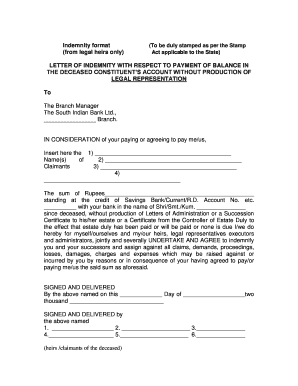

Letter of Indemnity for Income Tax in Case of Death Form

What is the letter of indemnity for income tax in case of death

The letter of indemnity for income tax in case of death serves as a formal document that protects the interests of the deceased's estate and beneficiaries. This letter is particularly important in situations where the deceased had outstanding tax obligations or where the tax authority requires assurance that all tax matters will be settled. It outlines the responsibilities of the estate's executor or administrator to manage any tax liabilities that may arise following the individual's passing.

Key elements of the letter of indemnity for income tax in case of death

Several essential components must be included in the letter of indemnity to ensure its effectiveness:

- Identification of the deceased: Full name, Social Security number, and date of death.

- Executor information: Name and contact details of the person responsible for managing the estate.

- Tax obligations: A clear statement of any known tax liabilities or pending issues.

- Indemnity clause: A commitment to cover any tax-related claims against the estate.

- Signatures: Signatures of the executor and witnesses, if required by state law.

Steps to complete the letter of indemnity for income tax in case of death

Completing the letter of indemnity involves several key steps:

- Gather necessary information about the deceased, including tax records and estate details.

- Draft the letter, ensuring all required elements are included.

- Review the document for accuracy and compliance with state regulations.

- Obtain the necessary signatures from the executor and any required witnesses.

- Submit the letter to the appropriate tax authority or financial institution as needed.

How to obtain the letter of indemnity for income tax in case of death

To obtain a letter of indemnity for income tax, the executor or administrator of the estate typically needs to draft the document. It is advisable to consult with a tax professional or legal advisor to ensure that the letter meets all legal requirements. Templates may be available online, but customization to fit the specific circumstances of the estate is essential.

Legal use of the letter of indemnity for income tax in case of death

The legal use of the letter of indemnity is crucial in protecting the estate from potential tax claims. It serves as a binding agreement between the executor and the tax authority, ensuring that any outstanding tax obligations will be addressed. This document can be presented during audits or inquiries related to the deceased's tax status, providing peace of mind to the beneficiaries and ensuring compliance with tax laws.

Required documents

When preparing the letter of indemnity, several documents may be required:

- Death certificate of the individual.

- Last will and testament, if applicable.

- Tax returns for the years prior to death.

- Any correspondence from the IRS or state tax authority regarding outstanding tax matters.

Quick guide on how to complete letter of indemnity for income tax in case of death

Prepare Letter Of Indemnity For Income Tax In Case Of Death effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Letter Of Indemnity For Income Tax In Case Of Death across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Letter Of Indemnity For Income Tax In Case Of Death with ease

- Obtain Letter Of Indemnity For Income Tax In Case Of Death and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign Letter Of Indemnity For Income Tax In Case Of Death to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the letter of indemnity for income tax in case of death

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is death indemnity and how does it work?

Death indemnity is a form of insurance that provides financial compensation to beneficiaries upon the death of the policyholder. It is designed to alleviate financial burdens during a difficult time, ensuring that loved ones are supported. Using airSlate SignNow, you can easily manage documents related to death indemnity, facilitating smoother processing.

-

How can airSlate SignNow help with death indemnity paperwork?

airSlate SignNow simplifies the management of death indemnity documents by allowing users to send, sign, and store important files electronically. This ensures that all paperwork is handled efficiently, reducing the time spent on administrative tasks. Our platform is user-friendly, making it easy for both individuals and businesses to navigate.

-

What features does airSlate SignNow offer for death indemnity documentation?

The key features of airSlate SignNow for death indemnity documentation include custom eSignature options, secure cloud storage, and real-time tracking of documents. These features enhance the user experience by ensuring that important documents are signed and stored securely. Our platform also provides templates that simplify the creation of death indemnity forms.

-

Is airSlate SignNow cost-effective for managing death indemnity processes?

Yes, airSlate SignNow offers a cost-effective solution for managing death indemnity processes. With competitive pricing plans, users can choose a subscription that fits their budget while accessing essential features for handling documents. This ensures that businesses can manage their needs efficiently without overspending.

-

Can airSlate SignNow integrate with other tools for processing death indemnity claims?

Absolutely! airSlate SignNow offers integrations with various third-party applications that can enhance the efficiency of processing death indemnity claims. Whether it's a CRM, accounting software, or another tool, our platform can easily be connected to streamline your workflow. This interoperability saves time and reduces errors.

-

What benefits do businesses gain by using airSlate SignNow for death indemnity documentation?

Using airSlate SignNow for death indemnity documentation provides businesses with enhanced efficiency, improved compliance, and reduced operational costs. The platform automates many manual processes, allowing teams to focus on more critical tasks. Additionally, the security measures in place protect sensitive information related to death indemnity.

-

How secure is airSlate SignNow for dealing with sensitive death indemnity documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive death indemnity documents. Our platform employs industry-standard encryption and regular security audits to protect your data. Users can rest assured that their documents are safe, secure, and compliant with legal regulations.

Get more for Letter Of Indemnity For Income Tax In Case Of Death

- Form 3dc35

- Justia motion to set aside default or judgment or form

- Court rules notice of motion general courts service of form

- General form of a motion of plaintiff and notice to defendant

- Process server order directing service of process form

- Motion to set aside declaration 3dc42 forms workflow

- Ex parte motion for examination of judgment debors or form

- For the third circuit united states of america form

Find out other Letter Of Indemnity For Income Tax In Case Of Death

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors