"FORM NO 16 See Rule 311a PART a Certificate under Section Webtel 2010-2026

Understanding Form No 16

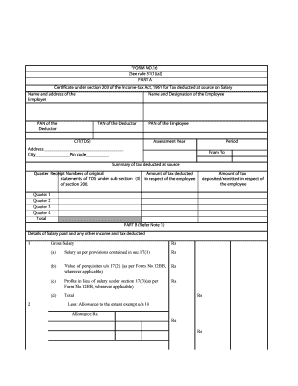

Form No 16 is a certificate under Section 203 of the Income Tax Act, which serves as proof of tax deducted at source (TDS) on salary income. This document is essential for employees as it provides details about the salary paid, TDS deducted, and other relevant information needed for filing income tax returns. It is typically issued by employers to their employees at the end of the financial year, summarizing the tax withheld and the income earned during that period.

Steps to Complete Form No 16

Filling out Form No 16 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including salary slips and previous tax returns. Next, enter personal details such as name, PAN, and address accurately. Then, input the salary details, including basic pay, allowances, and deductions. Finally, ensure that the TDS amount is correctly calculated and reflected in the form. Once completed, review the information for any discrepancies before submission.

Legal Use of Form No 16

Form No 16 is legally recognized as a valid document for tax purposes in the United States. It serves as evidence of tax compliance and is often required when filing income tax returns. The information contained within the form must be accurate, as discrepancies can lead to penalties or audits. Additionally, retaining a copy of Form No 16 is advisable for future reference and verification of tax filings.

Obtaining Form No 16

Employees can obtain Form No 16 from their employers, who are responsible for issuing it at the end of each financial year. If an employee has not received the form, they should contact their HR or payroll department to request it. In cases where the employer fails to provide the form, employees can refer to their salary slips and TDS certificates to gather the necessary information for tax filing.

Key Elements of Form No 16

Form No 16 contains several critical components that are essential for tax filing. These include the employer's name and address, employee details such as name and PAN, the total salary paid, the TDS deducted, and the financial year for which the form is issued. Additionally, it may include details of any other deductions claimed by the employee, such as those under sections 80C to 80U of the Income Tax Act.

IRS Guidelines for Form No 16

The IRS provides specific guidelines regarding the use of Form No 16 in the context of tax filings. It is important for taxpayers to understand the requirements for reporting income and claiming deductions accurately. Form No 16 can assist in substantiating income claims and ensuring compliance with IRS regulations. Taxpayers should ensure they are familiar with these guidelines to avoid potential issues during the filing process.

Quick guide on how to complete quotform no 16 see rule 311a part a certificate under section webtel

Complete "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel with ease

- Obtain "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you choose. Adjust and eSign "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct quotform no 16 see rule 311a part a certificate under section webtel

Create this form in 5 minutes!

How to create an eSignature for the quotform no 16 see rule 311a part a certificate under section webtel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of source of income?

A certificate of source of income is an official document that verifies an individual's income source. It is typically required for various financial processes, including loan applications, tax purposes, and more. With airSlate SignNow, you can easily create and manage this document electronically.

-

How can I obtain a certificate of source of income using airSlate SignNow?

To obtain a certificate of source of income using airSlate SignNow, first, create an account on our platform. Once logged in, you can use our document templates to generate the certificate, customize it with your details, and send it for eSignature seamlessly. Our user-friendly interface simplifies the entire process.

-

What are the benefits of using airSlate SignNow for my certificate of source of income?

Using airSlate SignNow for your certificate of source of income offers numerous benefits, including time efficiency, cost-effectiveness, and security. Our platform allows you to sign, send, and store documents electronically, reducing the need for physical paperwork. Plus, your documents are protected with advanced security features.

-

Is there a cost associated with generating a certificate of source of income on airSlate SignNow?

Yes, there may be costs associated with generating a certificate of source of income on airSlate SignNow, depending on your subscription plan. We offer various pricing tiers designed to meet different business needs, from freelancers to large enterprises. You can choose the one that suits your requirements best.

-

Can I integrate airSlate SignNow with other applications for processing my certificate of source of income?

Absolutely! airSlate SignNow supports integrations with numerous applications, enhancing your ability to process the certificate of source of income effectively. You can integrate it with CRM systems, cloud storage services, and productivity tools to streamline your workflow.

-

How long does it typically take to receive a certificate of source of income after using airSlate SignNow?

The time it takes to receive a certificate of source of income can vary based on the signing process and your recipients. Generally, with airSlate SignNow, the process is expedited, and you can track the status in real-time. Most users report receiving completed documents within hours.

-

Are there any security measures in place for sensitive documents like the certificate of source of income?

Yes, airSlate SignNow prioritizes security for all documents, including the certificate of source of income. We utilize encryption and secure cloud storage to protect your sensitive information from unauthorized access. You can trust that your documents are managed securely.

Get more for "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel

Find out other "FORM NO 16 See Rule 311a PART A Certificate Under Section Webtel

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online