PIT 4 Real File State of New Mexico Form

What is the PIT 4 Real File State Of New Mexico

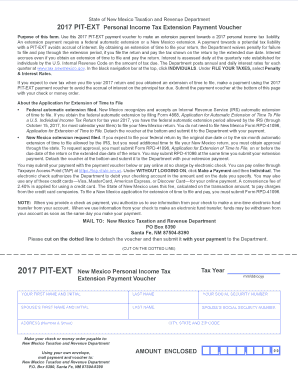

The PIT 4 Real File is a specific form used in New Mexico for reporting personal income tax. It is essential for individuals who need to declare their income and calculate taxes owed to the state. This form is particularly relevant for those who have income from various sources, including employment, self-employment, or investments. Understanding the purpose and requirements of the PIT 4 is crucial for compliance with state tax laws.

Steps to complete the PIT 4 Real File State Of New Mexico

Completing the PIT 4 Real File involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Access the PIT 4 form through the New Mexico Taxation and Revenue Department website or other authorized platforms.

- Fill out the form by entering your personal information, income details, and any applicable deductions or credits.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or via mail, following the specified submission guidelines.

Legal use of the PIT 4 Real File State Of New Mexico

The PIT 4 Real File is legally binding when completed and submitted in accordance with New Mexico tax laws. It must be signed and dated by the taxpayer to validate the information provided. Electronic submissions are accepted and considered legally compliant if they meet the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

Timely filing of the PIT 4 Real File is crucial to avoid penalties. The standard deadline for submitting this form is typically April 15 of each year. However, taxpayers may need to check for any specific extensions or changes in deadlines due to state regulations or special circumstances. Keeping track of these dates ensures compliance and helps avoid unnecessary fines.

Required Documents

When filling out the PIT 4 Real File, several documents are necessary to support your income claims and deductions. These include:

- W-2 forms from employers for reported wages.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, including receipts for business expenses and charitable contributions.

Form Submission Methods (Online / Mail / In-Person)

The PIT 4 Real File can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the New Mexico Taxation and Revenue Department's website, which allows for quick processing.

- Mailing a printed copy of the completed form to the designated tax office.

- In-person submission at local tax offices for those who prefer face-to-face assistance.

Quick guide on how to complete 2017 pit 4 real file state of new mexico

Complete PIT 4 Real File State Of New Mexico effortlessly on any device

Online document administration has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage PIT 4 Real File State Of New Mexico on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and electronically sign PIT 4 Real File State Of New Mexico with ease

- Locate PIT 4 Real File State Of New Mexico and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method to share your form, be it via email, text message (SMS), an invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document administration needs in just a few clicks from any device of your preference. Alter and electronically sign PIT 4 Real File State Of New Mexico and ensure excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

I am a resident of California. I interned in New Jersey last year. From what I read, all I need is two state tax forms and one non-resident form for federal taxes. Do I also need to take into account that I live in California, but I interned out-of-state? Will this alter my process to file the taxes?

Let’s see if I understand this. You live in California. You interned in New Jersey. Why are you a non-resident for the Fed? You lived in the US, you are a resident. I’m guessing you lived in New Jersey while you were an intern, so you would file a part year resident for New Jersey. If you moved from Jersey to Ca mid year then you would file as a part year resident for California also.Get someone to do this for you as you don’t seem to understandGetATMEtaxprep.com

-

For 2017, I do not owe any tax to the state of California. How should I file my taxes, online or by sending hard copies of forms? Also, do I need an ITIN for this?

In theory if your income does not arise in CA or is not sufficient to be taxed, you do not have to file a return. In practice it may be safer to do so, demonstrating to the Franchise Tax Board that you do not owe them anything. They have a couple of times tried to tax me - an expat who never resided in CA - because one of the financial/insurance firms we represent sent me a 1099-Misc from a CA address. It took a month to sort them out.For your tax returns to any state or to the IRS, you need a TIN. For Americans this is the social security number, for non-US nationals the ITIN. Have you applied for it? If not, and if you owe US tax, you should immediately apply. You cannot e-file a return without a TIN, so you will need to file on paper with a copy of your ITIN application.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

Create this form in 5 minutes!

How to create an eSignature for the 2017 pit 4 real file state of new mexico

How to create an electronic signature for your 2017 Pit 4 Real File State Of New Mexico online

How to make an electronic signature for your 2017 Pit 4 Real File State Of New Mexico in Google Chrome

How to generate an eSignature for signing the 2017 Pit 4 Real File State Of New Mexico in Gmail

How to make an electronic signature for the 2017 Pit 4 Real File State Of New Mexico straight from your mobile device

How to generate an eSignature for the 2017 Pit 4 Real File State Of New Mexico on iOS

How to make an eSignature for the 2017 Pit 4 Real File State Of New Mexico on Android

People also ask

-

What is the PIT 4 Real File State Of New Mexico used for?

The PIT 4 Real File State Of New Mexico is primarily utilized for reporting the wages of employees and the withholding taxes to the New Mexico Taxation and Revenue Department. This file ensures compliance with state tax regulations and is essential for businesses operating within New Mexico.

-

How does airSlate SignNow simplify the process of submitting the PIT 4 Real File State Of New Mexico?

airSlate SignNow streamlines the submission of the PIT 4 Real File State Of New Mexico by allowing users to electronically sign and send documents securely. With its easy-to-use interface, businesses can quickly prepare and submit their PIT 4 filings, ensuring timely compliance with state requirements.

-

What are the pricing options for airSlate SignNow when handling PIT 4 Real File State Of New Mexico?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, from startups to large enterprises. With affordable monthly subscriptions, companies can efficiently manage their documentation needs, including the PIT 4 Real File State Of New Mexico, without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software to manage the PIT 4 Real File State Of New Mexico?

Yes, airSlate SignNow can seamlessly integrate with various accounting and financial software, making it easier to manage the PIT 4 Real File State Of New Mexico. This integration helps streamline document handling and ensures that your tax filings are accurate and up-to-date.

-

What features does airSlate SignNow offer for managing the PIT 4 Real File State Of New Mexico?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage to manage the PIT 4 Real File State Of New Mexico effectively. These tools enhance productivity and ensure that your tax submissions are prepared and filed correctly.

-

Is it easy to track the status of my PIT 4 Real File State Of New Mexico submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking capabilities, allowing you to monitor the status of your PIT 4 Real File State Of New Mexico submissions. You'll receive notifications when documents are viewed or signed, ensuring you stay informed throughout the process.

-

What are the benefits of using airSlate SignNow for the PIT 4 Real File State Of New Mexico?

Using airSlate SignNow for the PIT 4 Real File State Of New Mexico offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for sensitive documents. Additionally, the platform's user-friendly design makes it easy for teams to collaborate and ensure compliance with state regulations.

Get more for PIT 4 Real File State Of New Mexico

- Illinois third party administrator license 2009 form

- 2013 il 1363 form

- Dmv chicago randolph form

- Casher of checks application for license in form

- Indiana state form 50292

- Indiana entertainment permit form

- Application for temporary beer wine permit indiana form

- Tc 20 utah corporation franchise or income tax forms publications

Find out other PIT 4 Real File State Of New Mexico

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer