Clear Print Form REW 1 1041 Real Estate Withh

What is the Clear Print Form REW 1 1041 Real Estate Withh

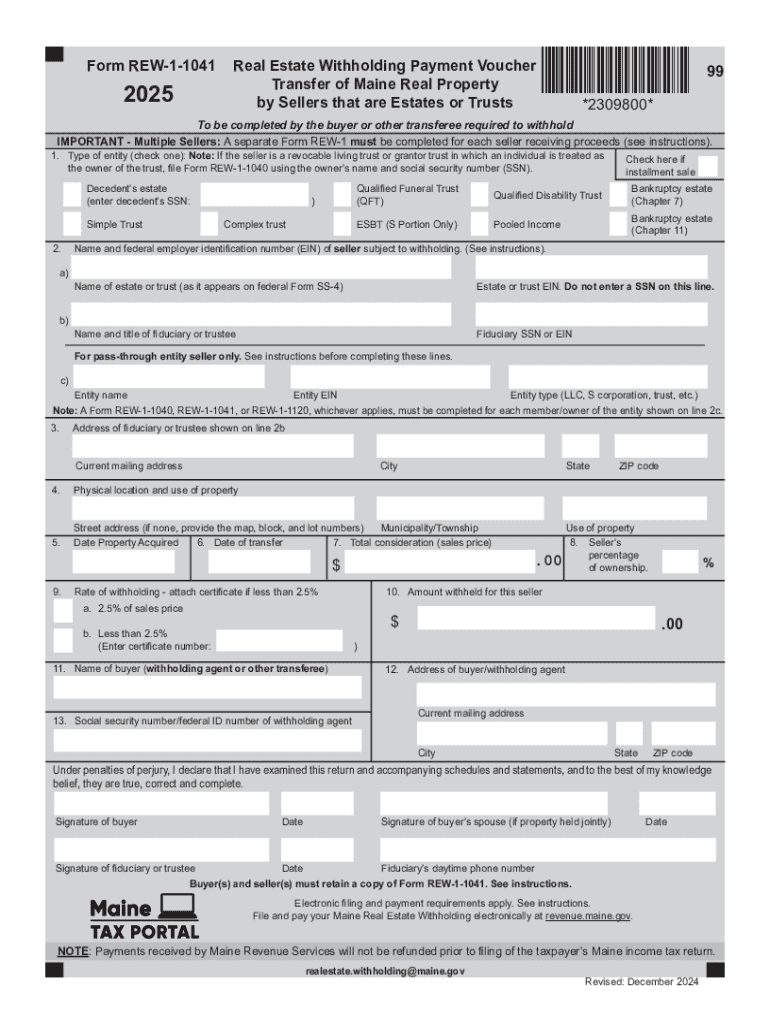

The Clear Print Form REW 1 1041 is a specific document used in real estate transactions, particularly in the context of property transfers and disclosures. This form is essential for ensuring that all parties involved in a real estate transaction are aware of the pertinent details regarding the property being transferred. It serves to provide transparency and protect the rights of both buyers and sellers by documenting key information related to the transaction.

How to use the Clear Print Form REW 1 1041 Real Estate Withh

Using the Clear Print Form REW 1 1041 involves several straightforward steps. First, ensure you have the latest version of the form, which can be obtained from the appropriate regulatory body or real estate authority. Next, fill out the required fields accurately, including property details, buyer and seller information, and any disclosures necessary for the transaction. Once completed, the form must be signed by all relevant parties to validate the agreement. It is advisable to keep a copy for your records.

Steps to complete the Clear Print Form REW 1 1041 Real Estate Withh

Completing the Clear Print Form REW 1 1041 requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from a reliable source.

- Fill in the property address and legal description accurately.

- Provide the names and contact information of the buyer and seller.

- Include any necessary disclosures regarding the property condition or history.

- Review the completed form for accuracy and completeness.

- Obtain signatures from all parties involved.

- Keep a copy of the signed form for your records.

Legal use of the Clear Print Form REW 1 1041 Real Estate Withh

The Clear Print Form REW 1 1041 is legally binding once signed by all parties involved in the real estate transaction. It is crucial to ensure that the form is filled out correctly to avoid any legal disputes. The form serves as a record of the agreement and the disclosures made, which can be referenced in case of future disagreements or legal inquiries. Understanding the legal implications of this form can help protect the rights of all parties involved.

Key elements of the Clear Print Form REW 1 1041 Real Estate Withh

Several key elements are essential to the Clear Print Form REW 1 1041. These include:

- Property Information: Address, legal description, and any relevant property details.

- Buyer and Seller Details: Names, addresses, and contact information of all parties.

- Disclosures: Information regarding the property's condition, any known issues, and other relevant disclosures.

- Signatures: Required signatures from all parties to validate the agreement.

Who Issues the Form

The Clear Print Form REW 1 1041 is typically issued by state or local real estate authorities, ensuring compliance with regional regulations. It is important to obtain the form from an official source to ensure that it meets all legal requirements. This helps to maintain the integrity of the transaction and provides assurance that all necessary disclosures and information are included.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the clear print form rew 1 1041 real estate withh

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Clear Print Form REW 1 1041 Real Estate Withh?

The Clear Print Form REW 1 1041 Real Estate Withh is a standardized form used in real estate transactions to ensure clarity and compliance. It simplifies the process of documenting essential information, making it easier for both buyers and sellers to understand their obligations. Utilizing this form can enhance the efficiency of real estate dealings.

-

How can airSlate SignNow help with the Clear Print Form REW 1 1041 Real Estate Withh?

airSlate SignNow provides a seamless platform for electronically signing and sending the Clear Print Form REW 1 1041 Real Estate Withh. Our solution ensures that all parties can easily access, review, and sign the document from anywhere, streamlining the entire process. This not only saves time but also reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow with the Clear Print Form REW 1 1041 Real Estate Withh?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including options for individuals and teams. You can choose a plan that best fits your usage of the Clear Print Form REW 1 1041 Real Estate Withh, ensuring you only pay for what you need. Additionally, we provide a free trial to help you evaluate our services.

-

What features does airSlate SignNow offer for the Clear Print Form REW 1 1041 Real Estate Withh?

With airSlate SignNow, you gain access to features such as customizable templates, secure cloud storage, and real-time tracking for the Clear Print Form REW 1 1041 Real Estate Withh. These features enhance document management and ensure that you can monitor the signing process effectively. Our platform is designed to simplify your workflow.

-

What are the benefits of using airSlate SignNow for real estate documents?

Using airSlate SignNow for real estate documents like the Clear Print Form REW 1 1041 Real Estate Withh offers numerous benefits, including increased efficiency and reduced paperwork. Our electronic signature solution is legally binding and secure, ensuring that your transactions are both compliant and protected. This can lead to faster closings and improved customer satisfaction.

-

Can I integrate airSlate SignNow with other tools for managing the Clear Print Form REW 1 1041 Real Estate Withh?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, allowing you to manage the Clear Print Form REW 1 1041 Real Estate Withh alongside your existing workflows. Whether you use CRM systems, project management tools, or cloud storage services, our integrations enhance your productivity. This flexibility ensures that you can work efficiently within your preferred ecosystem.

-

Is airSlate SignNow secure for handling the Clear Print Form REW 1 1041 Real Estate Withh?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Clear Print Form REW 1 1041 Real Estate Withh is protected. We utilize advanced encryption and authentication measures to safeguard your documents and data. You can trust that your sensitive information is in safe hands while using our platform.

Get more for Clear Print Form REW 1 1041 Real Estate Withh

- What is telecommuting and what are the pros and cons form

- Sample sexual harassment policy ilo form

- How to complain about sexual harassment at work form

- Checklist for investigating sexual harassment form

- Internal investigation checklist pro bono partnership form

- Employee satisfaction survey the best templates 2020 form

- Multiple choice survey questions everything you need to form

- Please place a check mark under the number that best represents your feelings for the corresponding form

Find out other Clear Print Form REW 1 1041 Real Estate Withh

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document