Indiana Tax Form Es 40

What is the Indiana Tax Form ES 40

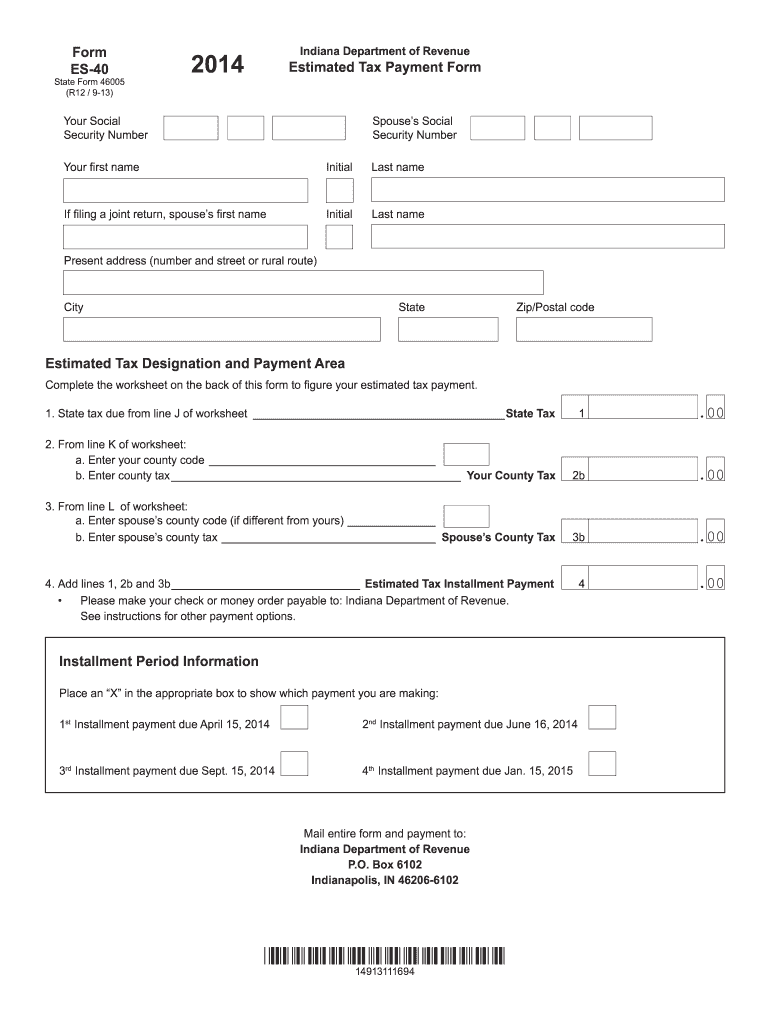

The Indiana Tax Form ES 40 is a state-specific document used for reporting estimated tax payments for individuals and businesses. This form is essential for taxpayers who expect to owe tax of $1,000 or more when they file their annual return. It allows taxpayers to make quarterly payments throughout the year, ensuring compliance with state tax regulations. The form is designed to help manage tax liabilities effectively and avoid penalties associated with underpayment.

Steps to Complete the Indiana Tax Form ES 40

Completing the Indiana Tax Form ES 40 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your expected tax liability for the year based on your income projections. Once you have this figure, divide it by four to determine your quarterly payment amount. Fill out the form with your personal information, including your Social Security number, and the calculated payment amount for each quarter. Finally, review the form for accuracy before submission.

How to Obtain the Indiana Tax Form ES 40

The Indiana Tax Form ES 40 can be obtained from the Indiana Department of Revenue's official website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, the form may be available at local tax offices or libraries. Ensure that you are using the most current version of the form to avoid any issues with filing.

Legal Use of the Indiana Tax Form ES 40

The Indiana Tax Form ES 40 is legally binding when completed and submitted according to state guidelines. To ensure its validity, taxpayers must adhere to the filing deadlines and make timely payments. The form must be signed and dated by the taxpayer or an authorized representative. Compliance with the Indiana tax laws and regulations is crucial to avoid penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana Tax Form ES 40 are critical for avoiding penalties. Typically, estimated tax payments are due on the 15th of April, June, September, and January of the following year. It is important to mark these dates on your calendar to ensure timely submission. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day, but taxpayers should verify this with the Indiana Department of Revenue.

Penalties for Non-Compliance

Failure to file the Indiana Tax Form ES 40 or make the required payments can result in significant penalties. Taxpayers may incur a penalty of up to ten percent of the unpaid tax amount. Additionally, interest will accrue on any unpaid balance. To avoid these consequences, it is essential to stay informed about filing requirements and payment schedules.

Quick guide on how to complete indiana tax form es 40

Effortlessly Prepare Indiana Tax Form Es 40 on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Indiana Tax Form Es 40 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The Easiest Way to Modify and eSign Indiana Tax Form Es 40 with Ease

- Locate Indiana Tax Form Es 40 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive details using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow efficiently manages your document needs in just a few clicks from any device you choose. Adjust and eSign Indiana Tax Form Es 40 and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana tax form es 40

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 40 es 2020 in relation to airSlate SignNow?

The it 40 es 2020 refers to recent updates and features relevant to the airSlate SignNow platform. This integration optimizes document workflows, enabling users to send and eSign documents more efficiently. Businesses stand to benefit greatly from these enhancements in their daily operations.

-

How does airSlate SignNow's pricing structure accommodate the it 40 es 2020?

airSlate SignNow offers flexible pricing plans that cater to various business needs, aligning with the it 40 es 2020 updates. This allows organizations to choose a plan that best fits their budgets and document signing requirements. Always check the website for the latest pricing information and offers.

-

What features are included in the it 40 es 2020 version of airSlate SignNow?

The it 40 es 2020 version of airSlate SignNow includes enhanced document templates, improved user interface, and advanced security measures. These features aim to streamline the eSigning process while ensuring compliance and security. Users will find these tools very beneficial in optimizing their document transactions.

-

Can I integrate airSlate SignNow with other applications using the it 40 es 2020?

Yes, airSlate SignNow supports integration with a variety of applications under the it 40 es 2020 enhancements, including CRM systems and cloud storage services. This allows users to create a seamless workflow, making it easier to manage documents across platforms. Integration capabilities increase efficiency and improve user experience.

-

What are the benefits of using airSlate SignNow with the it 40 es 2020 features?

Using airSlate SignNow with the it 40 es 2020 features offers numerous benefits, such as faster document turnaround times and improved compliance. Businesses can save time and reduce errors in their signing processes. Ultimately, these advantages lead to increased productivity and operational efficiency.

-

Is airSlate SignNow's customer support enhanced with the it 40 es 2020 update?

Yes, the it 40 es 2020 update includes enhancements to airSlate SignNow's customer support. Users can now access a more comprehensive knowledge base and receive quicker responses from support teams. This ensures that any issues related to eSigning or document management can be resolved efficiently.

-

How secure is airSlate SignNow with the it 40 es 2020 features?

The it 40 es 2020 features of airSlate SignNow include enhanced security protocols to protect sensitive information. Strong encryption and secure access controls are implemented to safeguard user data. This level of security helps businesses maintain compliance with legal and regulatory requirements in their operations.

Get more for Indiana Tax Form Es 40

- Barnabas health medical group patient registration form patient registration form

- Participation rubric form

- Region and all state audition ticket bandlink form

- Knjiga osnovnih sredstava form

- Yorku course performance summary

- Examples of form 4562 filled out

- Training workshop contract template form

- Planning perance agreement template form

Find out other Indiana Tax Form Es 40

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation