Tr 579 it Form

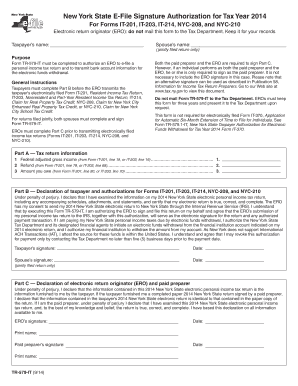

What is the TR-579 IT?

The TR-579 IT is a specific form used in New York State, primarily related to tax documentation. This form is essential for individuals and businesses to report certain tax-related information accurately. Understanding the purpose and requirements of the TR-579 IT is crucial for compliance with state tax laws. It serves as a tool for taxpayers to declare their eligibility for specific tax benefits or exemptions, ensuring that they meet the necessary criteria established by the state.

How to Use the TR-579 IT

Using the TR-579 IT involves several steps to ensure that all required information is accurately reported. First, gather all necessary documents that pertain to your tax situation. This includes income statements, previous tax returns, and any documentation that supports your eligibility for the claims made on the form. Next, fill out the TR-579 IT carefully, ensuring that all sections are completed with accurate information. It is advisable to review the form for any errors before submission, as inaccuracies can lead to delays or penalties.

Steps to Complete the TR-579 IT

Completing the TR-579 IT requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including income statements and prior tax returns.

- Download the TR-579 IT form from the New York State Department of Taxation and Finance website.

- Carefully fill out the form, ensuring that all required fields are completed.

- Double-check for accuracy, particularly in numerical entries and personal information.

- Sign and date the form where indicated.

- Submit the completed form via the appropriate method, whether online, by mail, or in person.

Legal Use of the TR-579 IT

The legal use of the TR-579 IT is governed by New York State tax regulations. This form must be completed in accordance with the guidelines set forth by the state to ensure its validity. Proper use of the form can help taxpayers avoid legal issues related to tax compliance. It is important to understand the legal implications of the information provided on the TR-579 IT, as inaccuracies can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the TR-579 IT are critical for compliance. Taxpayers must be aware of the specific dates by which the form must be submitted to avoid penalties. Typically, the TR-579 IT should be filed alongside your annual tax return. It is advisable to check the New York State Department of Taxation and Finance for the most current deadlines and any changes that may occur each tax year.

Required Documents

To complete the TR-579 IT, certain documents are required. These may include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation supporting any claims for exemptions or deductions.

- Previous tax returns for reference.

- Any additional forms that may be relevant to your tax situation.

Having these documents ready will facilitate a smoother completion process and ensure all necessary information is included.

Quick guide on how to complete tr 579 it

Effortlessly prepare Tr 579 It on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without complications. Manage Tr 579 It on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to alter and eSign Tr 579 It with minimal effort

- Obtain Tr 579 It and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you choose. Modify and eSign Tr 579 It and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tr 579 it

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tr579 and how does it benefit my business?

tr579 is a comprehensive digital signature solution offered by airSlate SignNow. It enables businesses to streamline their document signing process, signNowly reducing turnaround time and improving workflow efficiency. By implementing tr579, organizations can ensure secure and legally binding electronic signatures.

-

How much does tr579 cost?

The pricing for tr579 varies based on the specific plan you choose with airSlate SignNow. Plans are designed to cater to businesses of all sizes, providing flexible options to accommodate special requirements and budget constraints. For detailed pricing information, visit our website and select the plan that best suits your needs.

-

What features are included in the tr579 solution?

tr579 comes equipped with a variety of features such as document management, team collaboration, and advanced security options. Users can easily create, send, and track documents while enjoying features like templates and customizable workflows. These capabilities help enhance productivity and make document signing more efficient.

-

How can I integrate tr579 with other software tools?

Integrating tr579 with other software tools is seamless through airSlate SignNow's robust API and pre-built integrations. Popular platforms such as Google Drive, Salesforce, and Zapier are supported, allowing you to enhance your workflow without hassles. Leveraging these integrations can help you automate processes and ensure a smoother user experience.

-

Is tr579 secure and compliant with regulations?

Yes, tr579 prioritizes security and compliance by using encryption and meeting industry standards such as GDPR and SOC 2. Every electronic signature created through airSlate SignNow is legally binding and can withstand scrutiny in legal settings. This compliance helps organizations maintain trust and accountability in their document management processes.

-

Can I access tr579 on mobile devices?

Absolutely! tr579 is fully accessible on mobile devices, allowing you to manage and sign documents on the go. The airSlate SignNow mobile app provides an intuitive user interface, ensuring that you can easily execute document transactions from anywhere, at any time. This flexibility enhances productivity for mobile professionals.

-

How do I get started with tr579?

Getting started with tr579 is simple. First, visit the airSlate SignNow website to choose a suitable plan for your business. Once you sign up, you can immediately explore the features of tr579 and begin sending and eSigning documents right away with minimal setup required.

Get more for Tr 579 It

- Domiciliary letters 50223486 form

- North carolina department of revenue motor form

- Davie business tax receipt form

- Kentucky transportation cabinet department of vehicle form

- Emergency plan for your child care facility form

- Get the stdhiv lab test request form new dhh louisiana

- Mediation letter sample form

- Np sample collaborative agreement form

Find out other Tr 579 It

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors