Dayton Individual Return 24 2024-2026

What is the Dayton Individual Return 24

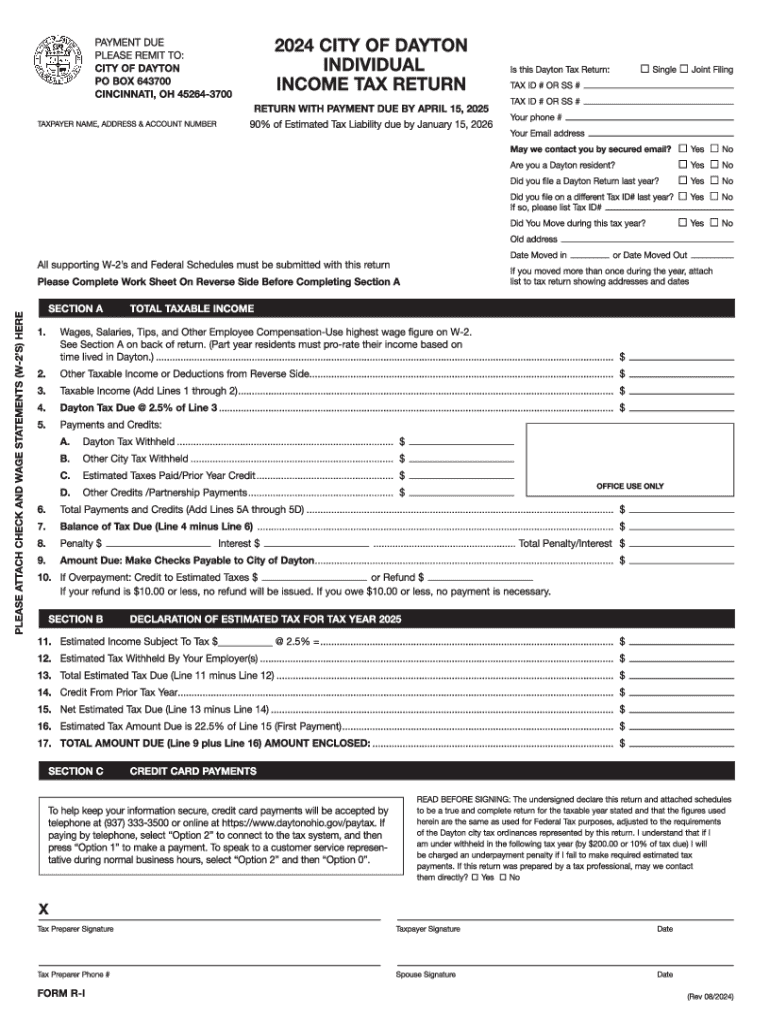

The Dayton Individual Return 24 is a specific tax form used by residents of Dayton, Ohio, to report their income for local tax purposes. This form is essential for individuals who earn income within the city limits and are subject to the local income tax. The return captures various income types, including wages, salaries, and other earnings, ensuring compliance with local tax regulations.

Steps to complete the Dayton Individual Return 24

Completing the Dayton Individual Return 24 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- Calculate any applicable deductions or credits that may reduce your taxable income.

- Review the completed form for accuracy before submission.

Required Documents

To successfully file the Dayton Individual Return 24, you will need several documents:

- W-2 forms from all employers.

- 1099 forms for any freelance or contract work.

- Documentation of any other income sources, such as rental income.

- Records of deductions, including receipts for business expenses or charitable contributions.

Form Submission Methods

The Dayton Individual Return 24 can be submitted through various methods:

- Online: Many taxpayers choose to file electronically using tax software that supports the form.

- By Mail: Completed forms can be mailed to the appropriate tax authority in Dayton.

- In-Person: Taxpayers may also submit their returns directly at designated city offices.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Dayton Individual Return 24. Typically, the deadline aligns with the federal tax deadline, which is usually April 15. However, local extensions may apply, so checking the latest updates from the Dayton tax authority is advisable.

Penalties for Non-Compliance

Failing to file the Dayton Individual Return 24 by the deadline can result in penalties. These may include:

- Late filing fees, which accumulate over time.

- Interest on any unpaid taxes, which can increase the total amount owed.

- Potential legal action if taxes remain unpaid for an extended period.

Create this form in 5 minutes or less

Find and fill out the correct dayton individual return 24

Create this form in 5 minutes!

How to create an eSignature for the dayton individual return 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing an Ohio income tax return individual?

Filing an Ohio income tax return individual involves gathering your financial documents, completing the appropriate forms, and submitting them to the Ohio Department of Taxation. You can use airSlate SignNow to eSign your documents securely and efficiently, ensuring a smooth filing process. Our platform simplifies the steps, making it easier for you to manage your tax obligations.

-

How can airSlate SignNow help with my Ohio income tax return individual?

airSlate SignNow provides a user-friendly platform that allows you to eSign your Ohio income tax return individual documents quickly. With our solution, you can streamline the signing process, reduce paperwork, and ensure that your tax return is filed accurately and on time. Our features are designed to enhance your efficiency during tax season.

-

What are the pricing options for using airSlate SignNow for my Ohio income tax return individual?

airSlate SignNow offers flexible pricing plans that cater to various needs, including individuals filing their Ohio income tax return. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need. Our cost-effective solution provides great value, especially during tax season.

-

Are there any integrations available for airSlate SignNow when filing an Ohio income tax return individual?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Ohio income tax return individual. These integrations allow you to import data directly, reducing manual entry and minimizing errors. This feature enhances your overall filing experience.

-

What benefits does airSlate SignNow offer for Ohio income tax return individual filers?

Using airSlate SignNow for your Ohio income tax return individual offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to eSign documents from anywhere, ensuring you can file your taxes conveniently. Additionally, our secure system protects your sensitive information throughout the process.

-

Can I track the status of my Ohio income tax return individual with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Ohio income tax return individual documents. You will receive notifications when your documents are viewed and signed, giving you peace of mind during the filing process. This transparency helps you stay informed every step of the way.

-

Is airSlate SignNow suitable for first-time Ohio income tax return individual filers?

Absolutely! airSlate SignNow is designed to be user-friendly, making it an excellent choice for first-time Ohio income tax return individual filers. Our intuitive interface guides you through the eSigning process, ensuring you can complete your tax return with confidence. Plus, our customer support is available to assist you if you have any questions.

Get more for Dayton Individual Return 24

- South indian bank new account opening form

- Form 22 annual return 41630976

- Girl scout parent involvement form

- Arrow of light certificate template form

- 111209070 consolidation of folios form cdr idfc mutual fund

- Ia w 4 form

- Memorandum of marriage under the punjab anand marriage act form

- Authorization to release patient health information

Find out other Dayton Individual Return 24

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure