Irs Form 8736

What is the IRS Form 8736

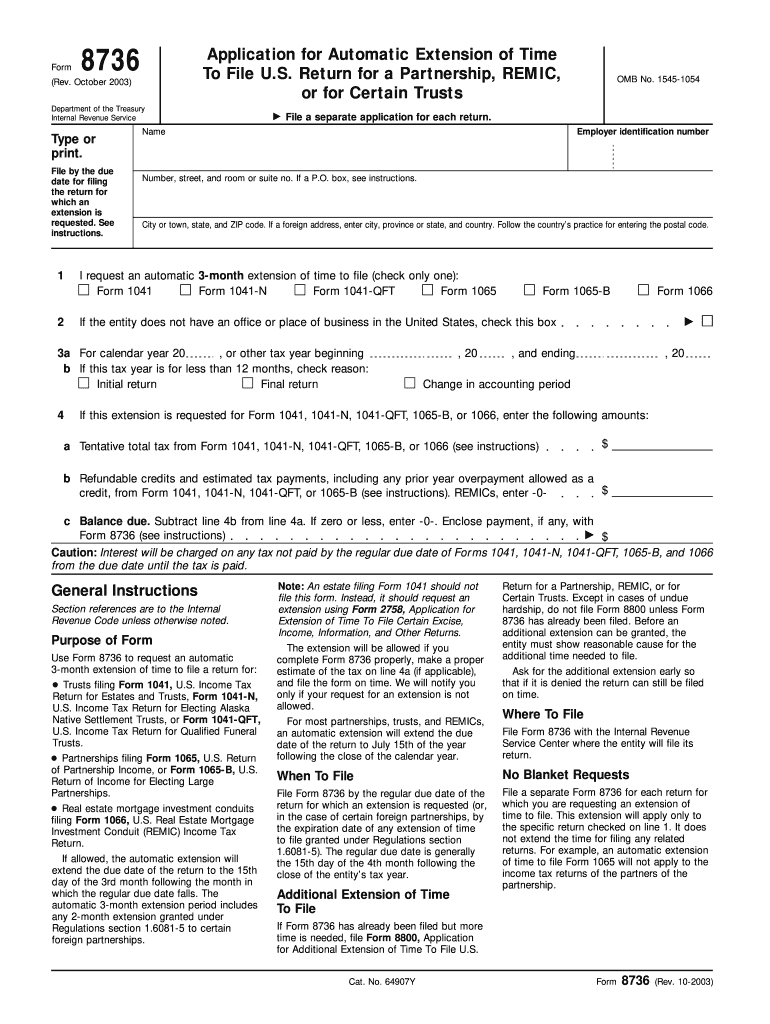

The IRS Form 8736 is a request for an automatic extension of time to file certain tax returns. This form is typically used by corporations and partnerships that need additional time to prepare their tax documents. It is important to note that while Form 8736 allows for an extension of time to file, it does not extend the time to pay any taxes owed. Understanding the purpose of this form is crucial for ensuring compliance with IRS regulations.

Steps to complete the IRS Form 8736

Completing the IRS Form 8736 involves several key steps:

- Gather necessary information, including the entity's name, address, and Employer Identification Number (EIN).

- Indicate the type of return for which you are requesting an extension.

- Specify the tax year for which the extension applies.

- Sign and date the form to certify its accuracy.

Once completed, ensure that all information is accurate to avoid delays in processing.

How to obtain the IRS Form 8736

The IRS Form 8736 can be obtained directly from the IRS website or through tax preparation software that supports IRS forms. Users can download the form in PDF format, which can be printed and filled out manually. Additionally, tax professionals may have access to this form and can assist in its completion.

Legal use of the IRS Form 8736

The legal use of the IRS Form 8736 is governed by IRS guidelines. To ensure that the form is legally binding, it must be completed accurately and submitted within the appropriate timeframe. Failure to comply with these requirements may result in penalties or denial of the extension request. It is essential to maintain a copy of the submitted form for your records.

Form Submission Methods

The IRS Form 8736 can be submitted through various methods:

- Online: Some tax software programs allow for electronic filing of the form.

- Mail: The completed form can be mailed to the appropriate IRS address, which varies based on the entity's location.

- In-Person: Taxpayers may also choose to deliver the form in person to their local IRS office.

Choosing the right submission method can help ensure timely processing of your extension request.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IRS Form 8736 is crucial for compliance. Generally, the form must be filed by the original due date of the tax return for which the extension is being requested. Missing this deadline can result in penalties and interest on any unpaid taxes. It is advisable to mark your calendar with these important dates to avoid any issues.

Quick guide on how to complete irs form 8736

Handle Irs Form 8736 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and store it securely online. airSlate SignNow provides all the necessary tools to generate, alter, and electronically sign your documents swiftly without interruptions. Manage Irs Form 8736 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Irs Form 8736 with ease

- Obtain Irs Form 8736 and then click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Irs Form 8736 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8736

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8736 and how is it used?

Form 8736 is a crucial document for businesses seeking to formally apply for a specific exemption or benefit. It is used to ensure compliance with regulatory requirements while streamlining the application process. Utilizing airSlate SignNow, you can easily fill, sign, and send Form 8736, ensuring a secure and efficient workflow.

-

How does airSlate SignNow simplify the use of Form 8736?

airSlate SignNow simplifies the use of Form 8736 by providing intuitive templates and a step-by-step signing process. Users can draft, share, and eSign the form digitally, eliminating the hassle of paperwork and reducing turnaround times. This means you can focus on your core business activities while ensuring your Form 8736 is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for Form 8736?

Yes, there is a pricing structure in place for using airSlate SignNow, which varies based on the features and number of users. However, it offers a cost-effective solution that saves time and resources when managing your Form 8736. Consider the value of streamlined processes and enhanced compliance as part of your investment.

-

Can I integrate Form 8736 with other applications using airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly connect your workflow with tools you already use. This means you can manage your Form 8736 alongside other documents, helping to enhance productivity and efficiency.

-

What are the security measures in place for handling Form 8736 with airSlate SignNow?

airSlate SignNow prioritizes security by using advanced encryption and authentication methods to protect your data. When handling Form 8736, you can rest assured that your information is guarded against unauthorized access and bsignNowes. Compliance with industry standards further strengthens your confidence in using our platform.

-

How can I track the status of my Form 8736 after sending it?

With airSlate SignNow, you can easily track the status of your sent Form 8736. The platform provides real-time updates and notifications when the document is viewed, signed, or completed. This transparency helps you stay informed about the progress and ensures timely follow-ups.

-

Are there any specific features for customizing Form 8736?

Yes, airSlate SignNow offers a variety of customization options for Form 8736. You can add your branding, adjust layout elements, and include necessary fields to meet your specific needs. This flexibility allows you to create a personalized document that reflects your business while ensuring it meets all requirements.

Get more for Irs Form 8736

- Investigation interview template form

- Angola visa application form passport visas express com

- Mitsubishi warranty registration form

- Annual test amp maintenance report for backflow prevention assemblies form

- Formulari ds 260

- Arizona form 140ez

- Arizona form 131 771933940

- Flamingo flocking ransom note western high school form

Find out other Irs Form 8736

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter