Alabama Pte V Form

What is the Alabama Pte V

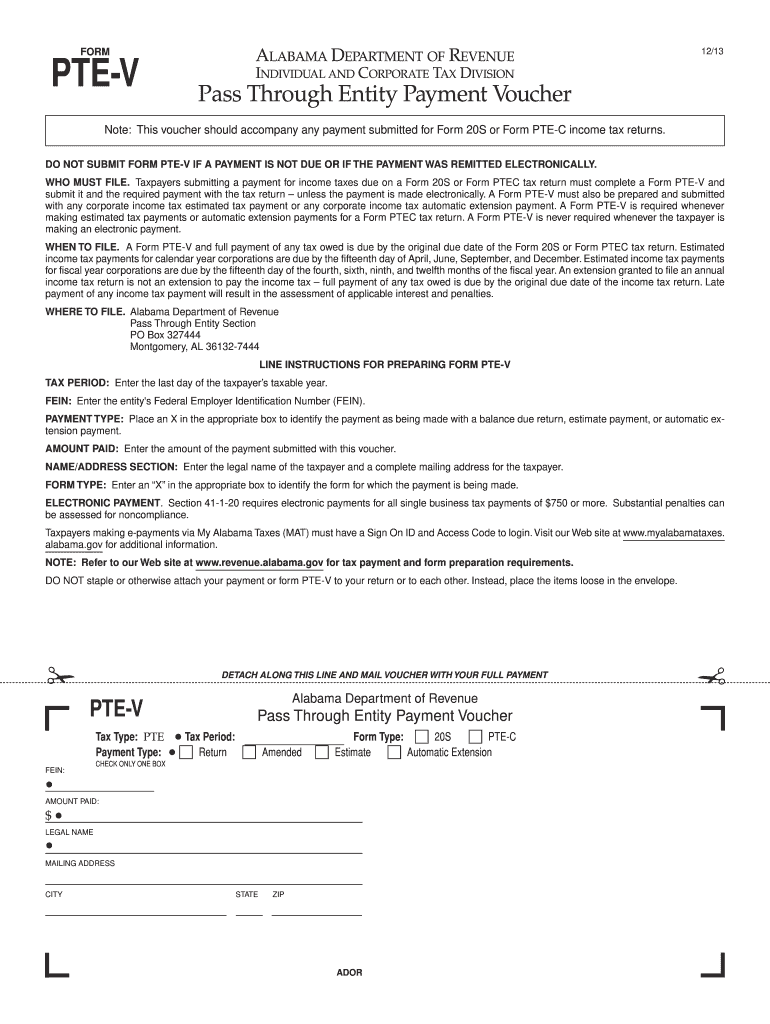

The Alabama Pte V is a specific form used for reporting certain tax-related information in the state of Alabama. This form is essential for individuals and businesses that need to disclose particular financial details to the state tax authorities. It is often utilized in various tax scenarios, making it a critical document for compliance with Alabama tax laws.

How to use the Alabama Pte V

Using the Alabama Pte V involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and information relevant to the form. This may include income statements, expense reports, and other financial records. Next, carefully fill out the form, ensuring that all sections are completed accurately to avoid delays or penalties. Once completed, the form can be submitted through the appropriate channels, which may include online submission or mailing it to the designated tax office.

Steps to complete the Alabama Pte V

Completing the Alabama Pte V requires a systematic approach:

- Gather required documentation, including income and expense records.

- Review the form's instructions to understand each section's requirements.

- Fill out the form meticulously, ensuring accuracy in all entries.

- Double-check for any errors or omissions before submission.

- Submit the form via the designated method, either online or by mail.

Legal use of the Alabama Pte V

The Alabama Pte V is legally binding when completed and submitted according to state regulations. It must adhere to the guidelines set forth by the Alabama Department of Revenue. Ensuring compliance with these regulations is crucial, as improper use or submission can result in penalties or legal issues. The form serves as an official record of the information provided, making it important for both taxpayers and the state.

Key elements of the Alabama Pte V

Several key elements must be included when filling out the Alabama Pte V. These include:

- Taxpayer identification information, such as name and address.

- Details regarding income sources and amounts.

- Expenses that may be deductible under Alabama tax law.

- Signatures and dates to validate the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Alabama Pte V are crucial for compliance. Typically, the form must be submitted by a specific date each year, often aligning with federal tax deadlines. It is important to stay informed about these dates to avoid late fees or penalties. Regularly checking with the Alabama Department of Revenue can provide updates on any changes to filing schedules.

Quick guide on how to complete alabama pte v

Complete Alabama Pte V effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a great eco-friendly substitute to traditional printed and signed documents, as you can easily find the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Alabama Pte V on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign Alabama Pte V with minimal effort

- Find Alabama Pte V and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to record your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Alabama Pte V and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alabama pte v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to pte v?

airSlate SignNow is an electronic signature solution that allows businesses to efficiently send and eSign documents, streamlining the signing process. It integrates the concept of pte v by providing a powerful platform that simplifies document management and enhances workflow efficiency.

-

How does the pricing of airSlate SignNow compare to other solutions when considering pte v?

When evaluating pte v, airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. It provides a cost-effective solution without compromising on features, allowing users to maximize their investment in document management.

-

What key features does airSlate SignNow include for pte v functionality?

airSlate SignNow includes essential features for pte v, such as customizable templates, in-app notifications, and advanced security options. These features ensure that users can quickly manage their documents while maintaining compliance and data protection.

-

Can airSlate SignNow be integrated with other tools to enhance pte v processes?

Yes, airSlate SignNow seamlessly integrates with various applications to support pte v processes. Users can connect with CRM systems, cloud storage services, and other productivity tools to create a more streamlined workflow and enhance overall efficiency.

-

What are the benefits of using airSlate SignNow for pte v documentation?

Using airSlate SignNow for pte v documentation provides numerous benefits, including cost savings, faster turnaround times, and improved collaboration among team members. The easy-to-use interface ensures that users can quickly adapt to the platform and increase productivity.

-

Is airSlate SignNow suitable for businesses of all sizes dealing with pte v?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes handling pte v documentation. Whether you're a startup or a large corporation, the platform offers customizable features and pricing plans to meet your specific needs.

-

How secure is airSlate SignNow when dealing with sensitive pte v documents?

airSlate SignNow prioritizes the security of your sensitive pte v documents by employing industry-standard encryption and secure cloud storage. Additionally, user authentication and audit trails ensure that your data remains protected throughout the signing process.

Get more for Alabama Pte V

- Mental health screener by umass doc integration samhsa form

- Food safety manager reciprocity certificate from city of houston form

- Express scripts 100295586 form

- Va prostate cancer disability benefits questionnaire form

- Form 14653 statement example

- Nodejs fill pdf form

- Zip codes in delaware county pa pdf co delaware pa form

- Commission draw agreement template form

Find out other Alabama Pte V

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer