Nh Dp 8 Form

What is the NH DP 8?

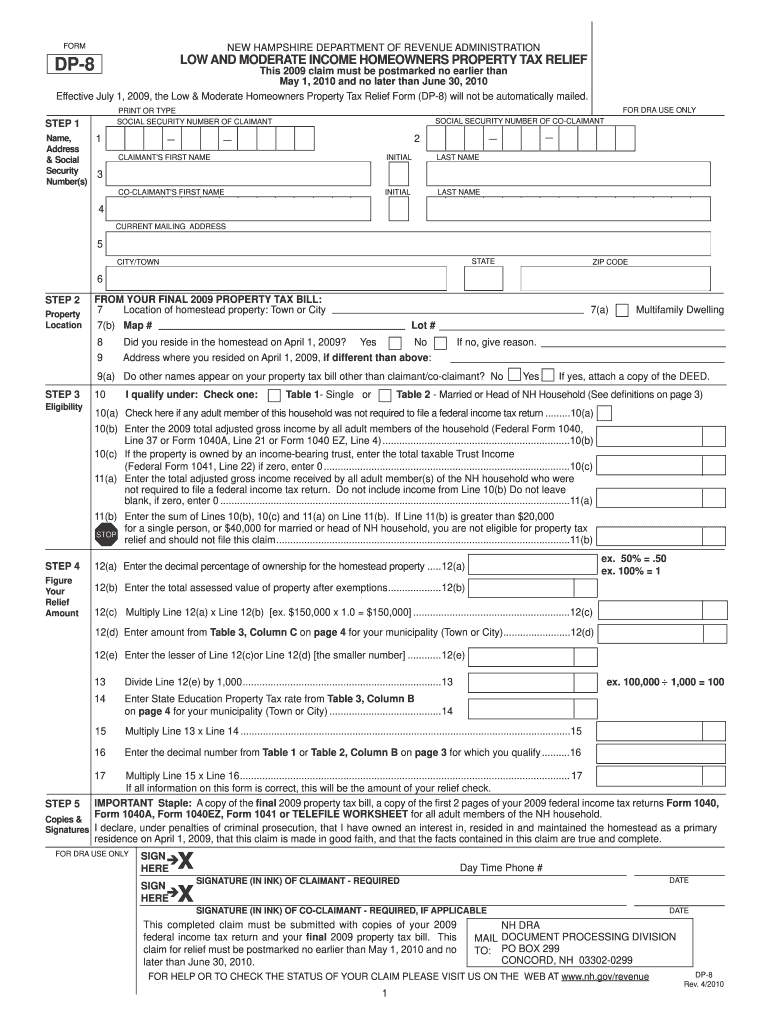

The NH DP 8 form, also known as the low moderate tax form DP-8, is utilized in New Hampshire for reporting certain tax information. This form is specifically designed for individuals and businesses to declare their tax obligations under specific guidelines set by the state. It is essential for ensuring compliance with local tax regulations and helps in determining eligibility for various tax benefits. Understanding the purpose and requirements of the NH DP 8 is crucial for accurate tax reporting.

How to Use the NH DP 8

Using the NH DP 8 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and previous tax returns. Next, fill out the form with precise details regarding your income, deductions, and any applicable credits. It is important to review the form thoroughly before submission to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to Complete the NH DP 8

Completing the NH DP 8 form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including income statements and previous tax filings.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring to include any taxable benefits.

- Calculate deductions and credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form through your chosen method, either online or by mail.

Legal Use of the NH DP 8

The NH DP 8 form is legally binding when filled out and submitted according to state regulations. To ensure its legality, it must be completed with accurate information and signed by the taxpayer. The form complies with applicable tax laws and regulations, making it an essential document for tax reporting in New Hampshire. Failure to use the form correctly can result in penalties or legal issues, so understanding its legal implications is vital.

Filing Deadlines / Important Dates

Filing deadlines for the NH DP 8 form are crucial for compliance with state tax laws. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or state announcements. Missing the deadline may result in penalties or interest on unpaid taxes, so timely submission is essential.

Required Documents

To complete the NH DP 8 form accurately, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation of any deductions or credits claimed.

- Identification documents, including Social Security number.

Having these documents ready will facilitate a smoother completion process and help ensure that all information reported is accurate.

Quick guide on how to complete nh dp 8

Effortlessly Prepare Nh Dp 8 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed files, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle Nh Dp 8 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Modify and eSign Nh Dp 8 with Ease

- Find Nh Dp 8 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal weight as a conventional ink signature.

- Review all the information and then click on the Done button to save your updates.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, lengthy form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Nh Dp 8 and guarantee seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nh dp 8

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NH form DP 8?

The NH form DP 8 is a document used for the application of disability parking permits in New Hampshire. It is essential for individuals who require parking accommodations due to a disability. Understanding the proper usage and requirements of the NH form DP 8 can streamline the application process.

-

How can airSlate SignNow help with the NH form DP 8?

AirSlate SignNow allows users to easily fill out, sign, and eSign the NH form DP 8 online. This digital solution eliminates the need for printing and scanning, making it convenient for applicants to submit their documents quickly. With airSlate SignNow, managing your NH form DP 8 is simpler than ever.

-

Are there any fees associated with using airSlate SignNow for the NH form DP 8?

While airSlate SignNow offers a variety of plans, submitting the NH form DP 8 is often included in the subscription at no additional cost. Customers benefit from a cost-effective solution that streamlines document management without hidden fees. Check our pricing plans for more details.

-

What features does airSlate SignNow offer for the NH form DP 8?

AirSlate SignNow provides features such as document templates, eSigning capabilities, and tracking for the NH form DP 8. Users can collaborate with multiple parties in real-time, ensuring transparency and efficiency in the signing process. These tools make completing the NH form DP 8 easier and faster.

-

Is airSlate SignNow compliant with legal requirements for NH form DP 8?

Yes, airSlate SignNow is compliant with legal requirements for electronic signatures, including those necessary for the NH form DP 8. Our platform adheres to relevant regulations, ensuring that your signed documents are legally binding and secure. This compliance helps protect sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for managing the NH form DP 8?

Absolutely! AirSlate SignNow integrates seamlessly with various third-party applications, enhancing your experience with the NH form DP 8. Utilize popular tools like Google Drive, Dropbox, and CRM software to manage your documents more efficiently and improve workflow.

-

What benefits does using airSlate SignNow provide for submitting the NH form DP 8?

Using airSlate SignNow for the NH form DP 8 offers numerous benefits, including time savings and reduced paper waste. The platform's intuitive interface simplifies the signing process, making it accessible for users of all skill levels. Additionally, the ability to store documents securely in the cloud enhances organization and retrieval.

Get more for Nh Dp 8

Find out other Nh Dp 8

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word