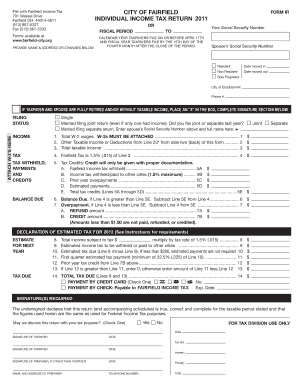

Fairfield Income Tax Form

What is the Fairfield Income Tax

The city of Fairfield income tax is a municipal tax levied on individuals and businesses operating within the city limits. This tax is typically calculated based on a percentage of earned income, including wages, salaries, and business profits. The revenue generated from this tax is used to fund essential city services such as public safety, infrastructure, and community programs. Understanding the specifics of the Fairfield income tax is crucial for residents and business owners to ensure compliance and proper financial planning.

Steps to complete the Fairfield Income Tax

Completing the city of Fairfield income tax forms involves several key steps to ensure accuracy and compliance. Here are the general steps to follow:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Obtain the appropriate Fairfield city tax forms, which can be downloaded from the city’s tax office website or filled out online.

- Fill out the forms accurately, ensuring all income sources are reported and deductions are applied where applicable.

- Review the completed forms for any errors or omissions.

- Submit the forms either electronically through an e-filing system or via mail to the Fairfield tax office.

Required Documents

To successfully file the city of Fairfield income tax, certain documents are required. These typically include:

- W-2 forms from employers showing annual wages.

- 1099 forms for any freelance or contract work.

- Documentation of any additional income sources, such as rental income.

- Records of deductible expenses, if applicable.

- Previous year’s tax return for reference.

Form Submission Methods

Residents and businesses can submit their city of Fairfield tax forms through various methods. These include:

- Online Submission: Many taxpayers prefer to file electronically through the city’s designated e-filing system, which is secure and efficient.

- Mail: Taxpayers can print the completed forms and send them via postal service to the Fairfield tax office.

- In-Person: Individuals may also choose to visit the tax office directly to submit their forms and receive assistance if needed.

Penalties for Non-Compliance

Failing to comply with the city of Fairfield income tax regulations can result in various penalties. These may include:

- Late filing fees for submissions made after the deadline.

- Interest on unpaid taxes, which accumulates over time.

- Potential legal action for persistent non-compliance, which may lead to garnishment of wages or liens against property.

Legal use of the Fairfield Income Tax

The legal framework governing the city of Fairfield income tax ensures that it is collected and enforced in accordance with state and federal laws. Compliance with these regulations is essential for both individuals and businesses. Properly filed tax forms serve as legally binding documents, and using a reliable electronic signature solution can enhance the validity of submissions. Adhering to the legal requirements helps avoid penalties and ensures that taxpayers contribute fairly to the city's revenue.

Quick guide on how to complete fairfield income tax

Prepare Fairfield Income Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the needed form and store it securely online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Fairfield Income Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Fairfield Income Tax with ease

- Locate Fairfield Income Tax and click Get Form to initiate the process.

- Make use of the tools available to complete your document.

- Emphasize important parts of the document or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Fairfield Income Tax and ensure effective communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fairfield income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Fairfield income tax rate?

The city of Fairfield income tax rate is set at a competitive level to ensure both sustainability for city services and affordability for residents. Understanding this rate is essential for anyone filing taxes in the area, and airSlate SignNow can help streamline your document management related to tax filings.

-

How can airSlate SignNow assist with city of Fairfield income tax documentation?

airSlate SignNow provides an intuitive platform for creating, signing, and managing tax documents efficiently. By using our eSigning solutions, residents and businesses in Fairfield can easily manage their income tax documents on time, reducing stress during tax season.

-

Are there any fees associated with filing city of Fairfield income tax using airSlate SignNow?

While airSlate SignNow itself does not charge fees specifically for filing the city of Fairfield income tax, there may be costs related to third-party services or additional features you choose to access. Our service offers cost-effective solutions to minimize your overall expenses and streamline the process.

-

What features does airSlate SignNow offer for city of Fairfield income tax submissions?

airSlate SignNow offers a range of features perfect for city of Fairfield income tax submissions, including easy document creation, secure electronic signatures, and automated workflows. These features help you manage your tax submissions efficiently and ensure compliance with local regulations.

-

Can I integrate airSlate SignNow with other tax software for city of Fairfield income tax?

Yes, airSlate SignNow can be seamlessly integrated with various tax software platforms to enhance your city of Fairfield income tax preparation and submission process. By integrating these tools, you can centralize your financial operations and improve the efficiency of your tax-related tasks.

-

What are the benefits of using airSlate SignNow for city of Fairfield income tax preparation?

Using airSlate SignNow for your city of Fairfield income tax preparation provides numerous benefits, such as saving time, reducing paper clutter, and ensuring secure document handling. Our platform empowers users to focus on maximizing their tax deductions while we handle the administrative tasks.

-

Is airSlate SignNow secure for handling city of Fairfield income tax documents?

Absolutely! airSlate SignNow prioritizes the security of your city of Fairfield income tax documents with industry-leading encryption and secure storage solutions. Our commitment to data protection ensures that your sensitive tax information remains confidential and secure.

Get more for Fairfield Income Tax

Find out other Fairfield Income Tax

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document