Etrade W 8ben Form

What is the Etrade W-8BEN?

The Etrade W-8BEN form is a document required by the Internal Revenue Service (IRS) for foreign individuals and entities to certify their foreign status. This form allows non-U.S. persons to claim a reduced rate of withholding tax on certain types of income they receive from U.S. sources, such as dividends and interest. By submitting the W-8BEN, individuals can avoid or reduce the amount of tax withheld on their earnings, ensuring compliance with U.S. tax regulations while benefiting from tax treaties that may exist between their country and the United States.

How to obtain the Etrade W-8BEN

To obtain the Etrade W-8BEN form, individuals can visit the official IRS website or the Etrade platform. The form is available for download in PDF format, allowing users to fill it out electronically or print it for manual completion. It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted by financial institutions or the IRS. Users should also verify that they meet the eligibility criteria before completing the form.

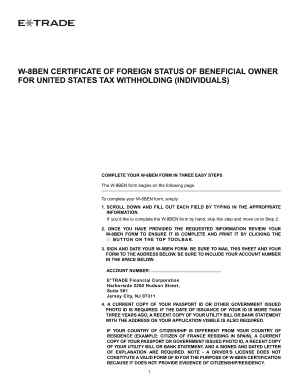

Steps to complete the Etrade W-8BEN

Completing the Etrade W-8BEN involves several key steps:

- Provide personal information, including your name, country of citizenship, and address.

- Indicate your foreign tax identification number, if applicable.

- Claim any applicable tax treaty benefits by specifying the relevant article and the type of income.

- Sign and date the form to certify that the information provided is accurate and complete.

Once completed, the form should be submitted to Etrade or the relevant financial institution to ensure proper processing of any income subject to withholding tax.

Legal use of the Etrade W-8BEN

The legal use of the Etrade W-8BEN form is essential for compliance with U.S. tax laws. By submitting this form, foreign individuals confirm their non-resident status and claim benefits under applicable tax treaties. The form must be filled out accurately to avoid issues with the IRS or the withholding agent. It is also crucial to keep the form updated, as any changes in residency or tax status may require a new submission. Legal consequences for failing to provide accurate information can include higher withholding tax rates and potential penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Etrade W-8BEN form. These guidelines include instructions on who should use the form, the information required, and the submission process. It is vital for users to familiarize themselves with these guidelines to ensure compliance and avoid delays in processing. The IRS also emphasizes the importance of maintaining accurate records and ensuring that the form is renewed every three years or whenever there is a change in circumstances that affects the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Etrade W-8BEN form are crucial for maintaining compliance with U.S. tax laws. Generally, the form should be submitted before the first payment is made to ensure the correct withholding rate is applied. If the form is not submitted in a timely manner, the withholding agent may be required to withhold tax at a higher rate. Users should also be aware of any specific deadlines related to tax treaty claims and ensure they are submitted annually, as required by the IRS.

Quick guide on how to complete etrade w 8ben

Effortlessly Prepare Etrade W 8ben on Any Device

The management of online documents has become increasingly popular among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents swiftly and without delays. Manage Etrade W 8ben on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Etrade W 8ben with Ease

- Find Etrade W 8ben and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it directly to your PC.

Say goodbye to lost or mishandled files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Etrade W 8ben to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etrade w 8ben

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w 8ben etrade form and why is it important?

The w 8ben etrade form is a certificate used by foreign individuals and entities to signNow their foreign status and claim tax treaty benefits. This form is essential for ensuring that non-U.S. investors do not pay unnecessary withholding taxes on U.S.-source income.

-

How can airSlate SignNow help with signing the w 8ben etrade form?

airSlate SignNow provides a seamless platform to electronically sign the w 8ben etrade form, streamlining the process for users. With our easy-to-use interface, you can quickly fill out, sign, and send your form, signNowly reducing the time involved in handling paperwork.

-

Is there a cost associated with using airSlate SignNow for the w 8ben etrade form?

Yes, airSlate SignNow operates on a subscription-based model, offering various pricing plans suitable for individual users or larger teams. By opting for airSlate SignNow, you gain access to robust features that simplify the management of forms like the w 8ben etrade.

-

What features does airSlate SignNow offer for managing the w 8ben etrade form?

airSlate SignNow offers features such as customizable templates, secure storage, and real-time tracking to make managing the w 8ben etrade form efficient. Users can collaborate in real-time, ensuring all parties complete the necessary details for tax documentation.

-

Can I integrate airSlate SignNow with other applications for the w 8ben etrade form?

Absolutely! airSlate SignNow supports numerous integrations with popular applications like Google Drive, Salesforce, and more. This allows users to easily access and manage their w 8ben etrade forms directly from tools they already use.

-

What benefits does airSlate SignNow provide for eSigning the w 8ben etrade form?

Using airSlate SignNow for eSigning the w 8ben etrade form offers numerous benefits, including enhanced security and compliance with legal standards. Additionally, it speeds up the signing process, helping you submit your tax documents promptly.

-

Is the process of signing the w 8ben etrade form secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and complies with industry standards, ensuring that your w 8ben etrade form is signed and transmitted securely. With encryption and secure access controls, you can trust that your information remains safe.

Get more for Etrade W 8ben

- 9 1 skills practice graphing quadratic functions form

- Seec form 10 ct gov ctdol state ct

- Bdembassyusa form

- Ucc financing statement cooperative addendum form

- Hmrc self assessment form pdf hmrc self assessment form pdf the sa100 form is simply the main document you need to fill when

- A preliminary analysis of the president s budget and an update of cbo s budget and economic outlook form

- Clear print form rew 1 1041 real estate withh

- Compensation agreement template form

Find out other Etrade W 8ben

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself

- eSign California Life-Insurance Quote Form Online