Sponsorship Receipt Form

What is the Sponsorship Receipt

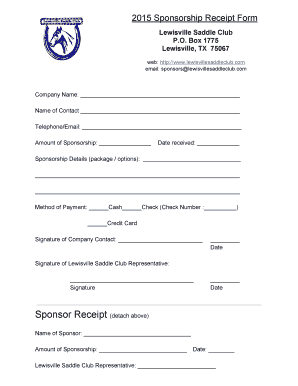

A sponsorship receipt is a formal document that acknowledges a financial contribution made by a sponsor to support a particular event, project, or initiative. This receipt serves as proof of the transaction and is often required for tax purposes. It typically includes details such as the name of the sponsor, the amount donated, the date of the contribution, and the purpose of the sponsorship. In the United States, this document is crucial for both donors and recipients to maintain accurate financial records and comply with tax regulations.

Key elements of the Sponsorship Receipt

When creating a sponsorship receipt, several key elements must be included to ensure it is valid and useful for both parties. These elements typically consist of:

- Sponsor Information: Name, address, and contact details of the sponsor.

- Recipient Information: Name, address, and contact details of the organization or individual receiving the sponsorship.

- Donation Amount: The total amount contributed by the sponsor.

- Date of Contribution: The date when the donation was made.

- Purpose of Sponsorship: A brief description of what the sponsorship supports.

- Signature: An authorized signature from the recipient to validate the receipt.

How to use the Sponsorship Receipt

The sponsorship receipt is primarily used for record-keeping and tax purposes. Sponsors can use it to document their charitable contributions, which may be eligible for tax deductions. Recipients should retain copies of all sponsorship receipts to provide transparency in their financial reporting. Additionally, organizations may use these receipts to demonstrate community support and engagement when applying for future funding or sponsorships.

Steps to complete the Sponsorship Receipt

Completing a sponsorship receipt involves a few straightforward steps:

- Gather Information: Collect all necessary details from the sponsor and the recipient.

- Fill Out the Receipt: Enter the sponsor and recipient information, donation amount, date, and purpose of the sponsorship.

- Review for Accuracy: Ensure all information is correct and complete before finalizing the document.

- Obtain Signature: Have an authorized representative from the recipient organization sign the receipt.

- Distribute Copies: Provide a copy to the sponsor for their records and retain one for the recipient's files.

Legal use of the Sponsorship Receipt

The sponsorship receipt is legally binding when it meets specific criteria set forth by U.S. regulations. To be considered valid, it must accurately reflect the transaction and include all required elements. Compliance with tax laws is essential, as sponsors may need this document to substantiate their contributions during tax filings. Additionally, organizations should ensure that the receipt aligns with any state-specific requirements related to charitable donations.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how sponsorship receipts should be handled for tax purposes. Sponsors can typically deduct contributions made to qualified organizations, provided they have proper documentation. The IRS requires that receipts include the amount donated and a description of the purpose of the sponsorship. Organizations must also ensure they are recognized as tax-exempt under IRS regulations to issue valid receipts for tax deductions.

Quick guide on how to complete sponsorship receipt

Effortlessly Prepare Sponsorship Receipt on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Sponsorship Receipt on any gadget using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Alter and eSign Sponsorship Receipt with Ease

- Obtain Sponsorship Receipt and click on Get Form to begin.

- Take advantage of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Sponsorship Receipt and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sponsorship receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sponsorship receipt in the context of airSlate SignNow?

A sponsorship receipt is an official document generated through airSlate SignNow that acknowledges the receipt of sponsorship funds or donations. This receipt serves as a crucial record for both sponsors and recipients, ensuring transparency and proper documentation for financial transactions.

-

How does airSlate SignNow simplify the process of creating a sponsorship receipt?

airSlate SignNow streamlines the creation of a sponsorship receipt by providing customizable templates and an intuitive interface. Users can easily input sponsorship details, add digital signatures, and send the receipt to all relevant parties without hassle, optimizing efficiency throughout the process.

-

Can I integrate airSlate SignNow with my existing accounting software for sponsorship receipts?

Yes, airSlate SignNow offers integrations with various accounting and financial software systems, allowing you to streamline your financial documentation, including sponsorship receipts. This integration facilitates smooth data transfer, reducing manual entry and the potential for errors.

-

What are the benefits of using airSlate SignNow for issuing sponsorship receipts?

Using airSlate SignNow for issuing sponsorship receipts provides numerous benefits, including increased efficiency, reduced paperwork, and improved tracking. Digital signatures ensure authenticity, while easy storage options improve document management for future reference.

-

Is there a cost associated with creating sponsorship receipts using airSlate SignNow?

There are subscription plans available for airSlate SignNow that can accommodate your needs for creating sponsorship receipts. The pricing is based on user volume and features, ensuring a cost-effective solution that scales with your organization's requirements.

-

What features does airSlate SignNow offer for managing sponsorship receipts?

airSlate SignNow offers features such as customizable templates, secure eSigning, and tracking capabilities specifically for managing sponsorship receipts. These features ensure that every document is professionally presented and easily accessible for all involved parties.

-

How secure is the information on my sponsorship receipts created with airSlate SignNow?

Security is a priority for airSlate SignNow. All sponsorship receipts are protected with industry-leading encryption and secure server protocols, ensuring that sensitive information remains confidential and protected from unauthorized access.

Get more for Sponsorship Receipt

- Housing stability benefitrent ready request city of hamilton form

- Esb nw1 form fill out ampamp sign online

- Child general passport application form

- Capital gains tax forms

- Motor vehicle proposal form jubilee general

- Invesco withdrawal online form

- Adult adhd self report scale asrs symptom checklist form

- Abilene high school athletic booster club abileneisd form

Find out other Sponsorship Receipt

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast