Form 5633

What is the Form 5633

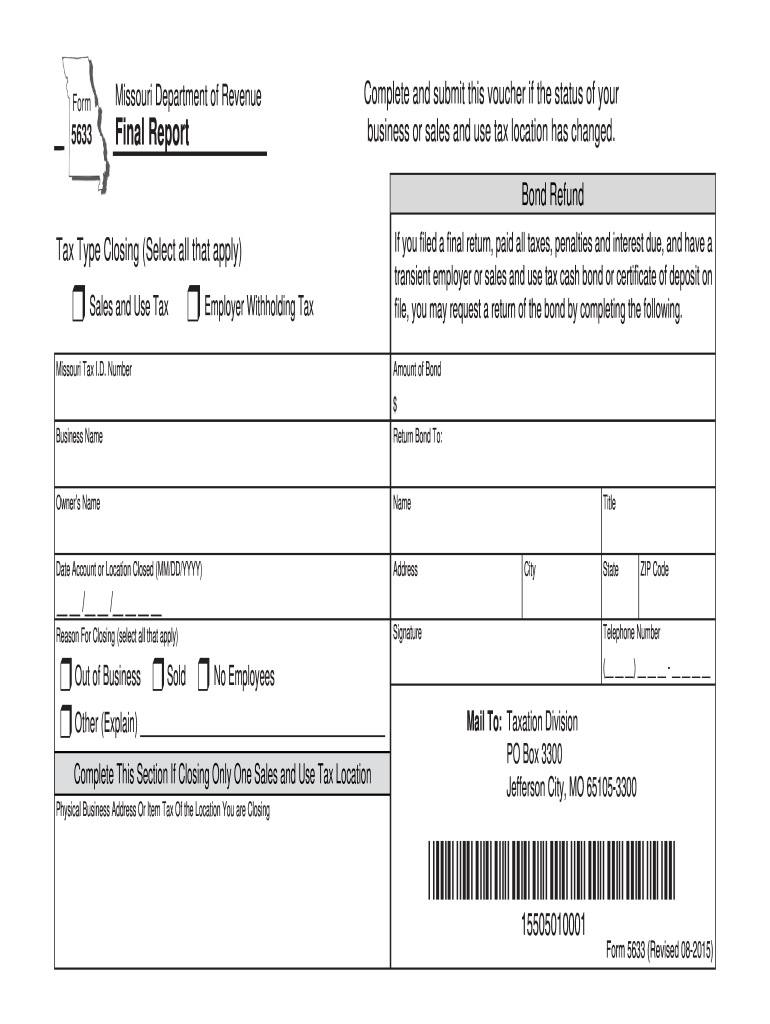

The Form 5633, officially known as the Missouri Department of Revenue Form 5633, is a document used primarily for tax purposes in the state of Missouri. This form is typically associated with specific tax filings and is essential for individuals or businesses looking to comply with state tax regulations. Understanding the purpose of this form is crucial for ensuring that all necessary information is accurately reported to the Missouri Department of Revenue.

How to use the Form 5633

Using the Form 5633 involves several straightforward steps. First, gather all necessary information required for the form, including personal identification details and any relevant financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once completed, you can submit the form through the appropriate channels, which may include online submission or mailing it directly to the Missouri Department of Revenue. It is important to keep a copy of the completed form for your records.

Steps to complete the Form 5633

Completing the Form 5633 involves a series of clear steps:

- Gather all required documentation, such as income statements and identification.

- Access the form online or obtain a physical copy from the Missouri Department of Revenue.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial details as prompted by the form.

- Review the completed form for accuracy before submission.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

Legal use of the Form 5633

The legal use of the Form 5633 is governed by state regulations that dictate how tax forms should be completed and submitted. To ensure that the form is legally binding, it must be filled out accurately and submitted within the specified deadlines. Moreover, utilizing a reliable platform for electronic signatures can enhance the legal standing of the document, providing an added layer of security and compliance with eSignature laws.

Key elements of the Form 5633

Key elements of the Form 5633 include essential personal information, such as the taxpayer's name, address, and identification number. Additionally, the form requires specific financial data relevant to the taxpayer's situation. It is crucial to ensure that all required fields are completed, as missing information can lead to delays or complications in processing the form. Understanding these elements can facilitate a smoother filing process.

Form Submission Methods

The Form 5633 can be submitted through various methods, including:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Missouri Department of Revenue’s online portal.

- Mail: Alternatively, the completed form can be printed and mailed to the appropriate address provided by the department.

- In-Person: Taxpayers may also choose to submit the form in person at designated locations.

Choosing the right submission method depends on personal preference and the specific requirements of the filing process.

Quick guide on how to complete form 5633

Prepare Form 5633 easily on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly and efficiently. Handle Form 5633 on any platform using the airSlate SignNow Android or iOS applications and simplify any document-based process today.

The simplest way to adjust and eSign Form 5633 with ease

- Obtain Form 5633 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Form 5633 and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5633

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5633 and how can airSlate SignNow help with it?

Form 5633 is a document that organizations often require for various compliance and administrative tasks. With airSlate SignNow, you can easily send and eSign form 5633, ensuring that it’s completed accurately and securely. Our platform simplifies the process, helping you manage your documents efficiently.

-

Can I integrate form 5633 with other applications using airSlate SignNow?

Yes, airSlate SignNow allows seamless integration of form 5633 with various applications, enhancing your workflow. You can connect it with tools like CRM systems and cloud storage services to streamline your document management process. This integration ensures that your form 5633 is always accessible and easy to manage.

-

What are the benefits of using airSlate SignNow for form 5633?

Using airSlate SignNow for form 5633 offers numerous benefits, including speed, security, and ease of use. You can complete the document electronically, eliminating paperwork and reducing delays. Additionally, our secure eSignature features ensure that your form 5633 remains confidential and compliant.

-

Is airSlate SignNow cost-effective for managing form 5633?

Absolutely! airSlate SignNow provides a cost-effective solution for managing form 5633 and other documents. With flexible pricing plans, businesses of all sizes can find an option that fits their budget while still enjoying robust features for eSigning and document management.

-

How does airSlate SignNow ensure the security of form 5633?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like form 5633. Our platform uses advanced encryption protocols and complies with international security standards to protect your data. This way, you can confidently sign and share form 5633 without compromising security.

-

What features does airSlate SignNow offer for form 5633?

airSlate SignNow offers a variety of features for managing form 5633, including customizable templates, automated workflows, and mobile access. These features enable you to tailor the document to meet your needs and simplify the signing process for all parties involved. This enhances efficiency and user experience.

-

Can I track the status of form 5633 sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for all documents, including form 5633. You can receive notifications when the document is opened, signed, or completed, giving you full visibility into the signing process. This feature helps you keep your workflow organized and on track.

Get more for Form 5633

Find out other Form 5633

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free