16 See Rule 311a Certificate under Section 203 of the Income Tax Act, 1961 for Tax Deducted at Source from Income Chargeable Und 2006

What is the 16 See Rule 311a Certificate Under Section 203 Of The Income Tax Act, 1961 For Tax Deducted At Source From Income Chargeable

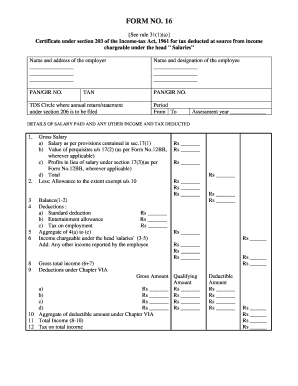

The 16 See Rule 311a Certificate is a crucial document under Section 203 of the Income Tax Act, 1961, specifically designed for tax deducted at source (TDS) from income that is chargeable under various heads. This certificate serves as proof that the tax has been withheld from payments made to individuals or entities. It is essential for taxpayers to understand that this certificate not only facilitates compliance with tax regulations but also aids in claiming credit for the TDS while filing income tax returns. The accurate issuance of this certificate ensures that the taxpayer can avoid double taxation and maintain transparency with tax authorities.

How to Obtain the 16 See Rule 311a Certificate Under Section 203 Of The Income Tax Act, 1961

Obtaining the 16 See Rule 311a Certificate involves a systematic approach. Taxpayers or deductors must apply for the certificate through the appropriate tax authority. This process typically requires the submission of specific documentation, including details of the tax deducted, the nature of the income, and identification information of both the deductor and the deductee. It is advisable to keep all relevant records organized to facilitate a smooth application process. Once the application is submitted, the tax authority will review the information provided and issue the certificate if all criteria are met.

Steps to Complete the 16 See Rule 311a Certificate Under Section 203 Of The Income Tax Act, 1961

Completing the 16 See Rule 311a Certificate involves several key steps:

- Gather necessary information, including the deductor's and deductee's details.

- Specify the amount of tax deducted and the corresponding income details.

- Ensure all fields in the certificate are filled out accurately to avoid discrepancies.

- Review the completed certificate for correctness before submission.

- Submit the certificate to the relevant tax authority or provide it to the deductee as required.

Legal Use of the 16 See Rule 311a Certificate Under Section 203 Of The Income Tax Act, 1961

The legal use of the 16 See Rule 311a Certificate is fundamental for both deductors and deductees. For deductors, it serves as evidence of compliance with tax withholding obligations, protecting them from potential penalties. For deductees, this certificate is vital for claiming TDS credits while filing their income tax returns. It is essential to ensure that the certificate is issued correctly and in a timely manner to uphold its legal validity. Failure to comply with the requirements may result in legal complications, including tax audits and penalties.

Key Elements of the 16 See Rule 311a Certificate Under Section 203 Of The Income Tax Act, 1961

Understanding the key elements of the 16 See Rule 311a Certificate is crucial for proper completion and usage. The certificate typically includes:

- The name and address of the deductor.

- The name and address of the deductee.

- The amount of income on which tax has been deducted.

- The rate at which tax has been deducted.

- The total amount of tax deducted.

- The financial year for which the certificate is issued.

Each of these elements plays a vital role in ensuring the accuracy and legality of the certificate.

IRS Guidelines Related to the 16 See Rule 311a Certificate

While the 16 See Rule 311a Certificate is specific to the Indian tax framework, it is important for U.S. taxpayers to be aware of IRS guidelines regarding foreign tax credits. Taxpayers may need to provide documentation similar to the 16 See Rule 311a Certificate when claiming credits for taxes paid to foreign governments. Understanding these guidelines helps ensure compliance with U.S. tax law while effectively managing international tax obligations.

Quick guide on how to complete 16 see rule 311a certificate under section 203 of the income tax act 1961 for tax deducted at source from income chargeable

Effortlessly Prepare 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right templates and securely store them online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und with Ease

- Obtain 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und and click Get Form to begin.

- Utilize our tools to fill in your form.

- Select essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und to maintain excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 16 see rule 311a certificate under section 203 of the income tax act 1961 for tax deducted at source from income chargeable

Create this form in 5 minutes!

How to create an eSignature for the 16 see rule 311a certificate under section 203 of the income tax act 1961 for tax deducted at source from income chargeable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961?

The 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 pertains to the issuance of tax deduction certificates for income chargeable under specific heads. This certificate is essential for individuals or entities seeking to ensure compliance with income tax regulations related to TDS. airSlate SignNow helps facilitate the process of obtaining this certificate with its user-friendly platform.

-

How can airSlate SignNow help with obtaining the 16 See Rule 311a Certificate?

airSlate SignNow streamlines the process of applying for the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 by allowing users to manage and eSign essential documents electronically. Our platform simplifies document workflows, ensuring that users can gather the necessary approvals for tax certificates efficiently. This is particularly beneficial for businesses managing multiple transactions requiring TDS compliance.

-

Is airSlate SignNow affordable for small businesses needing the 16 See Rule 311a Certificate?

Yes, airSlate SignNow offers cost-effective solutions tailored for businesses of all sizes, including small businesses. Our pricing structures are designed to help users achieve compliance with various tax regulations, including the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961, without breaking the bank. Explore our subscription options to find a plan that fits your budget.

-

What features does airSlate SignNow offer that assist with tax documentation?

airSlate SignNow boasts features like electronic signatures, document templates, and automated workflows, all of which are pivotal for managing tax documentation effectively. These features are particularly useful for businesses that need to prepare the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 efficiently. Our platform minimizes the hassle associated with traditional paperwork.

-

Can I integrate airSlate SignNow with other tools to help with tax compliance?

Absolutely! airSlate SignNow supports integration with various platforms and applications, enhancing its functionality for tax compliance tasks. This means you can easily connect it with your accounting software to manage the generation of the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 and maintain accurate records. Seamless integrations make your workflow more efficient.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documentation, such as the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961, offers enhanced efficiency and security. Our platform ensures that documents are handled quickly, securely, and in compliance with regulations. Additionally, the ease of electronic signatures speeds up the approval process, saving you valuable time.

-

How secure is my information when using airSlate SignNow?

Security is a top priority for airSlate SignNow. We utilize advanced encryption technologies to protect your data when applying for the 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961. With our commitment to data security, you can be confident that your personal and financial information is safe while using our platform.

Get more for 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und

Find out other 16 See Rule 311a Certificate Under Section 203 Of The Income tax Act, 1961 For Tax Deducted At Source From Income Chargeable Und

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist