Loan Officer Assistant Checklist Form

What is the Loan Officer Assistant Checklist

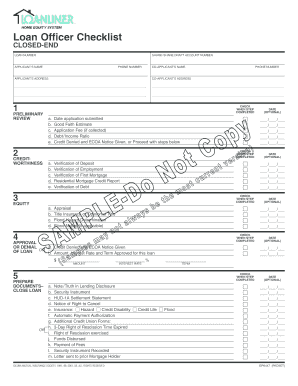

The Loan Officer Assistant Checklist is a comprehensive tool designed to assist loan officers and their assistants in managing the various tasks associated with the loan processing workflow. This checklist typically includes essential steps and documentation required for mortgage applications, ensuring that all necessary information is collected and organized efficiently. By following this checklist, loan officers can streamline their processes, reduce errors, and enhance client satisfaction.

How to use the Loan Officer Assistant Checklist

Using the Loan Officer Assistant Checklist involves several straightforward steps. First, review the checklist to familiarize yourself with the required documents and tasks. Next, gather all necessary paperwork, such as income verification, credit reports, and identification. As you complete each task, check it off the list to ensure nothing is overlooked. This methodical approach helps maintain organization and ensures compliance with industry standards.

Key elements of the Loan Officer Assistant Checklist

Key elements of the Loan Officer Assistant Checklist include a variety of documentation and procedural steps. Essential documents often required are:

- Loan application form

- Credit report

- Proof of income

- Employment verification

- Asset statements

In addition to documentation, the checklist may outline specific procedural steps, such as scheduling client meetings, conducting follow-ups, and ensuring timely communication with all parties involved in the loan process.

Steps to complete the Loan Officer Assistant Checklist

Completing the Loan Officer Assistant Checklist involves a series of organized steps. Begin by collecting all necessary documents from the borrower. Next, verify the accuracy of the information provided, ensuring that all data aligns with the requirements outlined in the checklist. Once all items are gathered and verified, submit the completed checklist along with the loan application to the appropriate processing department. Regularly review the checklist to ensure compliance and address any outstanding tasks promptly.

Legal use of the Loan Officer Assistant Checklist

The legal use of the Loan Officer Assistant Checklist is crucial for ensuring that all documentation and processes adhere to regulatory standards. The checklist should comply with the relevant laws and regulations governing mortgage lending in the United States. This includes adherence to the Equal Credit Opportunity Act (ECOA) and the Truth in Lending Act (TILA). Proper use of the checklist not only protects the interests of the borrower but also safeguards the lending institution from potential legal issues.

Required Documents

Required documents for the Loan Officer Assistant Checklist typically include:

- Completed loan application

- Government-issued identification

- Social Security number

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

Gathering these documents prior to starting the loan process can significantly expedite the application and approval timeline.

Quick guide on how to complete loan officer assistant checklist

Effortlessly Prepare Loan Officer Assistant Checklist on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents rapidly without setbacks. Manage Loan Officer Assistant Checklist on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Loan Officer Assistant Checklist effortlessly

- Locate Loan Officer Assistant Checklist and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Loan Officer Assistant Checklist while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan officer assistant checklist

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan officer assistant checklist?

A loan officer assistant checklist is a comprehensive tool designed to streamline the tasks of loan officer assistants, ensuring all necessary steps are completed efficiently. It helps in managing documentation, communication, and processing requirements throughout the loan application process. Utilizing a checklist can greatly enhance productivity and reduce errors.

-

How can the loan officer assistant checklist improve my workflow?

The loan officer assistant checklist improves your workflow by providing a clear list of tasks that need to be completed for each loan application. This structured approach reduces oversight and helps prioritize tasks, ensuring that nothing falls through the cracks. By following the checklist, loan officer assistants can work more effectively and stay organized.

-

What features should I look for in a loan officer assistant checklist?

When selecting a loan officer assistant checklist, consider features like task automation, customizable templates, and integration with your existing loan management software. These features can enhance efficiency by allowing for quick updates and tracking of completed tasks. Additionally, look for mobile accessibility, so you can manage tasks on the go.

-

Is the loan officer assistant checklist suitable for small businesses?

Absolutely! The loan officer assistant checklist is suitable for businesses of all sizes, including small firms. It can help small businesses maintain an organized approach to managing loan applications, enabling them to compete effectively with larger organizations. The checklist can also be customized to fit the specific needs of your operation.

-

How much does the loan officer assistant checklist cost?

The cost of a loan officer assistant checklist can vary depending on the software or tool you choose. Many providers offer tiered pricing models based on features and the number of users. It's essential to evaluate the cost against the efficiency and time savings the checklist brings to your loan processing tasks.

-

Can the loan officer assistant checklist be integrated with other tools?

Yes, the loan officer assistant checklist can often be integrated with various tools such as CRM systems, document management software, and eSignature solutions. This integration helps consolidate processes and minimizes the need to switch between different platforms, enhancing overall efficiency. Be sure to check compatibility with your current systems.

-

What are the benefits of using a digital loan officer assistant checklist?

Using a digital loan officer assistant checklist offers numerous benefits, including real-time updates, easy sharing among team members, and cloud accessibility. Digital checklists are often more versatile and can be customized as needed, making them a practical tool for modern lending environments. Additionally, they reduce paper waste and support remote work.

Get more for Loan Officer Assistant Checklist

- Certification form paying for visa sponsorship

- Construction site notice 15965403 form

- Ohio w4 form

- Applying for dbs reports to dbs bank ltd channel form

- Lock box authorization addendum rrar form

- Tmd form 3349 r

- Law society tenancy agreement template form

- Law society of separation agreement template form

Find out other Loan Officer Assistant Checklist

- Draw eSign Word Mac

- Draw eSign Document Free

- Draw eSign Form Online

- Draw eSign Form Now

- Draw eSign Presentation Later

- How To Draw eSign Presentation

- Encrypt eSign PDF Fast

- How To Encrypt eSign Form

- Search eSign PDF Computer

- How Can I Search eSign PDF

- Search eSign PDF Secure

- Search eSign PDF Android

- Search eSign Word Safe

- Search eSign Document Mac

- Search eSign Form iPad

- Send eSignature PDF Online

- How To Send eSignature PDF

- Send eSignature Word Online

- Send eSignature PDF iPad

- Send eSignature Word iOS