Hawaii Tax Form G 49 Fillable

What is the Hawaii Tax Form G-49 Fillable

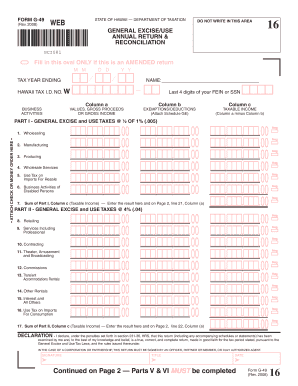

The Hawaii Tax Form G-49 is a crucial document used by businesses to report and reconcile their general excise tax (GET) liabilities. This form is essential for ensuring compliance with state tax regulations and is specifically designed for entities engaged in business activities within Hawaii. The fillable version of the G-49 allows users to complete the form electronically, making it easier to input information accurately and efficiently. This digital format not only saves time but also reduces the likelihood of errors that can occur when filling out paper forms.

How to use the Hawaii Tax Form G-49 Fillable

Using the Hawaii Tax Form G-49 fillable version involves a few straightforward steps. First, download the form from an official source or access it through a trusted platform that provides electronic forms. Once you have the form open, enter your business information, including your name, address, and tax identification number. Next, input the required financial data, such as gross income and deductions, in the designated fields. After completing the form, review all entries for accuracy before saving or printing it for submission.

Steps to complete the Hawaii Tax Form G-49 Fillable

Completing the Hawaii Tax Form G-49 fillable version can be done efficiently by following these steps:

- Access the fillable form from a reliable source.

- Enter your business details, including your legal name and address.

- Fill in the gross income and any applicable deductions.

- Review the information for accuracy.

- Save the completed form in a secure location.

- Submit the form either electronically or via mail, as per your preference.

Legal use of the Hawaii Tax Form G-49 Fillable

The legal use of the Hawaii Tax Form G-49 fillable version is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the designated deadlines. It is important to ensure that all information provided is truthful and reflects your business's actual financial activities. Failure to comply with these requirements can result in penalties or legal repercussions. Utilizing a reliable electronic signing solution can further enhance the legitimacy of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Tax Form G-49 are critical for compliance. Typically, the form is due annually, with specific dates varying based on your business's accounting period. It is essential to check the current tax calendar for any updates or changes to these deadlines. Failing to file on time can lead to late fees and potential interest charges on unpaid taxes, making it vital to stay informed about these important dates.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Tax Form G-49 can be submitted through various methods, offering flexibility to businesses. You can file the form online using the state's tax filing portal, which allows for quick processing. Alternatively, you can print the completed form and mail it to the appropriate tax office. For those who prefer face-to-face interactions, in-person submissions are also accepted at designated tax offices. Each method has its advantages, so choose the one that best fits your needs.

Quick guide on how to complete hawaii tax form g 49 fillable

Prepare Hawaii Tax Form G 49 Fillable effortlessly on any device

Digital document management has become increasingly valued by organizations and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, alter, and eSign your documents promptly without interruptions. Handle Hawaii Tax Form G 49 Fillable across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign Hawaii Tax Form G 49 Fillable with ease

- Obtain Hawaii Tax Form G 49 Fillable and select Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specially designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional pen-and-ink signature.

- Verify all information and click on the Done button to preserve your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Hawaii Tax Form G 49 Fillable to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii tax form g 49 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hawaii g 49 form?

The hawaii g 49 form is essential for businesses operating in Hawaii, providing a streamlined process for submitting businesses documents online. It is crucial for ensuring compliance with state regulations and aids in maintaining good standing. Utilizing the right tools, like airSlate SignNow, can simplify this process further.

-

How can airSlate SignNow help with the hawaii g 49 form?

airSlate SignNow offers an intuitive platform to electronically sign and send the hawaii g 49 form. By using our solution, businesses can ensure their documents are signed efficiently and securely, minimizing the turnaround time for necessary submissions. This leads to faster compliance with state requirements.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans that cater to different business needs, including options for startups and larger enterprises. Our plans are designed to be cost-effective, allowing you to efficiently manage documents like the hawaii g 49 form without breaking the bank. You can explore various features across different pricing tiers to find the best fit.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features tailored to improve document management. You can securely eSign, send, and store documents like the hawaii g 49 form digitally. Additionally, our platform supports templates, real-time tracking, and audit trails, ensuring a seamless signing experience.

-

Are there integrations available with airSlate SignNow?

Yes, airSlate SignNow offers multiple integrations with popular business tools and applications. This allows you to easily incorporate the signing of documents like the hawaii g 49 form into your existing workflows. Streamlined integration helps teams maintain productivity while managing crucial compliance tasks.

-

What are the benefits of using airSlate SignNow for eSignature solutions?

Using airSlate SignNow for eSignature solutions provides signNow benefits, including enhanced security, quick turnaround, and improved compliance. Businesses can efficiently handle the hawaii g 49 form and other essential documents without the hassle of traditional signing methods. This not only saves time but also contributes to a more organized document management process.

-

Is airSlate SignNow mobile-friendly for signing documents?

Absolutely! airSlate SignNow is mobile-friendly, allowing users to sign documents, including the hawaii g 49 form, on any device. Whether in the office or on-the-go, our mobile capabilities ensure that you can manage your signing needs anywhere, anytime, making it incredibly convenient.

Get more for Hawaii Tax Form G 49 Fillable

- Violet flame reiki manual form

- Dir training fund form

- 05 ctr ch10 7904 329 pm page 253 name 10 date class chemical quantities chapter 10 review package part 1 chapter test a a form

- Registro de corporaciones form

- The bedford handbook 11th edition pdf form

- Scholastic venn diagram form

- Fhc rowing apparel order form fhccreworg

- Lending money agreement template form

Find out other Hawaii Tax Form G 49 Fillable

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online