Cufbl Form

What is the Cufbl

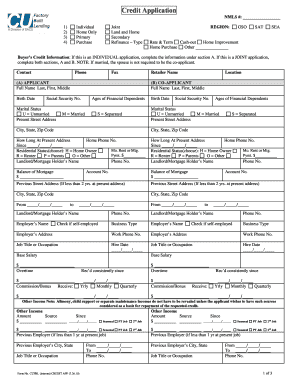

The Cufbl, or cu factory built lending, is a specialized lending program designed to facilitate the financing of factory-built homes. This program is particularly beneficial for individuals and families seeking affordable housing options. It provides a streamlined process for obtaining loans specifically tailored to the unique characteristics of factory-built homes, ensuring that borrowers have access to the necessary funds to purchase or refinance these properties.

How to use the Cufbl

Using the Cufbl involves several straightforward steps. First, potential borrowers should gather necessary documentation, including proof of income, credit history, and details about the property. Next, they can apply through a lender that offers the Cufbl program. Once the application is submitted, the lender will review the information and determine eligibility. If approved, the borrower will receive the loan terms, which they can review before finalizing the agreement.

Steps to complete the Cufbl

Completing the Cufbl process requires careful attention to detail. Here are the essential steps:

- Gather all required documentation, including financial statements and property details.

- Complete the loan application accurately, ensuring all information is up to date.

- Submit the application to the lender for review.

- Respond promptly to any requests for additional information from the lender.

- Review the loan offer, including interest rates and repayment terms.

- Sign the loan agreement and complete any necessary closing procedures.

Legal use of the Cufbl

The legal use of the Cufbl is governed by specific regulations that ensure compliance with federal and state lending laws. To be legally binding, all documentation must meet the requirements set forth by the relevant authorities. This includes proper disclosures, accurate representations of loan terms, and adherence to consumer protection laws. Utilizing a reputable platform like airSlate SignNow can help ensure that all signatures and documents are legally compliant and securely processed.

Required Documents

When applying for the Cufbl, borrowers must provide various documents to support their application. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns.

- Credit history report to assess creditworthiness.

- Details of the factory-built home, including specifications and location.

- Identification documents, such as a driver's license or passport.

Eligibility Criteria

Eligibility for the Cufbl program typically depends on several factors, including credit score, income level, and the type of factory-built home being financed. Lenders may have specific criteria that applicants must meet, such as a minimum credit score or debt-to-income ratio. Understanding these requirements can help potential borrowers prepare a strong application and increase their chances of approval.

Examples of using the Cufbl

There are various scenarios in which individuals might utilize the Cufbl program. For instance, a first-time homebuyer may seek financing to purchase a new factory-built home, benefiting from lower costs compared to traditional housing. Additionally, homeowners looking to refinance their existing loans on factory-built homes can also take advantage of the Cufbl to secure better interest rates or reduce monthly payments. These examples illustrate the flexibility and accessibility of the Cufbl for different housing needs.

Quick guide on how to complete cufbl

Complete Cufbl seamlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without hindrance. Handle Cufbl on any device using the airSlate SignNow Android or iOS applications, and enhance any document-driven process today.

How to modify and eSign Cufbl effortlessly

- Locate Cufbl and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Cufbl and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cufbl

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cufbl in the context of airSlate SignNow?

In the context of airSlate SignNow, 'cufbl' refers to our innovative technological approach aimed at enhancing the user experience. It encapsulates features that streamline document signing and management, making it easier for businesses to operate efficiently.

-

How does airSlate SignNow handle pricing for cufbl?

AirSlate SignNow offers a flexible pricing model that ensures affordability for businesses of all sizes. The 'cufbl' features are included in various pricing tiers, enabling customers to choose a plan that best fits their needs without compromising on functionality.

-

What features does cufbl include in airSlate SignNow?

The 'cufbl' features in airSlate SignNow include seamless eSigning, document templates, and automated workflows. These tools work together to simplify the entire process of sending and signing documents, making it easier for businesses to manage their paperwork.

-

What are the benefits of using airSlate SignNow with cufbl?

Using airSlate SignNow with the 'cufbl' solution provides numerous benefits, such as improved efficiency and reduced turnaround time for document completion. It allows teams to collaborate in real-time, enhancing overall productivity and customer satisfaction.

-

Is cufbl compatible with other applications?

Yes, airSlate SignNow's 'cufbl' functionalities are designed to integrate seamlessly with various applications, including CRM and project management tools. This compatibility allows businesses to work within their existing ecosystems without the hassle of switching between platforms.

-

How secure is the cufbl solution in airSlate SignNow?

The 'cufbl' solution in airSlate SignNow prioritizes security with advanced encryption and compliance measures. Businesses can rest assured that their documents and data are protected, meeting industry standards for confidentiality and integrity.

-

Can I customize the cufbl features in airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize its 'cufbl' features to align with your specific business needs. You can tailor templates, workflows, and signing processes to ensure they fit your organizational requirements perfectly.

Get more for Cufbl

- Lost stolen damaged or recovered property inventory sheet xls baylor form

- Landlord consent form 24451647

- Mra form 29757778

- Avon representative campaign planning form

- Cscs card application form pdf

- Blue cross blue shield minnesota watermark form

- Bmw cif form

- N 15 rev nonresident and part year resident income tax return forms fillable

Find out other Cufbl

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy