Ira Deduction Worksheet Form

What is the IRA Deduction Worksheet

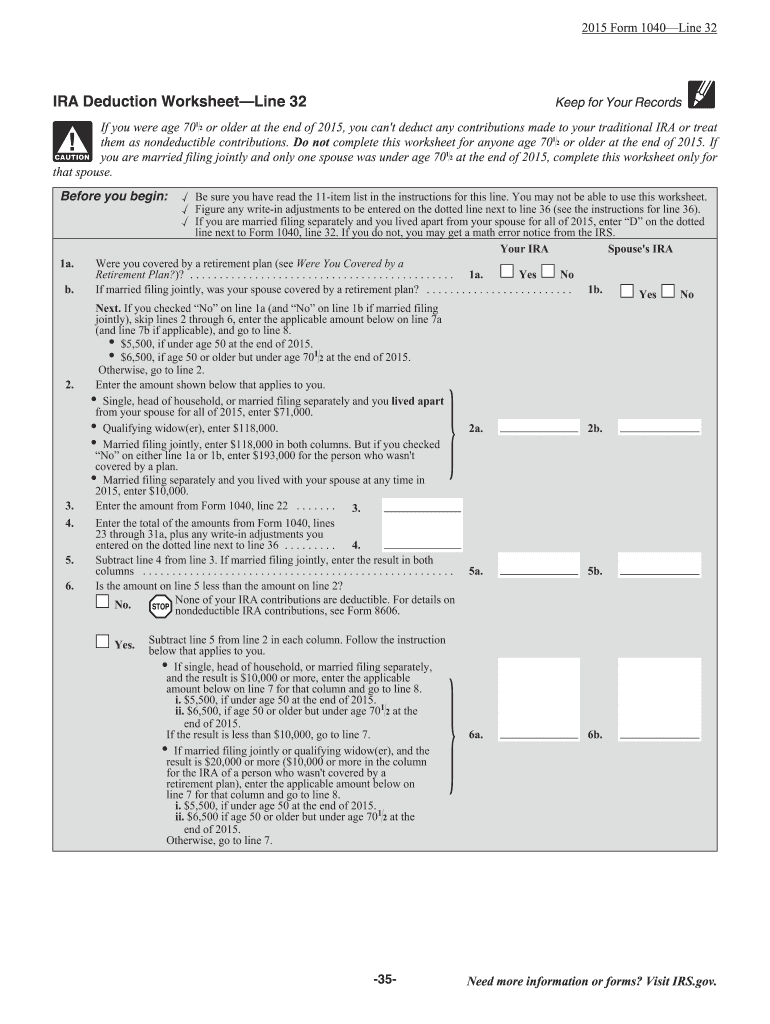

The IRA Deduction Worksheet is a crucial document used by taxpayers to determine their eligibility for deducting contributions made to an Individual Retirement Account (IRA) on their federal income tax returns. This worksheet helps individuals calculate the maximum amount they can deduct based on their filing status, income level, and participation in employer-sponsored retirement plans. Understanding this worksheet is essential for optimizing tax benefits associated with retirement savings.

How to use the IRA Deduction Worksheet

Using the IRA Deduction Worksheet involves several steps. First, gather your financial information, including your modified adjusted gross income (MAGI) and details about any retirement plans you may participate in. Next, follow the instructions on the worksheet to input your information accurately. The worksheet will guide you through calculations to determine your deductible amount. Finally, ensure that you keep this worksheet for your records, as it supports your tax return claims.

Steps to complete the IRA Deduction Worksheet

Completing the IRA Deduction Worksheet requires careful attention to detail. Begin by filling out your personal information, including your name and Social Security number. Then, report your MAGI, which is essential for determining your deduction limits. Follow the worksheet's instructions to answer questions regarding your participation in other retirement plans. After completing the calculations, review your results to confirm the deductible amount. This thorough approach ensures accuracy and compliance with IRS guidelines.

Key elements of the IRA Deduction Worksheet

Several key elements are essential to understanding the IRA Deduction Worksheet. These include your filing status, which affects deduction limits; your MAGI, which determines eligibility; and any contributions made to other retirement accounts. Additionally, the worksheet outlines phase-out ranges for higher-income earners, indicating how deductions may be reduced based on income levels. Familiarity with these elements is vital for effective tax planning.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the IRA Deduction Worksheet. These guidelines outline eligibility criteria for deducting IRA contributions, including income thresholds and filing status considerations. It is important to refer to the latest IRS publications to stay informed about any changes in tax laws that may affect your deductions. Adhering to these guidelines ensures compliance and maximizes your potential tax benefits.

Eligibility Criteria

Eligibility for using the IRA Deduction Worksheet is primarily based on income and filing status. Taxpayers must determine their MAGI to assess whether they qualify for full, partial, or no deductions. Additionally, participation in employer-sponsored retirement plans can impact eligibility. Understanding these criteria is crucial for making informed decisions about IRA contributions and maximizing tax advantages.

Quick guide on how to complete ira deduction worksheet

Complete Ira Deduction Worksheet effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Handle Ira Deduction Worksheet on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Ira Deduction Worksheet without effort

- Locate Ira Deduction Worksheet and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Ira Deduction Worksheet and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira deduction worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRA deduction worksheet?

An IRA deduction worksheet is a tool designed to help individuals calculate their potential deductions for contributions made to an IRA. It assists in determining the amount you can deduct based on your income, filing status, and retirement plan participation. Having a clear understanding of your deductions can help you maximize your retirement savings.

-

How can the airSlate SignNow platform assist with IRA deduction worksheets?

The airSlate SignNow platform simplifies the process of creating and managing IRA deduction worksheets. With its user-friendly interface, you can easily fill out the worksheet, eSign it, and save it for your records. This streamlined process ensures that your important documents are easily accessible whenever you need them.

-

Is there a cost associated with using airSlate SignNow for IRA deduction worksheets?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including individual users and businesses. Each plan provides access to its document management features, making it cost-effective for managing IRA deduction worksheets and other essential documents. You can choose a plan that aligns with your budget and requirements.

-

What features are available in the airSlate SignNow platform for managing financial documents?

AirSlate SignNow includes features such as document templates, eSigning, secure storage, and collaboration tools, which enhance your experience when working with financial documents like IRA deduction worksheets. Additionally, it provides audit trails and compliance features that ensure the integrity of your documents. These comprehensive tools cater to all your document management needs.

-

Can I integrate airSlate SignNow with other financial tools?

Yes, airSlate SignNow easily integrates with various financial tools and applications, which can streamline your workflow. Whether you use accounting software or financial management platforms, integrating them with airSlate SignNow allows for seamless document handling, including IRA deduction worksheets. This ensures that all your financial activities are connected and efficient.

-

How does airSlate SignNow ensure the security of my IRA deduction worksheets?

AirSlate SignNow prioritizes the security of your documents through advanced encryption protocols, secure cloud storage, and access controls. When you create or store your IRA deduction worksheets, you can trust that your sensitive information is well-protected. Regular security audits and compliance with industry standards further strengthen the platform's reliability.

-

What are the benefits of using airSlate SignNow for my IRA deduction worksheet?

Using airSlate SignNow for your IRA deduction worksheet provides several benefits, including time savings, ease of use, and accessibility. You can quickly complete and eSign your worksheets, ensuring that you stay organized for tax season. This efficient process helps you focus on maximizing your IRA contributions without the hassle of traditional paperwork.

Get more for Ira Deduction Worksheet

- Bellacinos application form

- Please refer to the academic integrity policy on the torrens university website before completing the form

- Security deposit receipt form

- Arizona marriage absentee application form

- Tata aig claim form 473508001

- Use the words in capitals to form a new word that fits into each blank

- Complete if the organization answered yes on form 990 part iv line 17 18 or 19 or if the

- Child custody visitation agreement template form

Find out other Ira Deduction Worksheet

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form