Download Self Declarartio N of Family Income PDF Form

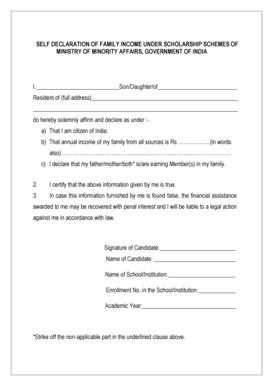

What is the self declaration of income form?

The self declaration of income form is a crucial document used to report an individual's income, typically required for various applications, such as loans, housing assistance, or tax purposes. This form provides a comprehensive overview of an individual's earnings, allowing institutions to assess financial eligibility or compliance with certain regulations. It is essential for individuals to accurately complete this form to ensure that their income is represented correctly, which can impact their financial opportunities and obligations.

Steps to complete the self declaration of income form

Completing the self declaration of income form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including pay stubs, tax returns, and any additional income sources. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Clearly state your income sources and amounts, ensuring that all figures are accurate. Finally, review the completed form for any errors before signing and dating it. This process helps maintain the integrity of the information provided.

Key elements of the self declaration of income form

Several key elements are essential to include in the self declaration of income form. These elements typically encompass:

- Personal Information: Full name, address, and contact details.

- Income Sources: A detailed list of all income sources, such as salary, freelance work, and other earnings.

- Total Income: The total amount of income earned over a specified period, usually annually.

- Signature: A declaration that the information provided is true and accurate, accompanied by the date of signing.

Legal use of the self declaration of income form

The self declaration of income form serves a significant legal purpose. It is often required by financial institutions, government agencies, and other organizations to verify an individual's income for various applications. To be legally binding, the form must be completed truthfully and accurately. Misrepresentation of income can lead to legal consequences, including penalties or denial of services. Therefore, it is crucial to understand the legal implications of submitting this form.

Form submission methods

Submitting the self declaration of income form can be done through various methods, depending on the requirements of the requesting institution. Common submission methods include:

- Online Submission: Many institutions allow for electronic submission through secure portals, making the process quick and efficient.

- Mail: The form can be printed and mailed to the designated address, ensuring that it is sent via a reliable postal service.

- In-Person: Some organizations may require or allow individuals to submit the form in person, providing an opportunity for immediate verification.

IRS guidelines for income declaration

The Internal Revenue Service (IRS) provides specific guidelines regarding income declaration, particularly for tax purposes. Individuals must report all sources of income, including wages, self-employment earnings, and interest income. Accurate reporting is essential to comply with federal tax laws and avoid potential audits or penalties. Understanding these guidelines helps ensure that individuals fulfill their tax obligations while accurately reflecting their financial situation.

Quick guide on how to complete download self declarartio n of family income pdf

Finalize Download Self Declarartio N Of Family Income Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Download Self Declarartio N Of Family Income Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Download Self Declarartio N Of Family Income Pdf with ease

- Locate Download Self Declarartio N Of Family Income Pdf and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Download Self Declarartio N Of Family Income Pdf and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the download self declarartio n of family income pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self declaration of income form?

A self declaration of income form is a document used by individuals to report their income for various purposes, such as loan applications or tax filings. This form can simplify income verification processes, ensuring that you can easily provide proof of your earnings when needed.

-

How can airSlate SignNow help with the self declaration of income form?

airSlate SignNow offers a user-friendly platform that allows you to create, send, and eSign self declaration of income forms efficiently. With our solution, you can streamline the documentation process, ensuring that all needed signatures are gathered quickly and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. Our plans ensure that you can access essential features for managing documents like the self declaration of income form, with options tailored to suit your budget.

-

Is my data secure when using the self declaration of income form on airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security with advanced encryption technology. When you send a self declaration of income form, you can trust that your sensitive information remains confidential and protected against unauthorized access.

-

Can I customize my self declaration of income form using airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize your self declaration of income form to fit your specific needs. You can add your branding, modify fields, and include any additional information to make the form comprehensive and user-friendly.

-

What integrations does airSlate SignNow support for managing self declaration of income forms?

airSlate SignNow integrates seamlessly with numerous applications, including CRMs and cloud storage services. This allows you to manage your self declaration of income form alongside other tools you already use, enhancing workflow efficiency.

-

What are the benefits of using airSlate SignNow for self declaration of income forms?

Using airSlate SignNow for your self declaration of income forms provides signNow benefits, including ease of use, reduced turnaround time, and enhanced accuracy. Our platform ensures that your documents are processed quickly, helping you avoid delays in approvals.

Get more for Download Self Declarartio N Of Family Income Pdf

- Sub central broward county phone number form

- Sample completed common application sewanee the university admission sewanee form

- Boy scout donation receipt form

- Carifate form

- Daily language review grade 6 pdf 50996885 form

- Conservaton program application conservation program application form

- Va form 29 389 veterans benefits administration

- Downloadrepossessed affidavit dispostion of motor vehicle under form

Find out other Download Self Declarartio N Of Family Income Pdf

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free