Tin Number Registration Form Online

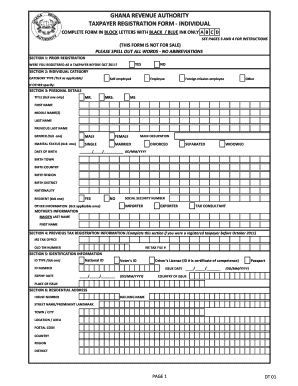

What is the tin number registration form online

The tin number registration form online is a digital document that individuals and businesses use to apply for a Tax Identification Number (TIN) issued by the Internal Revenue Service (IRS) in the United States. The TIN is essential for tax purposes, enabling the IRS to track taxpayers and their financial activities. This form can be completed and submitted electronically, streamlining the application process. It is important to ensure that all information provided is accurate to avoid delays in processing.

Steps to complete the tin number registration form online

Completing the tin number registration form online involves several key steps:

- Access the online form through the IRS website or an authorized platform.

- Provide personal information, including your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

- Indicate the reason for applying for a TIN, such as starting a new business or filing taxes.

- Review all information for accuracy before submitting the form.

- Submit the form electronically and save a copy for your records.

Legal use of the tin number registration form online

The tin number registration form online is legally recognized when filled out and submitted according to IRS regulations. The electronic submission process complies with the Electronic Signatures in Global and National Commerce Act (ESIGN), ensuring that eSignatures are valid and enforceable. It is crucial to adhere to all guidelines provided by the IRS to maintain the legality of the application, including providing truthful information and using secure platforms for submission.

Required documents

When completing the tin number registration form online, certain documents may be required to support your application. These typically include:

- Proof of identity, such as a driver's license or passport.

- Social Security card or Employer Identification Number (EIN) if applicable.

- Documentation that explains the reason for applying for a TIN, such as business formation documents.

Having these documents ready can help ensure a smooth application process.

Who issues the form

The tin number registration form online is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax administration in the United States. The IRS provides the necessary guidelines and resources for individuals and businesses to obtain their TIN. Once the application is submitted and approved, the IRS will issue the TIN, which is essential for tax reporting and compliance.

Application process & approval time

The application process for obtaining a tin number online is generally straightforward. After completing the registration form and submitting it electronically, applicants can expect a response from the IRS within a few weeks. The approval time may vary based on the volume of applications received and the accuracy of the information provided. It is advisable to monitor the status of your application and keep records of your submission.

Quick guide on how to complete tin number registration form online

Complete Tin Number Registration Form Online effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without any delays. Manage Tin Number Registration Form Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Tin Number Registration Form Online without any hassle

- Obtain Tin Number Registration Form Online and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Identify relevant sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets all your document management needs with a few clicks from your chosen device. Edit and eSign Tin Number Registration Form Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tin number registration form online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TIN number and why is it important for businesses?

A TIN number, or Tax Identification Number, is essential for businesses as it serves as a unique identifier for tax purposes. It helps organizations file taxes accurately and maintain compliance with federal regulations. Having a TIN number also streamlines the process of opening business accounts and ensuring proper reporting to the IRS.

-

How does airSlate SignNow help in managing TIN numbers?

With airSlate SignNow, businesses can easily incorporate TIN numbers into their documents, ensuring they are securely captured and shared. Our platform allows for electronic signatures on forms requiring TIN numbers, simplifying the process of collecting and managing sensitive information. This can enhance compliance and reduce paperwork hassle.

-

Is airSlate SignNow affordable for small businesses needing to handle TIN numbers?

Yes, airSlate SignNow offers competitive pricing that caters to small businesses who need to manage TIN numbers efficiently. Our cost-effective solution provides access to essential features without breaking the bank. This empowers small enterprises to streamline their document processes while remaining compliant with tax regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for TIN number management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage TIN numbers. This ensures that your documents are accurately linked and financial data is consistent across platforms. Our integrations simplify the workflow and enhance overall efficiency.

-

What security measures does airSlate SignNow implement for documents containing TIN numbers?

Security is a priority for airSlate SignNow, especially when handling sensitive information like TIN numbers. We use advanced encryption and compliance with industry standards to protect your documents. Additionally, access controls ensure that only authorized personnel can view or edit documents containing TIN numbers.

-

How does electronic signing from airSlate SignNow benefit documents requiring TIN numbers?

Electronic signing through airSlate SignNow allows you to streamline the approval process for documents that require a TIN number. It eliminates the need for physical signatures, reducing turnaround time. This not only improves efficiency but also enhances the overall experience for both senders and signers.

-

What features of airSlate SignNow are most beneficial for managing TIN numbers?

airSlate SignNow offers features like customizable templates and real-time tracking, which are particularly beneficial for managing documents that include TIN numbers. These tools help you create efficient workflows that ensure all necessary fields, including TIN numbers, are completed accurately. Plus, the audit trail feature provides an additional layer of accountability.

Get more for Tin Number Registration Form Online

Find out other Tin Number Registration Form Online

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF