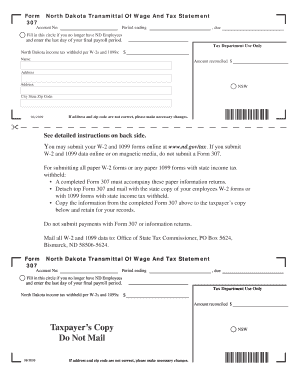

Nd Form 307

What is the ND Form 307?

The ND Form 307 is a tax form used by residents of North Dakota to report income and calculate their state tax liability. This form is essential for individuals and businesses alike, as it helps ensure compliance with state tax regulations. The form captures various types of income, deductions, and credits that may apply to the taxpayer's situation. Understanding the purpose of the ND Form 307 is crucial for accurate tax reporting and to avoid potential penalties.

Steps to Complete the ND Form 307

Filling out the ND Form 307 involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Begin by entering personal information, such as your name, address, and Social Security number.

- Report your total income from all sources on the designated lines of the form.

- Claim any eligible deductions and credits, ensuring you have documentation to support these claims.

- Calculate your total tax liability and any amount owed or refund due.

- Review the completed form for accuracy before submission.

Legal Use of the ND Form 307

The ND Form 307 is legally binding when completed accurately and submitted in accordance with state regulations. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the North Dakota Office of State Tax Commissioner. This includes proper completion, submission by the deadline, and maintaining records of all supporting documents. Failure to comply with these requirements could result in penalties or legal repercussions.

How to Obtain the ND Form 307

The ND Form 307 can be obtained through various means. It is available for download directly from the North Dakota Office of State Tax Commissioner's website. Additionally, taxpayers can request a physical copy by contacting the office or visiting local tax offices. Many tax preparation software programs also include the ND Form 307, allowing for easier completion and submission.

Form Submission Methods

Taxpayers have several options for submitting the ND Form 307. The form can be filed online through the North Dakota tax portal, which offers a convenient and secure method for submission. Alternatively, individuals may choose to mail the completed form to the appropriate tax office address. In-person submissions are also accepted at designated tax offices throughout the state. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Key Elements of the ND Form 307

The ND Form 307 includes several key elements that taxpayers must complete to ensure accurate reporting. These elements consist of personal identification information, total income, deductions, credits, and tax calculations. Each section is designed to capture specific financial details, which contribute to the overall tax liability. Understanding these elements is crucial for accurate completion and compliance with state tax laws.

Quick guide on how to complete nd form 307

Prepare Nd Form 307 easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Nd Form 307 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to edit and eSign Nd Form 307 without effort

- Obtain Nd Form 307 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure confidential information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nd Form 307 while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nd form 307

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with filling out North Dakota Form 307?

airSlate SignNow is an eSignature platform that streamlines the document signing process, making it easy for users to complete forms online. When filling out North Dakota Form 307, you can quickly upload the necessary document, eSign, and share it securely within the platform, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for filling out North Dakota Form 307?

airSlate SignNow provides a range of features essential for filling out North Dakota Form 307, including customizable templates, real-time collaboration, and secure document storage. Additional features like automated reminders and the ability to track document status help ensure timely completion of your forms.

-

Is there a mobile app for filling out North Dakota Form 307?

Yes, airSlate SignNow offers a mobile app that allows users to fill out North Dakota Form 307 on the go. The app is user-friendly, enabling you to eSign documents, upload files, and manage forms right from your smartphone or tablet.

-

Can I integrate airSlate SignNow with other tools for filling out North Dakota Form 307?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications, making it easy to collect data and manage documents when filling out North Dakota Form 307. Popular integrations include Google Drive, Salesforce, and Microsoft applications, enhancing your workflow.

-

What are the pricing options for using airSlate SignNow for filling out North Dakota Form 307?

airSlate SignNow offers flexible pricing plans that cater to various business needs, allowing you to choose the best option for filling out North Dakota Form 307. Plans include features like unlimited document signing, user management, and advanced security, ensuring you find a package that fits your budget.

-

How does airSlate SignNow enhance security when filling out North Dakota Form 307?

Security is a top priority for airSlate SignNow, especially when filling out North Dakota Form 307. The platform uses encryption, multi-factor authentication, and secure cloud storage to protect your sensitive data, ensuring that your documents are safe from unauthorized access.

-

Can multiple users collaborate on filling out North Dakota Form 307 using airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration among multiple users when filling out North Dakota Form 307. You can invite team members to review and sign the form, track changes in real time, and manage the document collectively, ensuring everyone stays in sync.

Get more for Nd Form 307

Find out other Nd Form 307

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form