HSA Payroll Deduction Form Ohr Gatech

What is the HSA Payroll Deduction Form Ohr Gatech

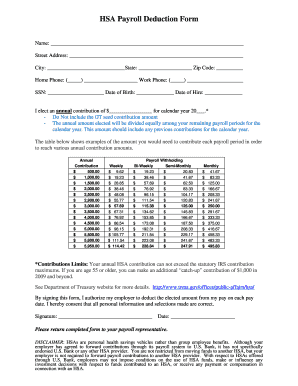

The HSA Payroll Deduction Form Ohr Gatech is a document used by employees to authorize their employer to deduct contributions to a Health Savings Account (HSA) directly from their paycheck. This form facilitates the process of setting up regular contributions, allowing employees to save for medical expenses while benefiting from tax advantages. By completing this form, employees can ensure that their contributions are automatically deposited into their HSA, promoting consistent savings for healthcare costs.

How to use the HSA Payroll Deduction Form Ohr Gatech

Using the HSA Payroll Deduction Form Ohr Gatech involves several straightforward steps. First, employees should obtain the form from their employer or the designated HR department. After filling out the necessary personal information, including name, employee ID, and selected contribution amount, the form must be submitted to HR for processing. Once approved, the specified amount will be deducted from each paycheck and deposited into the employee's HSA, simplifying the savings process for medical expenses.

Steps to complete the HSA Payroll Deduction Form Ohr Gatech

Completing the HSA Payroll Deduction Form Ohr Gatech requires careful attention to detail. Follow these steps:

- Obtain the form from your HR department or employer.

- Fill in your personal details, such as your full name and employee identification number.

- Select the amount you wish to contribute to your HSA from each paycheck.

- Review the form for accuracy, ensuring all information is correct.

- Sign and date the form to authorize the deductions.

- Submit the completed form to your HR department for processing.

Key elements of the HSA Payroll Deduction Form Ohr Gatech

The HSA Payroll Deduction Form Ohr Gatech includes several key elements essential for its validity and effectiveness. These elements typically consist of:

- Employee Information: Personal details such as name, employee ID, and contact information.

- Contribution Amount: The specific dollar amount to be deducted from each paycheck.

- Authorization Signature: The employee's signature, confirming their consent to the deductions.

- Date: The date when the form is completed and signed.

Legal use of the HSA Payroll Deduction Form Ohr Gatech

The legal use of the HSA Payroll Deduction Form Ohr Gatech is governed by specific regulations that ensure its validity. For the form to be legally binding, it must be completed accurately and signed by the employee. Employers must also maintain records of the form to comply with IRS regulations regarding HSA contributions. By adhering to these guidelines, both employees and employers can ensure that the contributions made through payroll deductions are recognized and protected under applicable laws.

Form Submission Methods

The HSA Payroll Deduction Form Ohr Gatech can typically be submitted through various methods, depending on the employer's policies. Common submission methods include:

- Online Submission: Many employers allow employees to submit the form electronically via a secure HR portal.

- Mail: Employees may also choose to print the form and send it via postal mail to the HR department.

- In-Person: Submitting the form directly to HR in person is another option, allowing for immediate confirmation of receipt.

Quick guide on how to complete hsa payroll deduction form ohr gatech

Effortlessly prepare HSA Payroll Deduction Form Ohr Gatech on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Handle HSA Payroll Deduction Form Ohr Gatech on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-oriented process today.

The easiest way to alter and eSign HSA Payroll Deduction Form Ohr Gatech with no hassle

- Locate HSA Payroll Deduction Form Ohr Gatech and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using specific tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign HSA Payroll Deduction Form Ohr Gatech to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsa payroll deduction form ohr gatech

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HSA Payroll Deduction Form Ohr Gatech?

The HSA Payroll Deduction Form Ohr Gatech is a document that allows employees to enroll in a Health Savings Account (HSA) and designate payroll deductions. This form is essential for managing tax-advantaged savings for healthcare expenses. Using airSlate SignNow, employees can easily sign and submit this form online, streamlining the enrollment process.

-

How does airSlate SignNow handle the HSA Payroll Deduction Form Ohr Gatech?

airSlate SignNow provides a user-friendly platform for creating, sending, and eSigning the HSA Payroll Deduction Form Ohr Gatech. With robust compliance features, our solution ensures that all submitted forms are securely stored and accessible. This simplifies record-keeping and enhances the efficiency of processing payroll deductions.

-

Are there any costs associated with using airSlate SignNow for HSA Payroll Deduction Forms Ohr Gatech?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our pricing model is designed to be cost-effective, ensuring that companies of all sizes can benefit from using the HSA Payroll Deduction Form Ohr Gatech feature. You can explore our plans on the website to find the best fit for your organization.

-

What are the benefits of using the HSA Payroll Deduction Form Ohr Gatech through airSlate SignNow?

Using airSlate SignNow for your HSA Payroll Deduction Form Ohr Gatech provides several advantages, including time savings and increased accuracy. Automated workflows reduce the likelihood of errors, while easy eSigning speeds up the process. Ultimately, this integration helps to promote better employee engagement in health savings initiatives.

-

Can I integrate airSlate SignNow with other software for managing HSA Payroll Deduction Forms Ohr Gatech?

Absolutely! airSlate SignNow offers seamless integrations with various HR and payroll systems, making it easy to manage the HSA Payroll Deduction Form Ohr Gatech within your existing workflows. These integrations help streamline processes and ensure data consistency across platforms, enhancing overall operational efficiency.

-

Is the HSA Payroll Deduction Form Ohr Gatech compliant with regulations?

Yes, the HSA Payroll Deduction Form Ohr Gatech created through airSlate SignNow is designed to comply with relevant financial and healthcare regulations. Our platform incorporates features that ensure all documents meet legal requirements, providing peace of mind for employers and employees alike.

-

How can I track the status of the HSA Payroll Deduction Form Ohr Gatech sent via airSlate SignNow?

With airSlate SignNow, tracking the status of the HSA Payroll Deduction Form Ohr Gatech is straightforward. Users can access real-time updates on document status, including when it has been viewed, signed, or completed. This feature provides greater transparency and enhances communication between HR departments and employees.

Get more for HSA Payroll Deduction Form Ohr Gatech

Find out other HSA Payroll Deduction Form Ohr Gatech

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document