facilitates the claiming of input tax credits on purchases that are made for resale or for use in the manufacturing of goods. It is essential for businesses to understand the significance of this form as it directly impacts their tax liabilities and compliance with state tax regulations.

How to Use the F Form in VAT

Using the F Form in VAT involves a systematic approach to ensure compliance with Kerala's tax laws. First, registered dealers must accurately fill out the form with details of their purchases, including the seller's information, invoice numbers, and the amount of VAT paid. This form must be submitted to the appropriate tax authority to claim input tax credits. It is important to maintain all supporting documentation, such as invoices, to substantiate the claims made on the F Form.

Steps to Complete the F Form in VAT

Completing the F Form in VAT requires careful attention to detail. Here are the steps to follow:

- Gather all relevant purchase invoices and documents.

- Fill in the dealer's registration details at the top of the form.

- List each purchase transaction, including the seller's name, invoice number, and the total VAT amount paid.

- Calculate the total input tax credit to be claimed.

- Review the form for accuracy and completeness before submission.

Legal Use of the F Form in VAT

The F Form in VAT is legally binding when filled out correctly and submitted in accordance with Kerala's tax regulations. It serves as proof of purchases made and the VAT paid, which allows businesses to reclaim input tax credits. Compliance with the legal requirements surrounding the F Form is essential to avoid penalties and ensure that the tax credits claimed are valid.

Key Elements of the F Form in VAT

Key elements of the F Form include:

- Dealer Information: The name, address, and registration number of the dealer.

- Purchase Details: Information about the purchases, including the seller's name and invoice details.

- VAT Amount: The total VAT paid on the purchases that are being claimed.

- Signature: The dealer's signature certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing the F Form in VAT is subject to specific deadlines set by the Kerala tax authorities. It is important for businesses to be aware of these dates to avoid late fees and penalties. Typically, the F Form must be filed quarterly, and the due dates may vary based on the financial year. Keeping track of these deadlines ensures compliance and helps maintain a good standing with tax authorities.

Quick guide on how to complete form 20 kerala

Complete form 20 kerala seamlessly on any device

Digital document management has gained traction with organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage vat kerala on any device using airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

The easiest method to alter and eSign form 20 f kvat effortlessly

- Find f kerala and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind concerns about lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign form 20 f kerala vat and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to vat kerala

Create this form in 5 minutes!

How to create an eSignature for the form 20 f kvat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 20 f kerala vat

-

What is VAT Kerala and how does it apply to my business?

VAT Kerala refers to the Value Added Tax implemented within the state of Kerala for various goods and services. Understanding VAT Kerala is crucial for businesses operating in this region, as it impacts pricing and tax compliance. Utilizing airSlate SignNow can help streamline document management related to VAT filings.

-

How can airSlate SignNow help with VAT Kerala compliance?

airSlate SignNow simplifies the signing and management of VAT-related documents, ensuring that your business remains compliant with VAT Kerala regulations. The platform enables users to send and eSign documents securely, helping to expedite VAT filing processes. By using airSlate SignNow, you can reduce the time spent on compliance tasks.

-

What features does airSlate SignNow offer for businesses dealing with VAT Kerala?

airSlate SignNow offers various features to assist businesses with VAT Kerala, including document templates, eSigning capabilities, and secure storage. These features allow users to create VAT-related documents quickly and efficiently while ensuring they meet regulatory requirements. Additionally, the platform offers integration with other tools to enhance productivity.

-

Is airSlate SignNow cost-effective for managing VAT Kerala documents?

Yes, airSlate SignNow is a cost-effective solution for managing documents related to VAT Kerala. It reduces the need for physical paperwork and minimizes operational costs by offering a cloud-based signing platform. Companies can save time and resources while ensuring compliance with VAT regulations.

-

Can I integrate airSlate SignNow with my existing accounting tools for VAT Kerala?

Absolutely! airSlate SignNow allows for smooth integration with popular accounting software that handles VAT Kerala transactions. This integration helps streamline your accounting processes and ensures that all VAT-related documents are easily accessible and manageable in one place.

-

What are the benefits of using airSlate SignNow for VAT Kerala document processing?

Using airSlate SignNow for VAT Kerala document processing brings numerous benefits such as enhanced efficiency, improved compliance, and reduced paperwork. By digitizing your document workflows, you can quickly send, sign, and store VAT-related documents, signNowly speeding up your processes. This ease of use reduces errors and improves overall productivity.

-

Are electronic signatures valid for VAT Kerala documents?

Yes, electronic signatures are legally valid for VAT Kerala documents, as per Indian law. airSlate SignNow complies with relevant regulations ensuring that your electronically signed documents hold up in legal contexts. This means you can confidently eSign your VAT documents without any worry regarding their legitimacy.

Get more for form 20 kerala

- Osha emergency action plan fillable form

- Current event sheet form

- Etr form

- What is academic intervention services form

- Expungement information student affairs penn state university studentaffairs psu

- Parentguardian sign in sign out sheet form

- Psychotherapy case discussion form ranzcp

- Confidential recommendation form endicott college

Find out other kerala taxes forms

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement