Nj927 Form PDF

What is the Nj927 Form Pdf

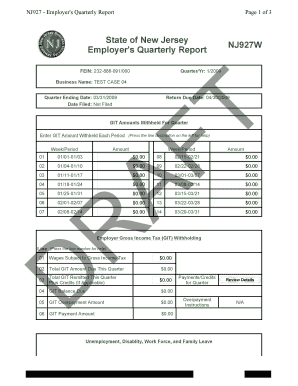

The Nj927 form, also known as the New Jersey Quarterly Payroll Report, is a crucial document for employers in New Jersey. This form is used to report wages paid to employees and the corresponding taxes withheld. It is essential for maintaining compliance with state tax regulations. The Nj927 form provides the state with necessary information regarding employee earnings, tax contributions, and unemployment insurance. Accurate completion of this form helps ensure that employers meet their tax obligations and avoid potential penalties.

Steps to complete the Nj927 Form Pdf

Completing the Nj927 form involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the quarter, including employee wages and tax withholdings. Next, enter the total wages paid to each employee in the designated sections of the form. It is important to accurately report the amounts to avoid discrepancies. After inputting the wage data, calculate the total taxes withheld and enter these figures as well. Finally, review the completed form for any errors before submitting it to the appropriate state agency.

Legal use of the Nj927 Form Pdf

The Nj927 form must be completed and submitted in accordance with New Jersey state laws. This form serves as a legal document that verifies the wages paid and taxes withheld by employers. Compliance with the submission deadlines is critical, as failure to file on time can result in penalties. Additionally, the information reported on the Nj927 form is subject to audits by state tax authorities, making accuracy essential for legal purposes. Employers must retain copies of submitted forms for their records to ensure they can provide documentation if required.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Nj927 form. The most efficient method is online filing, which allows for immediate processing and confirmation of submission. Alternatively, employers can choose to mail the completed form to the designated state office. For those who prefer in-person interactions, submitting the form at a local tax office is also an option. Regardless of the submission method, it is important to keep a copy of the submitted form for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the Nj927 form are established by the New Jersey Division of Taxation. Employers must submit the form quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. For example, the deadline for the first quarter, ending March 31, is April 30. It is crucial for employers to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates can help ensure timely submissions.

Key elements of the Nj927 Form Pdf

The Nj927 form includes several key elements that employers must complete accurately. These elements typically consist of employer identification information, employee wage details, and tax withholding amounts. Additionally, the form requires certification by the employer, affirming the accuracy of the reported information. Understanding each component of the form is essential for proper completion and compliance with state tax regulations.

Quick guide on how to complete nj927 form pdf

Effortlessly Prepare Nj927 Form Pdf on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent sustainable alternative to traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hassles. Manage Nj927 Form Pdf on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Alter and eSign Nj927 Form Pdf with Ease

- Obtain Nj927 Form Pdf and then click Get Form to get started.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign Nj927 Form Pdf and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj927 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 927 and why do I need it?

Form 927 is a crucial document used for various business processes, such as tax filings and compliance. Utilizing airSlate SignNow, you can easily prepare, send, and eSign form 927, ensuring that you meet all legal requirements promptly and efficiently.

-

How can airSlate SignNow help me with form 927?

airSlate SignNow streamlines the process of managing form 927 by allowing you to create and send this document for eSignature. Its user-friendly interface and automation capabilities mean you spend less time on paperwork and more time on your core business activities.

-

Is there a cost associated with using airSlate SignNow for form 927?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs. Each plan provides access to features that simplify the eSigning of important documents like form 927, making it a cost-effective solution for your business.

-

Can I integrate airSlate SignNow with other tools for managing form 927?

Absolutely! airSlate SignNow supports integration with numerous applications, enhancing your workflow for managing form 927. This means you can connect it with your existing software solutions to streamline document processing further.

-

What features does airSlate SignNow offer for form 927?

AirSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage specifically for documents like form 927. These tools ensure your forms are eSigned promptly and remain organized, boosting your business efficiency.

-

How secure is the eSigning of form 927 with airSlate SignNow?

When you use airSlate SignNow to eSign form 927, rest assured that your documents are protected with advanced security measures. The platform complies with industry standards, providing encryption and secure storage to safeguard your sensitive information.

-

Can I track the status of my form 927 once it's been sent for signing?

Yes, airSlate SignNow provides real-time tracking for your sent documents, including form 927. You can easily check the status of each document and receive notifications when it has been viewed and signed, keeping you updated every step of the way.

Get more for Nj927 Form Pdf

- Truncheon world form

- Pa notary application pdf form

- Oewd form 117 written employment and education verification form

- Pediatric septic shock collaborative triage trigger tool childrens mercy form

- Chemistry form ws8 3 1a

- Payment agent agreement template form

- Paymaster agreement template 787745558 form

- It support contract template form

Find out other Nj927 Form Pdf

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF