Ftb Form 3522

What is the Ftb Form 3522

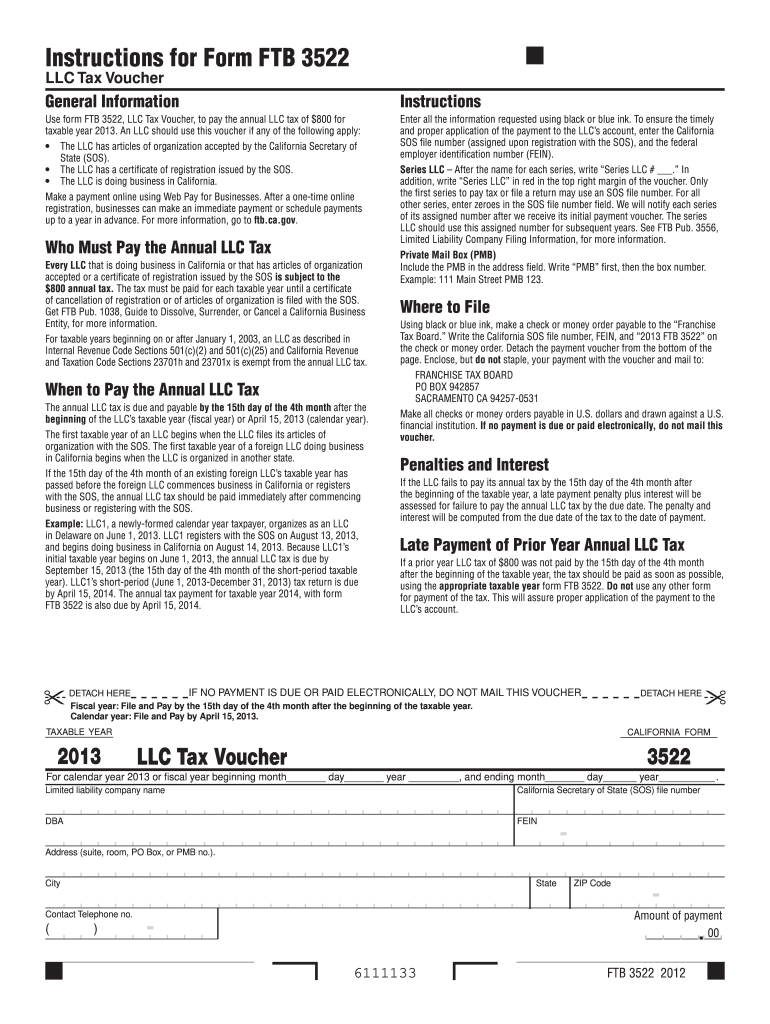

The Ftb Form 3522, also known as the LLC Tax Voucher, is a form used by Limited Liability Companies (LLCs) in California to report and pay their annual minimum franchise tax. This form is essential for compliance with California tax regulations and ensures that LLCs meet their financial obligations to the state. The form includes information about the LLC's income, deductions, and the amount of tax owed. Understanding this form is crucial for maintaining good standing with the California Franchise Tax Board.

How to use the Ftb Form 3522

Using the Ftb Form 3522 involves several key steps. First, ensure you have the latest version of the form, which can be obtained from the California Franchise Tax Board's website. Fill out the required information, including your LLC's name, address, and identification number. Next, calculate the minimum franchise tax owed based on your LLC's income. Once completed, the form can be submitted along with payment to the appropriate address specified by the Franchise Tax Board. It is important to keep a copy of the submitted form for your records.

Steps to complete the Ftb Form 3522

Completing the Ftb Form 3522 involves a systematic approach:

- Obtain the form from the California Franchise Tax Board's website.

- Enter your LLC's name, address, and California Secretary of State file number.

- Provide details about your LLC's income and calculate the minimum franchise tax.

- Review the form for accuracy and completeness.

- Submit the form along with the payment to the designated address.

Following these steps ensures that your submission is accurate and timely, helping you avoid penalties.

Legal use of the Ftb Form 3522

The legal use of the Ftb Form 3522 is governed by California tax laws. This form must be completed accurately and submitted on time to avoid penalties. It serves as a declaration of the LLC's tax obligations and is legally binding once filed. Compliance with the instructions and requirements outlined by the California Franchise Tax Board is essential for the form to be considered valid. Failure to adhere to these regulations may result in fines or loss of good standing for the LLC.

Filing Deadlines / Important Dates

Filing deadlines for the Ftb Form 3522 are crucial for LLCs to avoid penalties. The form is typically due on the 15th day of the fourth month after the close of the LLC's tax year. For most LLCs operating on a calendar year, this means the form is due by April 15. It is important to mark your calendar and ensure that the form is submitted on time to maintain compliance with state regulations.

Required Documents

To complete the Ftb Form 3522, certain documents and information are necessary. These include:

- Your LLC's California Secretary of State file number.

- Income statements or records to determine the minimum franchise tax.

- Previous tax returns or forms, if applicable.

Having these documents ready will facilitate a smoother completion process and ensure that all required information is accurately reported.

Quick guide on how to complete ftb form 3522

Prepare Ftb Form 3522 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Ftb Form 3522 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest way to modify and eSign Ftb Form 3522 without hassle

- Locate Ftb Form 3522 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ftb Form 3522 for outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb form 3522

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FTB form 3522?

FTB form 3522, also known as the Vehicle Registration Fee, is a form used in California for collecting the fees associated with registering vehicles. Understanding this form is essential for vehicle owners to ensure compliance with state regulations.

-

How can airSlate SignNow help with FTB form 3522?

airSlate SignNow simplifies the process of completing FTB form 3522 by providing an easy-to-use platform for eSigning and sending documents. With templates available, users can quickly fill out the necessary information and submit the form digitally.

-

Is there a cost associated with using airSlate SignNow for FTB form 3522?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs, making it an affordable choice for managing FTB form 3522. Users can choose from monthly or annual subscriptions based on their requirements, ensuring they pay only for what they need.

-

What features does airSlate SignNow offer for FTB form 3522?

airSlate SignNow provides features such as customizable templates, document tracking, and status notifications that enhance the user experience when managing FTB form 3522. These features streamline the document workflow, ensuring quick and efficient processing.

-

How does eSigning FTB form 3522 benefit users?

eSigning FTB form 3522 using airSlate SignNow eliminates the need for printing and scanning, saving time and resources. This digital process ensures that the document is securely submitted while maintaining compliance with all signing laws.

-

Can airSlate SignNow integrate with other applications for FTB form 3522?

Yes, airSlate SignNow offers integrations with various applications, making it easier to manage FTB form 3522 within your existing workflow. This capability allows for seamless data transfer and connectivity with other tools that your business may already use.

-

What are the benefits of using airSlate SignNow to manage FTB form 3522?

Using airSlate SignNow to manage FTB form 3522 streamlines the signing process, reduces paperwork, and enhances productivity. The intuitive interface and robust features reduce chances of errors, allowing for a smoother compliance experience.

Get more for Ftb Form 3522

- 2089 amendment to sale contract v01 132089 with sample qxd form

- Sibling relationship checklist form

- Cna supplementary statement verification form

- Lps walking field trip permission form loveland city schools lovelandschools

- Apprentice form for barber 35168336

- Incomplete sentences childrens form balikashfimdpabbcomb

- Individual income tax return city of troy inc form

- Dayton individual return 24 form

Find out other Ftb Form 3522

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word