2551m Deadline Form

What is the 2551m Deadline

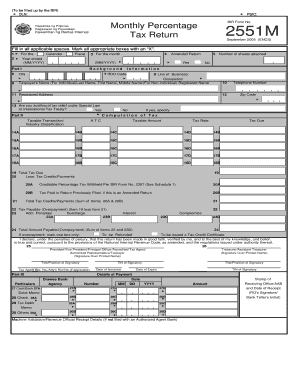

The 2551m deadline refers to the due date for filing the quarterly income tax return form, specifically the BIR Form 2551M. This form is essential for businesses and self-employed individuals in the United States who need to report their income and pay the corresponding taxes. The deadline for submitting the 2551m typically falls on the 25th day of the month following the end of each quarter. For example, the deadline for the first quarter is April 25, the second quarter is July 25, the third quarter is October 25, and the fourth quarter is January 25 of the following year.

Steps to Complete the 2551m Deadline

Completing the 2551m form requires careful attention to detail. Here are the steps to ensure accurate filing:

- Gather necessary financial documents, including income statements and expense receipts.

- Calculate total taxable income for the quarter.

- Determine the applicable tax rate based on your business structure.

- Fill out the BIR Form 2551M with the calculated figures.

- Review the completed form for accuracy.

- Submit the form either electronically or via mail before the deadline.

Legal Use of the 2551m Deadline

Filing the 2551m form by the designated deadline is crucial for legal compliance. Failure to submit the form on time can result in penalties and interest on unpaid taxes. The IRS recognizes electronically signed documents as legally binding, provided they meet specific requirements. Utilizing a reliable eSignature platform can streamline the filing process and ensure that all legal standards are met.

Required Documents

To successfully complete the 2551m form, certain documents are necessary. These typically include:

- Income statements detailing earnings for the quarter.

- Expense records to substantiate deductions.

- Previous tax returns for reference.

- Any relevant financial statements from your accounting software.

Form Submission Methods

The BIR Form 2551M can be submitted through various methods, making it accessible for all taxpayers. The available submission options include:

- Online submission through the IRS e-filing system.

- Mailing a printed version of the form to the appropriate IRS address.

- In-person submission at designated IRS offices.

Penalties for Non-Compliance

Non-compliance with the 2551m deadline can lead to significant penalties. Taxpayers may face fines for late submissions, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes, increasing the total amount owed. It is essential for businesses to prioritize timely filing to avoid these financial repercussions.

Quick guide on how to complete 2551m deadline

Finalize 2551m Deadline effortlessly on any gadget

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal sustainable substitute for conventional printed and signed documentation, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without hold-ups. Handle 2551m Deadline on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign 2551m Deadline with ease

- Find 2551m Deadline and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important parts of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just a few moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to secure your changes.

- Choose how you wish to send your form, whether by email, SMS, or a link invitation, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of tedious form navigation, or errors that necessitate reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign 2551m Deadline to ensure seamless communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2551m deadline

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2551m document and how can airSlate SignNow help with it?

The 2551m document is a crucial form used for specific regulatory purposes. With airSlate SignNow, you can easily upload, send, and eSign 2551m documents securely. Our platform streamlines the signing process, ensuring compliance and efficiency for your business.

-

How much does it cost to use airSlate SignNow for 2551m document management?

airSlate SignNow offers competitive pricing plans starting at an affordable monthly fee, which is designed to cater to businesses of all sizes. Whether you need basic features for signing 2551m documents or advanced capabilities for integration, our pricing is transparent and flexible. You can choose a plan that best fits your business needs.

-

What features does airSlate SignNow provide for managing 2551m documents?

AirSlate SignNow provides a wide range of features for managing 2551m documents, including customizable templates, tracking capabilities, and secure storage. Our user-friendly interface ensures that you can prepare and send 2551m documents effortlessly. Additionally, you can automate reminders and notifications to streamline workflows.

-

Can I integrate airSlate SignNow with other applications for managing 2551m documents?

Yes, airSlate SignNow offers seamless integration with various applications, enabling you to manage your 2551m documents efficiently. Whether you use CRMs, cloud storage solutions, or email platforms, our integrations enhance your document workflow. This connectivity helps maintain productivity by allowing you to leverage existing tools.

-

What are the benefits of using airSlate SignNow for eSigning 2551m documents?

Using airSlate SignNow for eSigning 2551m documents provides numerous benefits, including increased efficiency and enhanced security. The electronic signature process is faster, reducing the turnaround time for approvals. Furthermore, airSlate SignNow ensures that your 2551m documents are protected and comply with legal standards.

-

Is airSlate SignNow legally compliant for signing 2551m documents?

Yes, airSlate SignNow is compliant with industry standards and regulations, including those required for signing 2551m documents. Our platform complies with the ESIGN Act and UETA, ensuring that your electronic signatures are legally binding. This compliance gives you peace of mind when managing critical 2551m documentation.

-

What kind of support does airSlate SignNow offer for users dealing with 2551m documents?

AirSlate SignNow offers robust customer support for users handling 2551m documents. Our support team is available via chat, email, and phone to assist with any inquiries or issues. Additionally, we provide extensive resources, including guides and tutorials, to help you effectively utilize the platform.

Get more for 2551m Deadline

- Waller county 4 h elegibility form

- Wedding flower checklist form

- Employee referral forms

- Fill annexure h online form

- Www pdffiller com522716841 qvcc graduationfillable online qvcc graduation application fax email print form

- Episcopal orphan house scholarship fund form

- Request for diploma mailing or proxy pickup this p form

- Office of the registrarembry riddle aeronautical university form

Find out other 2551m Deadline

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast