Az 5000a Form PDF

What is the AZ 5000A Form PDF?

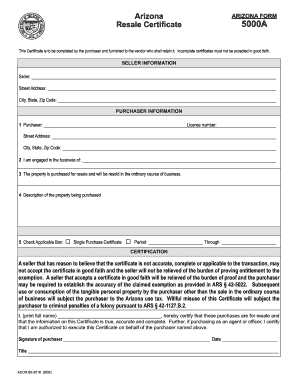

The AZ 5000A form is a document used primarily in the state of Arizona for specific tax-related purposes. This form is essential for individuals and businesses who need to report certain financial information to the state. It is designed to facilitate the collection of data required for tax assessments and compliance. The form is available in PDF format, making it easy to download, print, and fill out. Understanding the purpose of the AZ 5000A form is crucial for ensuring accurate reporting and adherence to state regulations.

How to Use the AZ 5000A Form PDF

Using the AZ 5000A form involves several straightforward steps. First, download the form in PDF format from a reliable source. Once you have the form, carefully read the instructions provided to ensure you understand the requirements. Fill out the form with the necessary information, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate state agency. Utilizing electronic tools for signing and submitting the form can streamline the process and enhance security.

Steps to Complete the AZ 5000A Form PDF

Completing the AZ 5000A form involves a series of methodical steps:

- Download the AZ 5000A form PDF from a trusted source.

- Read the instructions carefully to understand the information required.

- Fill in your personal or business details as prompted on the form.

- Double-check all entries for accuracy, ensuring that all required fields are completed.

- Sign the form electronically or manually, depending on your submission method.

- Submit the completed form to the designated state agency, either online or via mail.

Legal Use of the AZ 5000A Form PDF

The AZ 5000A form is legally binding when completed and submitted according to state regulations. It is essential that individuals and businesses comply with the legal requirements surrounding the use of this form. This includes adhering to deadlines for submission and ensuring that all information provided is truthful and accurate. Failure to comply with these legal stipulations can result in penalties or legal repercussions. Utilizing a trusted eSignature solution can further enhance the legal validity of the submitted document.

Key Elements of the AZ 5000A Form PDF

Several key elements are crucial to the AZ 5000A form. These include:

- Personal or Business Information: Accurate details about the individual or entity submitting the form.

- Financial Data: Specific financial information required for tax assessment.

- Signature: A valid signature is necessary to affirm the authenticity of the submission.

- Date of Submission: The date when the form is filled out and submitted, which is critical for compliance with deadlines.

Form Submission Methods

The AZ 5000A form can be submitted through various methods, offering flexibility to users. Common submission methods include:

- Online Submission: Many state agencies allow electronic submission through their websites, which can expedite processing times.

- Mail: The completed form can be printed and mailed to the appropriate agency address.

- In-Person Submission: Individuals may also choose to submit the form in person at designated state offices.

Quick guide on how to complete az 5000a form pdf

Finish Az 5000a Form Pdf seamlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and electronically sign your documents swiftly without interruptions. Manage Az 5000a Form Pdf on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The optimal method to alter and electronically sign Az 5000a Form Pdf effortlessly

- Obtain Az 5000a Form Pdf and select Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your modifications.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or mistakes necessitating the reprinting of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Az 5000a Form Pdf to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the az 5000a form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the az5000a and how does it benefit my business?

The az5000a is an advanced e-signature solution provided by airSlate SignNow. It empowers businesses to streamline their document signing processes, making them faster and more efficient. With az5000a, you can effortlessly send, sign, and manage important documents without the need for physical paperwork.

-

How much does the az5000a solution cost?

Pricing for the az5000a varies based on the plan you choose, with options that cater to different business sizes and needs. airSlate SignNow offers competitive pricing that makes it a cost-effective solution for e-signatures. You can visit our pricing page for detailed information on subscription tiers and features included.

-

What are the key features of the az5000a?

The az5000a includes a range of features designed to enhance your e-signing experience. Key features include customizable templates, real-time tracking of document status, and secure storage options. With the az5000a, you can ensure that your documents are signed quickly and securely.

-

Is the az5000a easy to integrate with other tools?

Yes, the az5000a is designed for seamless integration with various third-party applications. Whether you use CRM systems, cloud storage, or project management tools, integrating the az5000a can enhance your workflow. Our platform provides easy API access for developers to connect with other software.

-

What industries can benefit from using the az5000a?

The az5000a is versatile and applicable to multiple industries including real estate, healthcare, legal, and finance. Any business needing efficient document signing can leverage the az5000a to improve operations and reduce turnaround times. Its adaptability makes it an excellent e-signature solution across sectors.

-

How secure is the az5000a for document signing?

Security is a top priority with the az5000a. airSlate SignNow employs advanced encryption and complies with global security standards to safeguard your documents. You can confidently use the az5000a knowing that all signed documents are protected against unauthorized access.

-

Can I use the az5000a on mobile devices?

Yes, the az5000a is fully optimized for mobile devices. Users can easily send and sign documents on smartphones and tablets, providing flexibility and convenience while on the go. This mobile access ensures that you can manage your documents anytime, anywhere.

Get more for Az 5000a Form Pdf

- Rch referral form

- Permission for medication st vrain valley school district form

- Boston boston scoliosis brace m3deasurement order form form

- Victorian companion card application form

- Accident report form ucpb general insurance co inc

- Subpoena form pdf colorado gov colorado

- Child registration form sleep medicine

- Il standing order form

Find out other Az 5000a Form Pdf

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document