Application for Refund of Duty Interest in Word Format

What is the application for refund of duty interest in Word format?

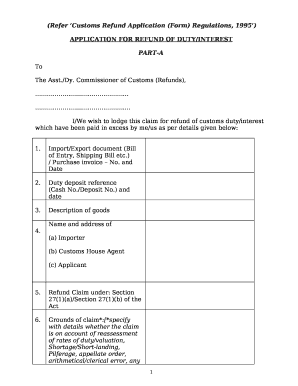

The application for refund of duty interest in Word format is a formal document used by individuals or businesses to request a refund on overpaid customs duties. This form is essential for ensuring that the request is properly documented and can be processed by the relevant authorities. It typically includes details such as the applicant's information, the amount of duty paid, and the reason for the refund request. Understanding the purpose of this application is crucial for anyone looking to reclaim excess payments made to customs.

Steps to complete the application for refund of duty interest in Word format

Completing the application for refund of duty interest involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and proof of payment. Next, fill out the form with accurate details, including your name, address, and the specifics of the duty paid. Be sure to clearly state the reason for the refund request. After completing the form, review it for any errors before submitting it to the appropriate customs authority. This careful approach helps to facilitate a smoother processing of your refund request.

Required documents for the application for refund of duty interest in Word format

When submitting the application for refund of duty interest, certain documents are typically required to support your request. These may include:

- Proof of payment for the customs duties

- Invoices related to the transaction

- Any correspondence with customs regarding the duty

- Identification documents, such as a driver's license or passport

Having these documents ready can expedite the review process and increase the likelihood of a successful refund.

Legal use of the application for refund of duty interest in Word format

The legal use of the application for refund of duty interest is governed by customs regulations and laws. This form must be filled out accurately and submitted within specific timeframes to be considered valid. Compliance with these regulations ensures that the application is recognized by customs authorities. Additionally, the use of electronic signatures on the form is permissible under U.S. law, provided that the signer meets the necessary legal requirements. Understanding these legal aspects is essential for anyone seeking to file a refund request.

Application process and approval time

The application process for a refund of duty interest typically involves submitting the completed form along with required documentation to the customs authority. After submission, the review process can take several weeks, depending on the complexity of the request and the workload of the customs office. It is advisable to keep track of your submission and follow up if you do not receive a response within the expected timeframe. Being proactive can help ensure that your refund request is processed in a timely manner.

Eligibility criteria for the application for refund of duty interest in Word format

Eligibility for filing an application for refund of duty interest generally includes having paid the customs duties in excess or in error. Additionally, the applicant must be the individual or entity that originally paid the duties. Certain time limits apply, often requiring the application to be submitted within a specific period after the payment was made. Understanding these criteria is important to ensure that your application meets the necessary requirements for consideration.

Quick guide on how to complete application for refund of duty interest in word format

Prepare Application For Refund Of Duty Interest In Word Format effortlessly on any device

Web-based document organization has become prevalent among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Application For Refund Of Duty Interest In Word Format on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Application For Refund Of Duty Interest In Word Format seamlessly

- Obtain Application For Refund Of Duty Interest In Word Format and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or mistakes that require reprinting document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Application For Refund Of Duty Interest In Word Format and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for refund of duty interest in word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a custom duty refund application form in word?

A custom duty refund application form in word is a document designed for businesses to request a refund for excess duties paid on goods imported. This fillable form can be easily edited and customized to suit specific needs, ensuring compliance with customs regulations. Using a standard format streamlines the submission process and enhances the likelihood of a successful refund.

-

How do I create a custom duty refund application form in word?

To create a custom duty refund application form in word, you can start with a template available on various online platforms or design your own using Microsoft Word tools. It’s essential to include all relevant information such as the reason for the refund, transaction details, and any attached documentation. Make sure to format the form clearly for easier submission.

-

Can I integrate airSlate SignNow with my custom duty refund application form in word?

Yes, you can integrate airSlate SignNow with your custom duty refund application form in word. The platform allows for seamless eSigning and document management, making it easier to handle refund applications securely and efficiently. This integration helps to streamline your workflow and ensures timely processing of your applications.

-

What are the pricing options for using airSlate SignNow with my custom duty refund application form in word?

airSlate SignNow offers various pricing plans to cater to different business needs, which can be found on the official website. Whether you are a small business or a large enterprise, you can choose a plan that includes features for managing your custom duty refund application form in word. Check for any ongoing promotions or discounts for new users.

-

What features enhance the effectiveness of a custom duty refund application form in word?

Key features that enhance the effectiveness of a custom duty refund application form in word include digital signature capabilities, template customization, and automatic document tracking. These features simplify the submission process and improve accuracy, ensuring that you meet all the requirements for a successful refund application. Additionally, integration with eSigning tools can save valuable time.

-

How can using a custom duty refund application form in word benefit my business?

Using a custom duty refund application form in word can signNowly benefit your business by simplifying the refund request process, reducing paperwork, and improving accuracy in submissions. Leveraging this form helps in efficiently tracking refunds, which can lead to improved cash flow. Additionally, having a standardized form ensures that all necessary information is included, reducing the chances of application rejections.

-

Is it secure to use airSlate SignNow for my custom duty refund application form in word?

Absolutely! airSlate SignNow implements advanced security measures to protect your documents and sensitive information. When you use the platform for your custom duty refund application form in word, you can trust that your data is secure with encryption and compliance with industry standards. This ensures that your applications are handled safely and professionally.

Get more for Application For Refund Of Duty Interest In Word Format

- Girl scout uniform order form

- 553 madiba street arcadia pretoria form

- Vaccination documentation worksheet form

- Ccm n020 60m complaint form

- Student permanent withdrawalmcps form 5654 page 1

- Clayton homes installation manual form

- Manufacturing license agreement template form

- Night club contract template form

Find out other Application For Refund Of Duty Interest In Word Format

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe