Morgan Stanley 529 Withdrawal Form

What is the Morgan Stanley 529 Withdrawal Form

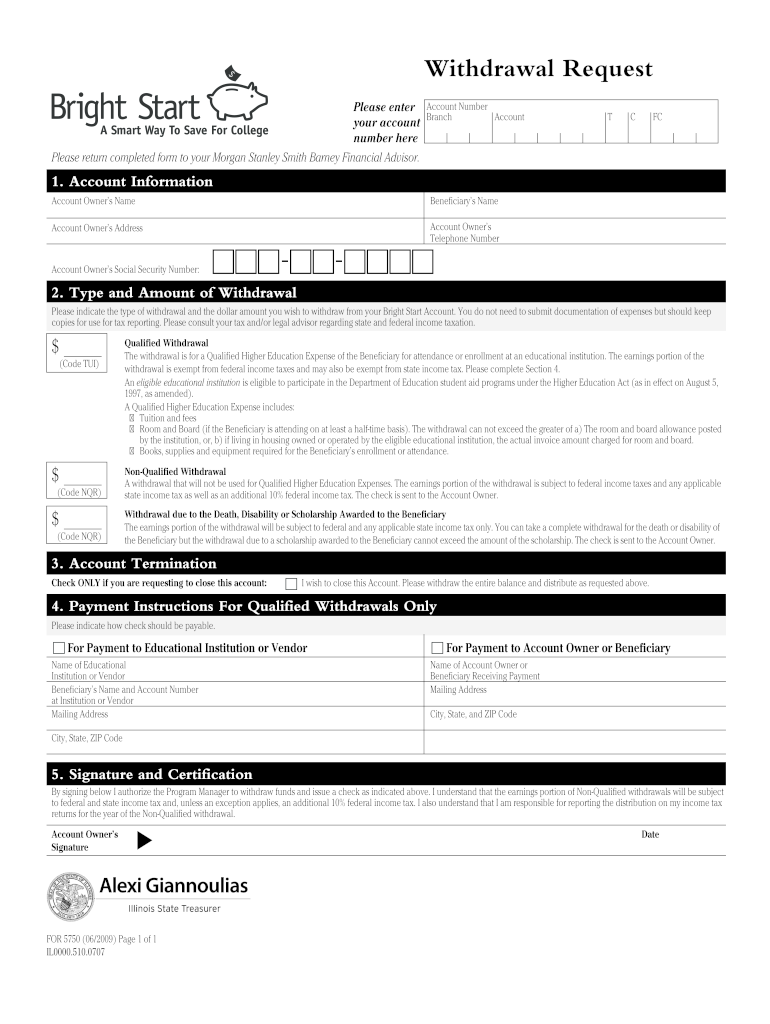

The Morgan Stanley 529 Withdrawal Form is a specific document designed for account holders wishing to withdraw funds from their 529 college savings plan. This form is essential for ensuring that the withdrawal process adheres to both internal policies and external regulations. The 529 plan is a tax-advantaged savings plan aimed at helping families save for future education costs, making the withdrawal process particularly important for educational expenses. Understanding this form is crucial for account holders to navigate their options effectively.

How to use the Morgan Stanley 529 Withdrawal Form

Using the Morgan Stanley 529 Withdrawal Form involves several straightforward steps. First, ensure you have the correct form, which can typically be found on the Morgan Stanley website or obtained from your financial advisor. Next, fill out the required fields accurately, including your account information and the amount you wish to withdraw. It is important to specify the purpose of the withdrawal, as this can affect tax implications. Finally, submit the completed form according to the specified submission methods, which may include online submission, mailing, or in-person delivery at a Morgan Stanley branch.

Steps to complete the Morgan Stanley 529 Withdrawal Form

Completing the Morgan Stanley 529 Withdrawal Form requires attention to detail. Begin by gathering all necessary information, including your account number and personal identification details. Follow these steps:

- Download or request the Morgan Stanley 529 Withdrawal Form.

- Fill in your personal information, including your name, address, and account number.

- Indicate the amount you wish to withdraw and the specific purpose for the funds.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form to validate your request.

After completing these steps, submit the form through the designated method to initiate your withdrawal.

Legal use of the Morgan Stanley 529 Withdrawal Form

The legal use of the Morgan Stanley 529 Withdrawal Form is governed by both federal and state regulations. It is crucial for account holders to ensure that their withdrawals comply with IRS guidelines regarding qualified education expenses. Withdrawals used for non-qualified expenses may incur taxes and penalties. The form serves as a formal request that, when completed correctly, provides legal documentation of the withdrawal, protecting both the account holder and Morgan Stanley in case of disputes or audits.

Required Documents

When submitting the Morgan Stanley 529 Withdrawal Form, certain documents may be required to support your request. These can include:

- A copy of your identification, such as a driver's license or passport.

- Documentation of the educational institution, such as an acceptance letter or invoice.

- Any additional forms or documents specified by Morgan Stanley that pertain to your specific withdrawal request.

Having these documents ready can streamline the process and help ensure that your withdrawal is processed without delays.

Form Submission Methods

The Morgan Stanley 529 Withdrawal Form can typically be submitted through several methods, providing flexibility for account holders. These methods may include:

- Online submission via the Morgan Stanley client portal.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at a local Morgan Stanley branch.

Choosing the right submission method can depend on your urgency and convenience, so consider your options carefully.

Quick guide on how to complete morgan stanley ira withdrawal terms form

Easily Prepare Morgan Stanley 529 Withdrawal Form on Any Device

Digital document handling has gained traction among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Morgan Stanley 529 Withdrawal Form on any platform through airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Effortlessly Edit and eSign Morgan Stanley 529 Withdrawal Form

- Find Morgan Stanley 529 Withdrawal Form and then click Get Form to begin.

- Take advantage of the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Alter and eSign Morgan Stanley 529 Withdrawal Form to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

How signNow is Morgan Stanley's decision to overhaul its performance review system by replacing its numerical scale with free-form adjectives?

The Washington Post recently stated that 10% of Fortune 500 companies abandoned annual performance reviews in exchange for a more fluid management model. Businesses like Gap, Google, Yahoo, and Deloitte have been longtime advocates for ditching the antiquated review approach, and now GE is on board, too.Bersin Deloitte report says that “More than 60% of all companies are redesigning (or have redesigned) their performance management process, typically moving from top-down rating and ranking to a feedback-centric, developmental, often rating-less model.”Here are the reasons why the yearly appraisals will come to an end in 2017:The process is too complex and rigidToo many biasesCauses anxiety & frustrationDoesn’t improve performanceDoesn’t focus enough on developing your peopleNot frequent nor real-time while things at companies change too fastThere is little to no connection to employee development; the focus is instead on associates’ past performanceNo focus on ongoing feedback or coaching41% of Millennial employees (the biggest generation in the workforce) want to be recognized regularlyMore info on replacing annual reviews with new alternative goals and performance management systems: 2017 Is The Year That Ends Annual Performance Reviews

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

-

Is it necessary to fill out Form 15G/Form 15H if my service is less than 5 years? I need to withdraw the amount.

Purposes for which Form 15G or Form 15H can be submitted. While these forms can be submitted to banks to make sure TDS is not deducted on interest, there a few other places too where you can submit them. TDS on EPF withdrawal – TDS is deducted on EPF balances if withdrawn before 5 years of continuous service.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the morgan stanley ira withdrawal terms form

How to create an eSignature for the Morgan Stanley Ira Withdrawal Terms Form in the online mode

How to generate an electronic signature for the Morgan Stanley Ira Withdrawal Terms Form in Google Chrome

How to create an electronic signature for putting it on the Morgan Stanley Ira Withdrawal Terms Form in Gmail

How to make an eSignature for the Morgan Stanley Ira Withdrawal Terms Form right from your smartphone

How to create an eSignature for the Morgan Stanley Ira Withdrawal Terms Form on iOS devices

How to create an eSignature for the Morgan Stanley Ira Withdrawal Terms Form on Android

People also ask

-

What is airSlate SignNow and how does it benefit an account firm?

airSlate SignNow is a powerful eSignature solution that streamlines document management for an account firm. It allows businesses to send, sign, and store documents effortlessly, enhancing efficiency and productivity. With a user-friendly interface, it simplifies workflows, enabling account firms to focus more on client relationships rather than manual paperwork.

-

How can airSlate SignNow improve the workflow of an account firm?

By using airSlate SignNow, an account firm can automate their document processes and reduce turnaround times signNowly. Features like templates and bulk sending allow firms to handle multiple clients quickly and accurately. The platform also integrates smoothly with existing tools used by account firms, promoting seamless workflows and better collaboration.

-

What are the pricing options available for airSlate SignNow for an account firm?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including those of account firms. You can choose from monthly or annual subscriptions, with features tailored to suit the needs of different teams. This cost-effective solution ensures that account firms can select a plan that fits their budget without sacrificing essential features.

-

Does airSlate SignNow integrate with other software commonly used by account firms?

Yes, airSlate SignNow offers integrations with popular software applications commonly used by account firms, including CRM systems and project management tools. This allows for a more streamlined experience, as your team can access all the necessary tools from a single platform. Such integrations enhance productivity and ensure that all client data remains synchronized.

-

Is airSlate SignNow secure for sensitive documents handled by an account firm?

Absolutely, airSlate SignNow prioritizes the security of documents, making it a reliable choice for an account firm. With features like encryption and secure cloud storage, you can be confident that sensitive information remains protected. This level of security helps account firms maintain compliance with industry regulations while ensuring client trust.

-

Can airSlate SignNow help reduce paper usage for an account firm?

Using airSlate SignNow can signNowly reduce paper usage for an account firm by digitizing the entire document signing process. This not only contributes to sustainability efforts but also lowers printing and storage costs associated with physical documents. Transitioning to eSignatures allows firms to be more eco-friendly while optimizing their operations.

-

What support options are available for account firms using airSlate SignNow?

airSlate SignNow provides dedicated customer support to assist account firms with any inquiries or technical issues. Users can access a wealth of resources such as tutorials, FAQs, and user guides. Direct support via chat, email, or phone ensures that account firms receive timely assistance whenever needed.

Get more for Morgan Stanley 529 Withdrawal Form

Find out other Morgan Stanley 529 Withdrawal Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors