Tax Compliance Verification Sheet Form

Understanding the Tax Compliance Verification Sheet

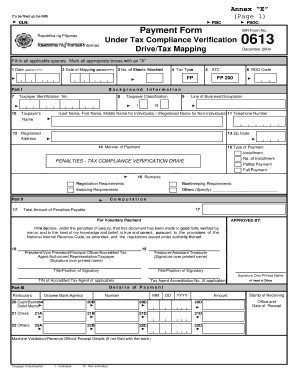

The Tax Compliance Verification Sheet is an essential document used to confirm that a taxpayer is compliant with their tax obligations. It serves as a formal declaration of a taxpayer's adherence to federal and state tax laws. This sheet is often required by various entities, such as banks or government agencies, to ensure that individuals or businesses have met their tax responsibilities. It typically includes information about the taxpayer's identification, tax status, and any outstanding obligations.

Steps to Complete the Tax Compliance Verification Sheet

Completing the Tax Compliance Verification Sheet involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including your tax identification number and records of your tax filings. Next, fill out the sheet with your personal or business details, ensuring that all information is current and correct. It is crucial to review the completed form for any errors before submission. Finally, sign and date the form to validate it, as an unsigned document may not be accepted.

How to Obtain the Tax Compliance Verification Sheet

The Tax Compliance Verification Sheet can typically be obtained from the relevant tax authority's website or office. In many cases, it is available as a downloadable form that can be printed and filled out manually. Some jurisdictions may also offer the option to complete the form online, streamlining the process. Be sure to check for any specific requirements or additional documentation needed when requesting this sheet.

Legal Use of the Tax Compliance Verification Sheet

The legal use of the Tax Compliance Verification Sheet is vital for ensuring that the information provided is recognized by authorities and third parties. This document must be completed accurately and submitted to the appropriate entities as required. Misrepresentation or failure to comply with the instructions can lead to legal repercussions, including fines or penalties. Therefore, understanding the legal implications of this document is essential for all taxpayers.

Key Elements of the Tax Compliance Verification Sheet

Several key elements must be included in the Tax Compliance Verification Sheet to ensure its validity. These elements typically consist of:

- Taxpayer Identification: This includes the name, address, and tax identification number of the taxpayer.

- Tax Status: A declaration of the taxpayer's current compliance status regarding federal and state taxes.

- Signature: The taxpayer's signature is required to affirm the accuracy of the information provided.

- Date: The date of completion must be included to establish the timeline of compliance.

IRS Guidelines for the Tax Compliance Verification Sheet

The IRS provides specific guidelines regarding the use and submission of the Tax Compliance Verification Sheet. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding the necessary documentation, deadlines for submission, and any potential penalties for non-compliance. Following IRS guidelines helps maintain transparency and accountability in tax matters.

Quick guide on how to complete tax compliance verification sheet

Prepare Tax Compliance Verification Sheet easily on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a superb environmentally-friendly option to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary resources to create, edit, and eSign your documents quickly without delays. Manage Tax Compliance Verification Sheet on any system with airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and eSign Tax Compliance Verification Sheet effortlessly

- Find Tax Compliance Verification Sheet and click on Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides expressly for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your device.

Eliminate concerns over lost or misplaced documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tax Compliance Verification Sheet and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax compliance verification sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax compliance verification certificate sample?

A tax compliance verification certificate sample is a document that confirms an individual's or entity's adherence to tax regulations. This sample verifies that all tax obligations have been met, which can be crucial for business transactions and financial activities.

-

How can airSlate SignNow help with obtaining a tax compliance verification certificate sample?

airSlate SignNow streamlines the process of obtaining a tax compliance verification certificate sample by allowing users to eSign necessary documents quickly and securely. This helps businesses maintain compliance and ensures they have the right documentation when needed.

-

What features does airSlate SignNow offer for tax compliance verification?

airSlate SignNow provides features like customizable templates, secure eSignature capabilities, and audit trails that are essential for tax compliance verification. These features ensure that your documents, including a tax compliance verification certificate sample, are processed efficiently and securely.

-

Is airSlate SignNow cost-effective for managing tax compliance-related documents?

Yes, airSlate SignNow is a cost-effective solution for managing tax compliance-related documents, including tax compliance verification certificate samples. The platform offers various pricing plans that cater to different business sizes, enabling efficient document management without straining your budget.

-

Can airSlate SignNow integrate with other accounting software for tax compliance?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and financial software, making it easier to manage tax compliance documents, including tax compliance verification certificate samples. This integration allows for automated workflows that reduce manual efforts.

-

How does airSlate SignNow enhance the signing experience for tax compliance documents?

airSlate SignNow enhances the signing experience for tax compliance documents by offering an intuitive platform that simplifies the eSigning process. Users can easily access and eSign tax compliance verification certificate samples from any device, ensuring a hassle-free experience.

-

What benefits do businesses gain from using airSlate SignNow for tax compliance?

Using airSlate SignNow for tax compliance provides businesses with increased efficiency, reduced turnaround times, and enhanced security. This ensures that tax compliance verification certificate samples and other important documents are handled properly and are readily available when needed.

Get more for Tax Compliance Verification Sheet

- Fill in gf 40 form

- Vehicle inspection form 422499791

- Passport to leisure application form pdf 256kb milton keynes

- D39 formulier

- Restricted area identity card raic toronto pearson form

- Cdp verification of supervision experience amp statement of qualifications this form is used to verify a supervisor s

- Po box 8080 mckinney tx 75070 form

- Mount sinai house staff application form

Find out other Tax Compliance Verification Sheet

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple