Certificate of Non Filing Tax Return Form

What is the Certificate of Non Filing Tax Return

The Certificate of Non Filing Tax Return is an official document issued by the Internal Revenue Service (IRS) that verifies an individual or entity has not filed a tax return for a specific tax year. This certificate is often required for various purposes, such as applying for financial aid, securing loans, or fulfilling other legal obligations that require proof of non-filing status. It serves as a formal acknowledgment from the IRS that no tax return was submitted, which can be crucial for individuals who need to demonstrate their tax compliance status.

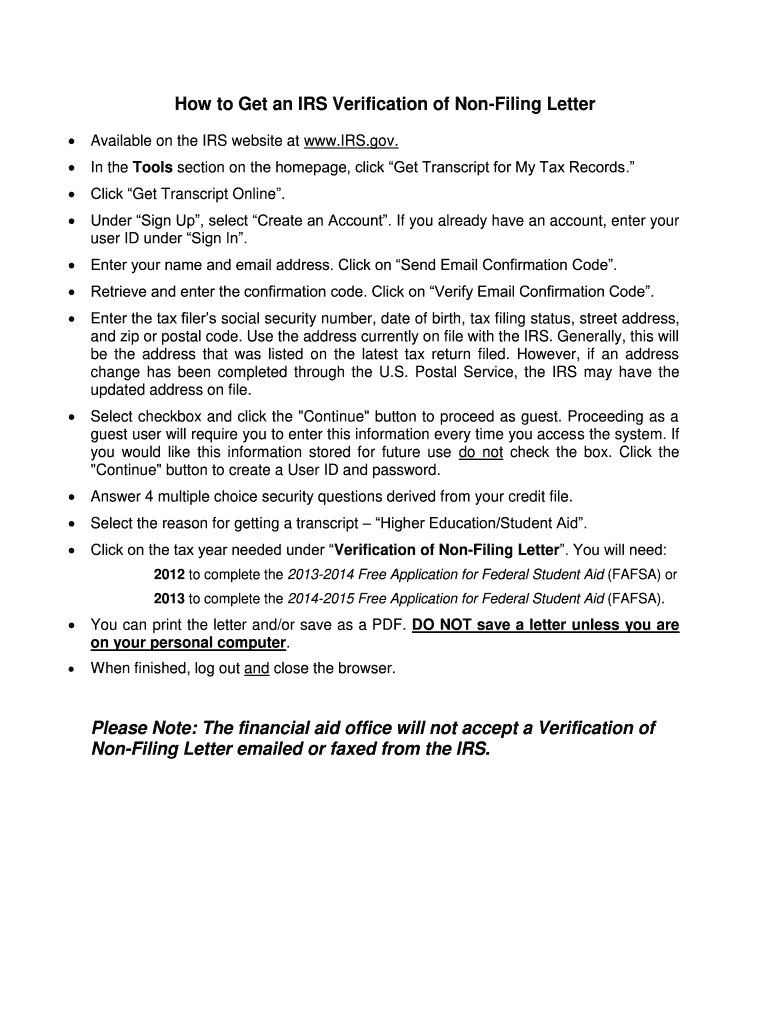

How to Obtain the Certificate of Non Filing Tax Return

To obtain the Certificate of Non Filing Tax Return, individuals must request a verification of non-filing letter from the IRS. This can be done by submitting Form 4506-T, Request for Transcript of Tax Return. On this form, taxpayers should specifically request the verification of non-filing status for the relevant tax year. It is important to provide accurate information, including the taxpayer's name, Social Security number, and the tax year in question. The IRS typically processes these requests within a few weeks, and the certificate will be sent directly to the taxpayer's address.

Steps to Complete the Certificate of Non Filing Tax Return

Completing the process for obtaining a Certificate of Non Filing Tax Return involves several key steps:

- Gather necessary information, including your name, Social Security number, and the tax year for which you need the certificate.

- Fill out Form 4506-T accurately, ensuring all details are correct to avoid delays.

- Submit the completed form to the IRS, either by mail or fax, as indicated on the form.

- Wait for the IRS to process your request, which may take several weeks.

- Receive your verification of non-filing letter by mail once the request has been processed.

Key Elements of the Certificate of Non Filing Tax Return

The Certificate of Non Filing Tax Return includes several important elements that validate its authenticity and purpose:

- Taxpayer Information: This includes the name, Social Security number, and address of the individual or entity requesting the certificate.

- Tax Year: The specific tax year for which the non-filing status is being verified.

- IRS Seal: An official seal or stamp from the IRS that confirms the document's legitimacy.

- Statement of Non-Filing: A clear statement indicating that no tax return was filed for the specified year.

Legal Use of the Certificate of Non Filing Tax Return

The Certificate of Non Filing Tax Return is legally recognized and can be used in various situations, including:

- Applying for federal student aid or financial assistance programs.

- Securing loans or mortgages that require proof of income or tax compliance.

- Meeting requirements for certain government programs or benefits.

- Providing documentation for legal matters where proof of non-filing is necessary.

IRS Guidelines

The IRS has specific guidelines regarding the issuance and use of the Certificate of Non Filing Tax Return. Taxpayers should be aware of the following:

- The certificate is only available for tax years where no return was filed.

- Requests for the certificate must be made using the appropriate IRS form, ensuring compliance with all submission requirements.

- Taxpayers should retain copies of their requests and any correspondence with the IRS for their records.

Quick guide on how to complete certificate of non filing tax return

Complete Certificate Of Non Filing Tax Return effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Certificate Of Non Filing Tax Return on any device with airSlate SignNow's Android or iOS apps and enhance any document-related task today.

How to adjust and eSign Certificate Of Non Filing Tax Return with ease

- Locate Certificate Of Non Filing Tax Return and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Choose how you wish to share your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Certificate Of Non Filing Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of non filing tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS non-filing letter template?

An IRS non-filing letter template is a pre-formatted document that individuals can use to inform the IRS that they did not file a tax return for a specific year. By using this template, you can ensure that you're communicating effectively with the IRS, as it contains all the necessary elements required for proper notification. airSlate SignNow provides an easy method to create, customize, and send your IRS non-filing letter template securely.

-

How can airSlate SignNow help me with my IRS non-filing letter template?

airSlate SignNow simplifies the process of creating and sending your IRS non-filing letter template. With our user-friendly interface, you can easily customize the template to fit your personal details and requirements. Additionally, our eSigning feature allows for quick and secure signing of documents, making everything efficient and hassle-free.

-

Is there a cost associated with using the IRS non-filing letter template on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans, which include access to the IRS non-filing letter template feature. Depending on your needs, you can choose a plan that fits your budget and requirements, providing you with an effective solution for all your document management needs. Our pricing is cost-effective, ensuring you receive value for your investment.

-

Are there specific features included in the IRS non-filing letter template?

The IRS non-filing letter template in airSlate SignNow includes standard fields, such as your personal information, tax year, and any additional clarifications you may want to provide. These features streamline the process, making it easy to input your details and generate a professional letter quickly. Moreover, you can tailor the content to suit your personal circumstances.

-

Can I integrate airSlate SignNow with other applications for managing my IRS non-filing letter template?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications, allowing you to manage your IRS non-filing letter template alongside other business tools. This makes it easier to keep track of your documents and streamline your workflow. Some popular integrations include Google Drive, Dropbox, and Microsoft Office.

-

What are the benefits of using airSlate SignNow for my IRS non-filing letter template?

Using airSlate SignNow for your IRS non-filing letter template provides multiple benefits, including ease of use, speed, and security. You can create, sign, and send documents from any device, expediting your communication with the IRS. Moreover, our platform ensures that your information is secure and complies with industry standards.

-

How do I get started with creating an IRS non-filing letter template on airSlate SignNow?

Getting started with airSlate SignNow is simple! First, sign up for an account and log in. Once you are in the platform, navigate to the templates section, where you can find or create your IRS non-filing letter template. From there, you can customize it according to your needs and quickly send it out for eSignature.

Get more for Certificate Of Non Filing Tax Return

- Genesee county ppo form

- Oda0008 form

- Breast cancer awareness crossword puzzle form

- Responsble indivuals list search form

- Irs posts form 4972 used to claim special tax

- Nm uniform prior authorization form

- Usn aviation support equipment navair navy form

- Infidelity clause post nuptial infidelity agreement template form

Find out other Certificate Of Non Filing Tax Return

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now