Toledo Non Resident Tax Form

What is the Toledo Non Resident Tax Form

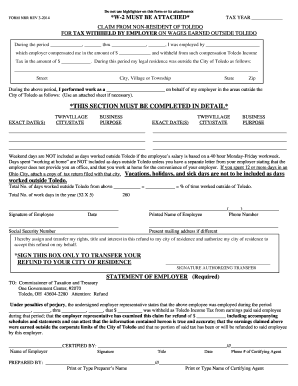

The Toledo Non Resident Tax Form, commonly referred to as the NRR form for Toledo, is a document required for individuals who earn income in the city of Toledo but do not reside there. This form allows non-residents to report their income and calculate any applicable city taxes. It ensures compliance with local tax regulations and helps prevent double taxation for those who may also be subject to taxes in their home jurisdiction.

How to use the Toledo Non Resident Tax Form

Using the Toledo Non Resident Tax Form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including W-2s and 1099s, which detail your earnings. Next, fill out the form by entering your income details, deductions, and any credits you may qualify for. Once completed, review the form for accuracy before submitting it to the City of Toledo's Income Tax Department.

Steps to complete the Toledo Non Resident Tax Form

Completing the NRR form for Toledo requires careful attention to detail. Follow these steps:

- Obtain the latest version of the NRR form from the City of Toledo's Income Tax Department.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned in Toledo, including wages and other earnings.

- Calculate any deductions or credits you are eligible for, which may reduce your taxable income.

- Review your entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Toledo Non Resident Tax Form

The Toledo Non Resident Tax Form is legally binding when filled out correctly and submitted to the appropriate authorities. It must comply with local tax laws and regulations to be considered valid. The form serves as a declaration of your income and tax obligations, and it is essential to ensure that all information provided is truthful and accurate to avoid potential legal issues.

Required Documents

To successfully complete the Toledo Non Resident Tax Form, you will need to gather several key documents:

- W-2 forms from employers that detail your earnings.

- 1099 forms for any freelance or contract work.

- Records of any deductions or credits you plan to claim.

- Identification documents, such as a driver's license or Social Security card.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Toledo Non Resident Tax Form. Typically, the deadline for submission coincides with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any specific local extensions or changes that may apply each tax year. Late submissions may result in penalties or interest charges.

Quick guide on how to complete toledo non resident tax form

Handle Toledo Non Resident Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without interruptions. Manage Toledo Non Resident Tax Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Toledo Non Resident Tax Form without hassle

- Find Toledo Non Resident Tax Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Toledo Non Resident Tax Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the toledo non resident tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Toledo city tax forms and why do I need them?

Toledo city tax forms are official documents required for filing taxes in the city of Toledo. These forms help residents report their income, calculate tax liability, and ensure compliance with local tax regulations. Utilizing airSlate SignNow can simplify this process by allowing you to eSign and send your completed tax forms securely.

-

How can airSlate SignNow help me with Toledo city tax forms?

airSlate SignNow offers a user-friendly platform where you can easily complete, sign, and manage your Toledo city tax forms. Its electronic signature capabilities ensure that you can quickly finalize your documents without the hassle of printing. Additionally, you can share forms directly with your accountant or tax preparer to streamline your operations.

-

Is there a cost associated with using airSlate SignNow for Toledo city tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to suit different needs, including those specifically for managing Toledo city tax forms. The pricing is competitive, and many users find it cost-effective compared to traditional filing methods. There are also options for free trials, allowing you to test the service before committing.

-

What features does airSlate SignNow provide for managing Toledo city tax forms?

airSlate SignNow includes several features for managing Toledo city tax forms such as customizable templates, bulk sending, and cloud storage. Additionally, it provides robust tracking tools to monitor the status of your documents, ensuring that all forms are signed and submitted on time. These features help enhance efficiency when dealing with tax compliance.

-

Are Toledo city tax forms secure when using airSlate SignNow?

Absolutely! airSlate SignNow employs high-level encryption and security protocols to protect your Toledo city tax forms. This includes secure data storage and the option for two-factor authentication to keep your sensitive information safe. You can confidently eSign and send your forms knowing that security is a top priority.

-

Can I integrate airSlate SignNow with other software for my Toledo city tax forms?

Yes, airSlate SignNow offers integrations with various software applications including popular tax software and accounting tools. This allows you to easily import and export your Toledo city tax forms, making it easier to manage your tax-related documents within your existing workflow. Check the integration options available to streamline your processes.

-

How does eSigning Toledo city tax forms benefit me?

eSigning Toledo city tax forms with airSlate SignNow benefits you by simplifying the signing process, reducing the time it takes to finalize documents. With eSignatures, you eliminate the need for printing, scanning, or mailing, making your tax filing more efficient. This convenience can help ensure you meet tax deadlines with ease.

Get more for Toledo Non Resident Tax Form

- Std255c form

- Sliding scale application form upper bay counseling and support upperbay

- Form 14 survivor retirement application pers mississippi

- Af form 1137

- Transfer on death confirmation affidavit 5302 222 form

- Application form for social welfare assets gov ie

- Utah quit claim deed form pdfword

- Thurston countys newly elected officials sworn in during form

Find out other Toledo Non Resident Tax Form

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now