Pay Wv State Taxes Form

Understanding the Pay Wv State Taxes

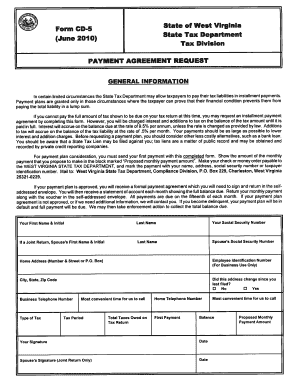

The pay wv state taxes process is essential for residents and businesses in West Virginia to meet their tax obligations. This process involves submitting the appropriate forms to the West Virginia State Tax Department. It is crucial to understand the specific requirements and deadlines associated with this process to ensure compliance and avoid penalties. The forms required may vary depending on the taxpayer's situation, such as individual income tax or business taxes.

Steps to Complete the Pay Wv State Taxes

Completing the pay wv state taxes involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Determine the correct forms needed based on your tax situation, such as the WV Personal Income Tax Return.

- Fill out the forms accurately, ensuring all information is complete and correct.

- Review the completed forms for any errors or omissions.

- Submit the forms electronically or by mail to the West Virginia State Tax Department by the designated deadline.

Legal Use of the Pay Wv State Taxes

The legal use of the pay wv state taxes forms is governed by state regulations that require accurate reporting of income and payment of taxes owed. Electronic submissions are recognized as legally binding when they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Utilizing a secure platform for electronic submissions can enhance the legal validity of your documents.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the pay wv state taxes. Typically, individual income tax returns are due on April fifteenth each year. However, extensions may be available under certain circumstances. Keeping track of these dates is vital to avoid late fees and penalties. The West Virginia State Tax Department provides a calendar of important dates to assist taxpayers in staying informed.

Required Documents

To successfully complete the pay wv state taxes, taxpayers must gather several key documents:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any additional income sources, such as freelance work.

- Receipts for any deductible expenses, such as medical or educational costs.

- Previous tax returns for reference and consistency.

Form Submission Methods

Taxpayers have several options for submitting their pay wv state taxes forms:

- Online submission through the West Virginia State Tax Department's e-filing system.

- Mailing paper forms directly to the appropriate tax office.

- In-person submissions at designated tax offices, which may be beneficial for those needing assistance.

Penalties for Non-Compliance

Failure to comply with the pay wv state taxes requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial to file all necessary forms accurately and on time to avoid these consequences. Understanding the implications of non-compliance can help motivate timely and correct submissions.

Quick guide on how to complete pay wv state taxes

Complete Pay Wv State Taxes effortlessly on any apparatus

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Pay Wv State Taxes on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Pay Wv State Taxes without breaking a sweat

- Find Pay Wv State Taxes and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs within a few clicks from any device of your choice. Modify and eSign Pay Wv State Taxes and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pay wv state taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wv state tax payment plan?

The WV state tax payment plan is a structured option that allows taxpayers to manage their state tax obligations over a set period. With this plan, individuals can make manageable monthly payments instead of settling their tax dues in one lump sum, easing the financial burden.

-

How can airSlate SignNow facilitate the wv state tax payment plan?

airSlate SignNow simplifies the process of setting up the WV state tax payment plan by enabling users to securely sign and send required documents electronically. This saves time and ensures that all paperwork is handled efficiently, making tax compliance a hassle-free experience.

-

Are there costs associated with the wv state tax payment plan?

While enrolling in the WV state tax payment plan generally incurs no direct fees, penalties may apply for late payments. Using airSlate SignNow, you can efficiently manage your payment schedules, ensuring timely submissions and avoidance of additional charges.

-

What are the benefits of using airSlate SignNow for my wv state tax payment plan?

Using airSlate SignNow for your WV state tax payment plan offers numerous benefits including easy document management, secure electronic signatures, and time-saving features. This user-friendly solution allows you to focus on your business while maintaining compliance with your tax obligations.

-

What features does airSlate SignNow offer to assist with tax payments?

airSlate SignNow provides features such as customizable templates, automated reminders, and real-time document tracking. These tools are designed to enhance your experience with the WV state tax payment plan, ensuring every step is as seamless as possible.

-

Can I integrate airSlate SignNow with other applications to manage my wv state tax payment plan?

Yes, airSlate SignNow offers integrations with various platforms to streamline your workflow when handling the WV state tax payment plan. Whether you're utilizing accounting software or customer relationship management tools, these integrations help enhance efficiency during tax season.

-

How do I get started with my wv state tax payment plan using airSlate SignNow?

To get started, simply sign up for airSlate SignNow and choose a template for your WV state tax payment plan documents. From there, you can customize your forms, gather necessary signatures, and track the progress of your payments effortlessly.

Get more for Pay Wv State Taxes

Find out other Pay Wv State Taxes

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word