Expenditure Form

What is the Expenditure Form

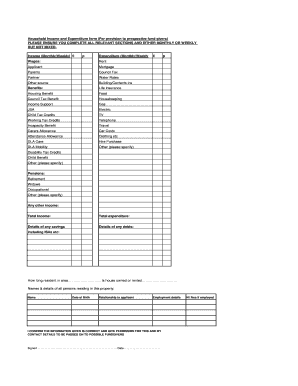

The Expenditure Form is a crucial document used to detail household income and expenses. It serves as a comprehensive record that helps individuals and families manage their finances effectively. This form typically includes sections for income sources, such as wages, benefits, and other earnings, as well as various expense categories, including housing, utilities, food, and transportation. By accurately filling out this form, users can gain insights into their financial health and make informed decisions regarding budgeting and spending.

How to Use the Expenditure Form

Using the Expenditure Form involves several straightforward steps. First, gather all necessary financial documents, including pay stubs, bank statements, and bills. Next, carefully fill out each section of the form, ensuring that all income sources and expenses are accurately represented. It is important to be thorough and honest to provide a realistic picture of your financial situation. Once completed, review the form for any errors or omissions before submission to ensure its accuracy and completeness.

Steps to Complete the Expenditure Form

Completing the Expenditure Form can be broken down into a series of manageable steps:

- Gather Financial Information: Collect all relevant documents that reflect your income and expenses.

- Fill Out Income Section: List all sources of income, including salaries, bonuses, and any other earnings.

- Detail Expense Categories: Break down your expenses into categories such as housing, food, transportation, and entertainment.

- Review and Edit: Double-check the information for accuracy and make any necessary corrections.

- Submit the Form: Follow the appropriate submission method, whether online, by mail, or in person.

Legal Use of the Expenditure Form

The legal use of the Expenditure Form depends on compliance with relevant regulations and guidelines. In many cases, this form may be required for financial assessments, loan applications, or government assistance programs. It is essential to ensure that the information provided is truthful and accurate, as discrepancies can lead to legal consequences. Additionally, using a reliable platform for submitting the form can enhance its legal standing, as electronic signatures and secure submissions are often recognized in various jurisdictions.

Key Elements of the Expenditure Form

Several key elements must be included in the Expenditure Form to ensure it serves its purpose effectively:

- Personal Information: Name, address, and contact details of the individual or household.

- Income Details: Comprehensive listing of all income sources, including amounts and frequency.

- Expense Breakdown: Detailed categorization of monthly expenses, including fixed and variable costs.

- Signature and Date: Acknowledgment of the accuracy of the information provided, often required for legal purposes.

Form Submission Methods

The Expenditure Form can typically be submitted through various methods, allowing for flexibility based on user preference:

- Online Submission: Many platforms offer secure online submission options, which can expedite processing and reduce paperwork.

- Mail Submission: Users can print the completed form and send it via postal mail to the designated authority.

- In-Person Submission: Some may choose to deliver the form directly to the relevant office, which can provide immediate confirmation of receipt.

Quick guide on how to complete expenditure form

Complete Expenditure Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without any hold-ups. Manage Expenditure Form on any device with the airSlate SignNow apps for Android or iOS, enhancing your document-based workflows today.

How to modify and electronically sign Expenditure Form with ease

- Locate Expenditure Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, and errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Expenditure Form while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the expenditure form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the average united kingdom household income?

The average united kingdom household income varies signNowly based on location, family size, and other factors. Understanding this figure can help you better assess the cost of living and the affordability of services like airSlate SignNow. It's important to analyze how your household income aligns with the overall trends in your area.

-

How does airSlate SignNow accommodate different income levels?

airSlate SignNow is designed to be cost-effective, making it accessible for households across various income levels in the united kingdom. Our pricing plans cater to different needs, allowing you to choose a solution that fits your budget. This flexibility ensures that everyone can benefit from our eSigning capabilities regardless of their household income.

-

What are the main features of airSlate SignNow that benefit households?

The main features of airSlate SignNow include secure eSigning, document management, and easy collaboration, all of which can enhance your productivity. These features are particularly beneficial for households in the united kingdom looking to manage important documents in a streamlined manner. By utilizing these tools, you can save time and resources, regardless of your household income.

-

Can airSlate SignNow help with financial documents related to household income?

Yes, airSlate SignNow is a great tool for managing financial documents such as tax returns, bank statements, and income declarations related to your household income. Our platform allows for secure eSigning, which makes it easier to finalize important financial agreements. This functionality is especially useful for households needing to keep their financial documentation organized.

-

Is airSlate SignNow compliant with UK laws regarding household income documentation?

Absolutely, airSlate SignNow is compliant with UK laws governing electronic signatures and document management. We prioritize security and legality, ensuring that documents related to your household income are handled with the utmost care. This compliance gives businesses and households peace of mind that their documents are valid and secure.

-

What integrations does airSlate SignNow offer that can benefit UK households?

airSlate SignNow offers a variety of integrations with popular applications such as Google Drive, Dropbox, and various CRM systems. These integrations allow households in the united kingdom to seamlessly manage their documents and workflows in one place. This connectivity can be particularly helpful for managing household income documentation efficiently.

-

How can I get started with airSlate SignNow if I have a low household income?

Getting started with airSlate SignNow is easy and affordable, even for those with a low household income in the united kingdom. We offer a free trial and several pricing options that cater to different budgets, ensuring that everyone can try out our features. This approach allows you to assess our platform's value without any immediate financial commitment.

Get more for Expenditure Form

- Bluestone discharge authority form

- Milwaukee fiduciary hub form

- Burn plan template form

- Life cycle of a star interactive form

- Digital image integrity form

- Quick guide to pooling and servicing agreements in foreclosure cases form

- Ethics today in early care and education form

- Permanent 12digit customer id no dor use onlyprin form

Find out other Expenditure Form

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement