Mystic Lake Win Loss Statement Form

What makes the mystic lake win loss statement form legally binding?

As the society takes a step away from in-office working conditions, the completion of paperwork increasingly occurs online. The mystic lake win loss statement form isn’t an exception. Working with it using electronic tools is different from doing this in the physical world.

An eDocument can be considered legally binding on condition that particular needs are met. They are especially vital when it comes to stipulations and signatures related to them. Typing in your initials or full name alone will not guarantee that the organization requesting the form or a court would consider it accomplished. You need a trustworthy tool, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your mystic lake win loss statement form when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legitimate and safe. It also offers a lot of opportunities for smooth completion security wise. Let's rapidly go through them so that you can stay certain that your mystic lake win loss statement form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: major privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties' identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data securely to the servers.

Filling out the mystic lake win loss statement form with airSlate SignNow will give better confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete mystic lake win loss statement

Prepare Mystic Lake Win Loss Statement effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed files, enabling you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Mystic Lake Win Loss Statement on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Mystic Lake Win Loss Statement with ease

- Locate Mystic Lake Win Loss Statement and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Mystic Lake Win Loss Statement to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mystic lake win loss statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

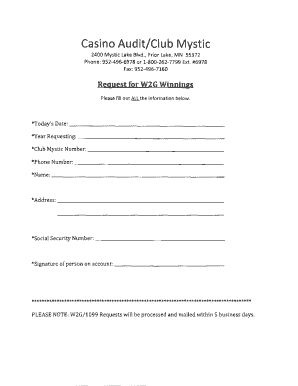

What is a Mystic Lake win loss statement?

A Mystic Lake win loss statement is a document that summarizes the wins and losses associated with gaming activities at Mystic Lake Casino. It provides insights into individual or overall performance and can be essential for accounting and tax purposes.

-

How can airSlate SignNow help with Mystic Lake win loss statements?

airSlate SignNow offers a streamlined process for creating and sharing Mystic Lake win loss statements electronically. With our eSigning capabilities, you can easily get necessary approvals and signatures, ensuring your documents are processed quickly and efficiently.

-

Is there a cost associated with generating Mystic Lake win loss statements using airSlate SignNow?

While airSlate SignNow offers various pricing plans, generating Mystic Lake win loss statements can be a cost-effective solution compared to traditional methods. Our competitive pricing ensures you get the features you need without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing Mystic Lake win loss statements?

Yes, airSlate SignNow integrates with multiple business tools and software, enhancing your workflow for managing Mystic Lake win loss statements. These integrations allow for seamless data sharing and streamlined document handling.

-

What features should I look for when preparing a Mystic Lake win loss statement?

When preparing a Mystic Lake win loss statement, look for features like templates for ease of use, collaboration tools, and secure storage. airSlate SignNow offers these features, making it easier for you to create comprehensive and professional statements.

-

How secure is my Mystic Lake win loss statement when using airSlate SignNow?

Security is a top priority at airSlate SignNow, and your Mystic Lake win loss statements are protected with advanced encryption methods. This ensures that your sensitive information remains confidential and secure during the signing and storage process.

-

Can I access my Mystic Lake win loss statement from anywhere?

Yes, with airSlate SignNow, you can access your Mystic Lake win loss statement from any device with an internet connection. This flexibility means you can manage and send your documents on the go or from the comfort of your home.

Get more for Mystic Lake Win Loss Statement

Find out other Mystic Lake Win Loss Statement

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free