INDIVIDUAL INCOME TAX RETURN City of Troy Inc 2024-2026

What is the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc

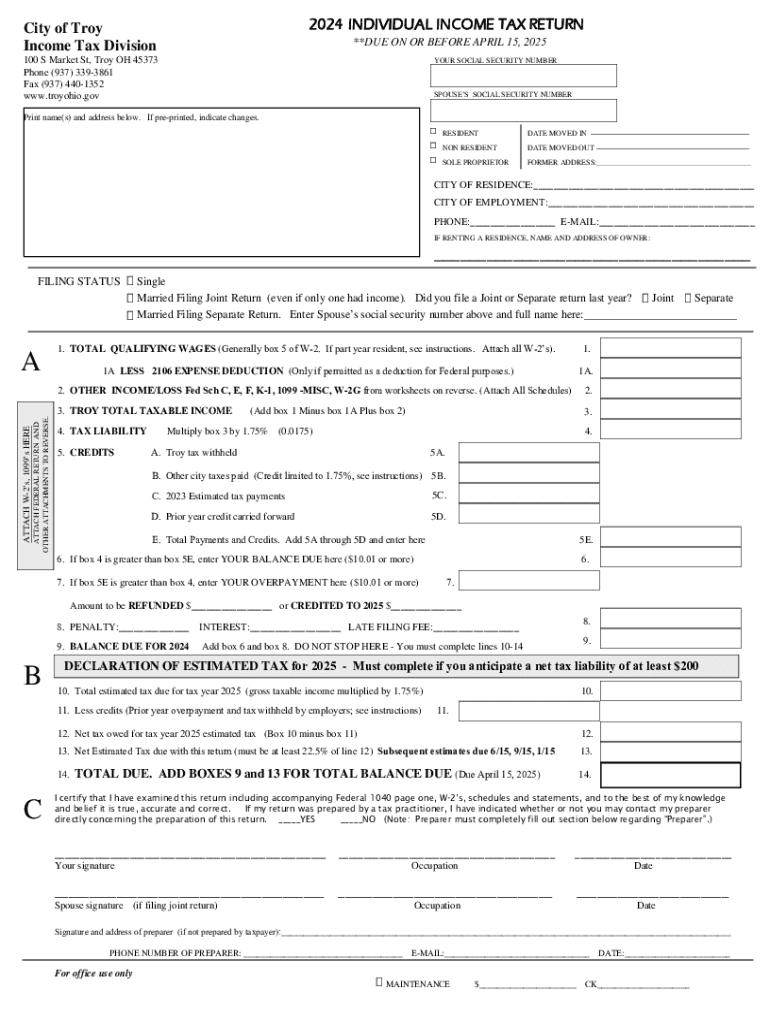

The INDIVIDUAL INCOME TAX RETURN City Of Troy Inc is a specific tax form used by residents of Troy, Michigan, to report their individual income to the local government. This form is essential for determining local tax liabilities and ensuring compliance with city tax regulations. It typically includes information about the taxpayer's income, deductions, and credits applicable within the city of Troy.

How to use the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc

To use the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc effectively, individuals must first gather all necessary financial documents, including W-2s, 1099s, and records of any other income sources. Once the required information is compiled, taxpayers can fill out the form, ensuring all sections are completed accurately. It's important to review the form for any errors before submission to avoid delays or penalties.

Steps to complete the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc

Completing the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc involves several key steps:

- Gather documents: Collect all income statements, including W-2s and 1099s.

- Fill out personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages, interest, and dividends.

- Claim deductions and credits: Identify any applicable deductions or credits to reduce your taxable income.

- Calculate tax owed: Follow the form's instructions to determine the total tax liability.

- Review and sign: Carefully check for accuracy and sign the form before submission.

Required Documents

When completing the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc, certain documents are required to ensure accurate reporting. These include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or dividends.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. Typically, the deadline for submission aligns with the federal tax deadline, which is usually April fifteenth. However, local regulations may have specific dates, so it's advisable to check the City of Troy's official guidelines for any updates or changes.

Penalties for Non-Compliance

Failing to file the INDIVIDUAL INCOME TAX RETURN City Of Troy Inc on time can result in penalties. The city may impose fines for late submissions, and interest may accrue on any unpaid taxes. Additionally, persistent non-compliance can lead to further legal actions or garnishments. It is essential to adhere to filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax return city of troy inc

Create this form in 5 minutes!

How to create an eSignature for the individual income tax return city of troy inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing an INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. using airSlate SignNow?

Filing your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. with airSlate SignNow is straightforward. Simply upload your tax documents, eSign them securely, and submit them directly to the relevant authorities. Our platform ensures that your information is protected and easily accessible.

-

How much does it cost to use airSlate SignNow for my INDIVIDUAL INCOME TAX RETURN City Of Troy Inc.?

airSlate SignNow offers competitive pricing plans tailored to your needs. You can choose from various subscription options that provide access to features specifically designed for managing your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. at an affordable rate. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for INDIVIDUAL INCOME TAX RETURN City Of Troy Inc.?

Our platform includes features such as document templates, secure eSigning, and real-time tracking for your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. These tools streamline the filing process and enhance your overall experience, making it easier to manage your tax documents.

-

Can I integrate airSlate SignNow with other software for my INDIVIDUAL INCOME TAX RETURN City Of Troy Inc.?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, allowing you to manage your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. efficiently. This integration helps you synchronize your data and simplifies the filing process, ensuring accuracy and saving you time.

-

Is airSlate SignNow secure for handling my INDIVIDUAL INCOME TAX RETURN City Of Troy Inc.?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. is protected. We use advanced encryption and secure storage solutions to safeguard your sensitive information throughout the entire process.

-

What are the benefits of using airSlate SignNow for my INDIVIDUAL INCOME TAX RETURN City Of Troy Inc.?

Using airSlate SignNow for your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc. offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the eSigning process, allowing you to focus on what matters most while ensuring your tax documents are filed correctly.

-

How can I get support if I have questions about my INDIVIDUAL INCOME TAX RETURN City Of Troy Inc.?

If you have questions regarding your INDIVIDUAL INCOME TAX RETURN City Of Troy Inc., our dedicated support team is here to help. You can signNow out via email, phone, or live chat for prompt assistance. We are committed to ensuring you have a smooth experience with our platform.

Get more for INDIVIDUAL INCOME TAX RETURN City Of Troy Inc

- Milk record sheet excel form

- Aefi reporting format

- Potbelly menu pdf form

- Mas form 16069398

- Snow plowing contract template form

- Sba form 1368 monthly sales figures

- Harare polytechnic application form pdf harare polytechnic application form pdf harare poly engineering courses

- Corporate yoga contract template form

Find out other INDIVIDUAL INCOME TAX RETURN City Of Troy Inc

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure