Form 2119

What is the Form 2119

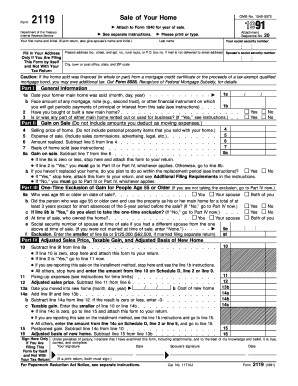

The Form 2119, officially known as the IRS Sale of Home Form 2119, is a tax document utilized by homeowners to report the sale of their primary residence. This form is essential for taxpayers who wish to claim the exclusion of gain from the sale of their home, as outlined in the Internal Revenue Code. It enables individuals to provide necessary details about the property sold, including the sale price, the date of sale, and any adjustments to the basis of the property. Understanding this form is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to Complete the Form 2119

Completing the Form 2119 involves several key steps to ensure accuracy and compliance. Begin by gathering relevant information about the property, including the original purchase price, any improvements made, and the final sale price. Next, fill out the form by providing details such as the address of the property, the date of sale, and the names of all sellers. It is important to calculate any gain or loss from the sale accurately, as this will affect your tax obligations. Review the completed form for any errors before submission to avoid delays or issues with the IRS.

Legal Use of the Form 2119

The legal use of the Form 2119 is governed by IRS guidelines, which stipulate that the form must be filed by taxpayers who sell their primary residence and wish to exclude any capital gains from their taxable income. To qualify for this exclusion, the taxpayer must meet specific criteria, including ownership and use tests. Properly completing and submitting the form ensures that the transaction is recorded legally, protecting the taxpayer from potential penalties or audits related to improper reporting of the sale.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2119 align with the general tax filing deadlines set by the IRS. Typically, taxpayers must submit the form along with their annual income tax return by April fifteenth of the following year after the sale. If the sale occurs in the last quarter of the year, it is advisable to consult IRS guidelines for any specific instructions or extended deadlines. Staying informed about these dates is crucial for avoiding late fees and ensuring compliance with tax regulations.

Required Documents

To complete the Form 2119 accurately, several documents are required. Taxpayers should gather the original purchase documents of the home, including the closing statement and any records of improvements made to the property. Additionally, documentation related to the sale, such as the final closing statement and any relevant correspondence with the buyer, will be necessary. Having these documents on hand will facilitate a smooth completion of the form and help substantiate claims made in the filing.

Examples of Using the Form 2119

Examples of using the Form 2119 include scenarios where homeowners sell their primary residence and realize a profit. For instance, if a couple purchased a home for two hundred thousand dollars and sold it for three hundred thousand dollars, they may be eligible to exclude a portion of the gain from their taxable income by filing the form. Another example is when a homeowner sells a property that has undergone significant renovations, which can affect the basis and potentially increase the exclusion amount. Understanding these examples helps clarify the practical application of the form in real-life situations.

Quick guide on how to complete form 2119

Complete Form 2119 seamlessly on any device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without delays. Manage Form 2119 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

How to edit and eSign Form 2119 effortlessly

- Obtain Form 2119 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 2119 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2119

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2119?

airSlate SignNow is a digital signature platform that enables businesses to send and eSign documents effortlessly. With the development of features like those introduced in 2119, airSlate SignNow offers an intuitive user experience and robust security measures, making it suitable for businesses of all sizes.

-

What are the pricing options for airSlate SignNow in 2119?

In 2119, airSlate SignNow offers several flexible pricing plans tailored to meet the needs of different businesses. From individual plans to enterprise solutions, pricing is designed to be competitive while providing comprehensive eSignature capabilities and document management features.

-

What features does airSlate SignNow offer as of 2119?

As of 2119, airSlate SignNow includes a variety of powerful features such as customizable templates, advanced analytics, and secure cloud storage. These features streamline document workflows and enhance collaboration, empowering businesses to work efficiently and securely.

-

How can airSlate SignNow benefit my business in 2119?

By adopting airSlate SignNow in 2119, businesses can improve their document turnaround times, reduce paper usage, and enhance customer satisfaction. The platform ensures that signing documents is a quick and secure process, ultimately leading to increased productivity.

-

Does airSlate SignNow integrate with other applications in 2119?

Yes, as of 2119, airSlate SignNow offers integrations with various applications, including popular CRM systems and project management tools. This seamless integration allows users to automate their workflows and manage documents easily across platforms, enhancing overall efficiency.

-

Is airSlate SignNow compliant with industry standards in 2119?

Yes, airSlate SignNow is fully compliant with industry standards and regulations, including ESIGN and UETA. This compliance ensures that all electronic signatures generated via the platform in 2119 are legally binding and secure.

-

How user-friendly is airSlate SignNow in 2119?

airSlate SignNow is known for its user-friendly interface, designed to simplify the eSigning process for all users. Even in 2119, users can navigate the platform without technical expertise, making it accessible for businesses of any size.

Get more for Form 2119

- Nuisance complaint aiken sc form

- Form w 9 rev october dekalb county georgia co dekalb ga

- Mathcounts state solutions form

- In on under above behind in front of between next to form

- Risk factors clinical presentations and predictors of stroke form

- Muscle amp nerve laboratory protocolprocedure for sending form

- Ummc doctors excuse form

- Oklahoma seniors cabaret hearing for seniors program form

Find out other Form 2119

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online