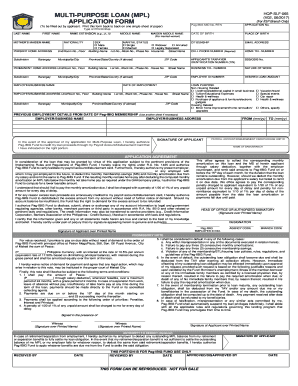

Pag Ibig Multi Purpose Loan Form Example

What is the Pag Ibig Multi Purpose Loan Form?

The Pag Ibig Multi Purpose Loan Form is a crucial document for individuals seeking financial assistance through the Pag Ibig Fund in the Philippines. This form allows members to apply for a loan that can be used for various purposes, such as home improvement, education, or medical expenses. The application process requires accurate information to ensure eligibility and proper processing of the loan request.

Steps to Complete the Pag Ibig Multi Purpose Loan Form

Completing the Pag Ibig Multi Purpose Loan Form involves several key steps to ensure that all required information is accurately provided. Begin by gathering necessary documents, such as proof of income and identification. Next, fill out the form with personal details, including your full name, address, and Pag Ibig membership number. Be sure to specify the purpose of the loan clearly. After completing the form, review all entries for accuracy before submission.

Key Elements of the Pag Ibig Multi Purpose Loan Form

The Pag Ibig Multi Purpose Loan Form includes several essential elements that applicants must complete. These elements typically encompass:

- Personal Information: Full name, address, contact details, and Pag Ibig membership number.

- Loan Purpose: A clear statement regarding the intended use of the loan funds.

- Income Details: Information about your current employment and income sources.

- Loan Amount Requested: The specific amount you wish to borrow.

- Signature: A signature to validate the application and confirm the accuracy of the provided information.

How to Obtain the Pag Ibig Multi Purpose Loan Form

The Pag Ibig Multi Purpose Loan Form can be obtained through various channels. Members can visit the official Pag Ibig Fund website to download a digital copy of the form. Alternatively, physical copies are available at Pag Ibig branches across the country. It is advisable to ensure that you are using the most current version of the form to avoid any processing delays.

Legal Use of the Pag Ibig Multi Purpose Loan Form

Using the Pag Ibig Multi Purpose Loan Form legally requires adherence to specific guidelines set by the Pag Ibig Fund. The form must be filled out truthfully, as providing false information can lead to penalties or denial of the loan application. Additionally, the form must be submitted within the designated time frame to ensure compliance with Pag Ibig regulations.

Application Process & Approval Time

The application process for the Pag Ibig Multi Purpose Loan involves submitting the completed form along with required documentation. Once submitted, the Pag Ibig Fund will review the application for completeness and accuracy. The typical approval time can vary, but applicants can expect a response within a few weeks. Factors affecting approval time include the completeness of the application and the volume of applications being processed.

Quick guide on how to complete pag ibig multi purpose loan form example

Complete Pag Ibig Multi Purpose Loan Form Example effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Pag Ibig Multi Purpose Loan Form Example on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Pag Ibig Multi Purpose Loan Form Example effortlessly

- Locate Pag Ibig Multi Purpose Loan Form Example and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to finalize your changes.

- Select how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form-finding, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Pag Ibig Multi Purpose Loan Form Example and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pag ibig multi purpose loan form example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form pag ibig loan?

A form pag ibig loan is a type of financing offered by the Pag-IBIG Fund in the Philippines, designed to assist members in acquiring homes and property. This loan offers affordable interest rates and flexible payment terms, making it accessible to ordinary Filipinos. Understanding the details of a form pag ibig loan is essential for potential borrowers to make informed decisions.

-

How can I apply for a form pag ibig loan through airSlate SignNow?

Applying for a form pag ibig loan through airSlate SignNow is simplified and efficient. You can complete your application online, eSign necessary documents, and submit your request without the need for physical meetings. Our platform streamlines the entire process to ensure a hassle-free experience for users.

-

What features does airSlate SignNow offer for managing form pag ibig loan applications?

airSlate SignNow provides several features to manage form pag ibig loan applications efficiently. Users can easily create, edit, and share loan documents while ensuring they are eSigned securely. The platform also offers templates specifically designed for pag ibig loans, saving time and reducing errors.

-

Are there any fees associated with the form pag ibig loan application?

While applying for a form pag ibig loan might involve some processing fees, these can vary based on specific terms and the loan amount. It's important to review the terms provided by the Pag-IBIG Fund as well as any fees related to the document processing through airSlate SignNow. Transparency about these fees helps borrowers plan their finances effectively.

-

What are the benefits of using airSlate SignNow for my form pag ibig loan documentation?

Using airSlate SignNow for form pag ibig loan documentation offers numerous benefits, including enhanced security and ease of access. You can sign documents from anywhere, reducing delays in the loan approval process. Additionally, our platform ensures that all documentation is stored safely and can be accessed anytime.

-

Can I integrate airSlate SignNow with other tools for my form pag ibig loan processes?

Yes, airSlate SignNow seamlessly integrates with various tools and applications that can assist in managing your form pag ibig loan processes. This ensures you can streamline your workflow, whether you're using project management software or customer relationship management (CRM) systems. Integration enhances efficiency and helps maintain accurate records.

-

What is the turnaround time for processing a form pag ibig loan application?

The turnaround time for processing a form pag ibig loan application can vary based on several factors, including the completeness of your application and the volume of requests. Generally, using airSlate SignNow can help expedite the process by simplifying document submission and ensuring all forms are correctly completed. Quick processing ultimately benefits borrowers looking to secure their loans promptly.

Get more for Pag Ibig Multi Purpose Loan Form Example

Find out other Pag Ibig Multi Purpose Loan Form Example

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer