Credit Application Hajoca Form

What is the Credit Application Hajoca

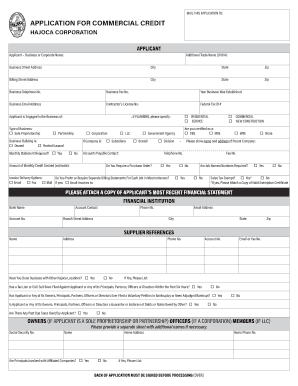

The Credit Application Hajoca is a formal document used by businesses and individuals seeking credit from Hajoca Corporation, a leading distributor of plumbing, heating, and industrial supplies in the United States. This application serves as a request for credit terms and outlines the applicant's financial history, creditworthiness, and other essential details necessary for the approval process. Completing this form accurately is crucial for establishing a credit account with Hajoca, allowing for efficient transactions and access to a wide range of products and services.

How to use the Credit Application Hajoca

Using the Credit Application Hajoca involves several straightforward steps. First, gather all necessary information, including your business details, financial statements, and references. Next, fill out the application form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions before submitting it. The application can typically be submitted electronically, which streamlines the process and allows for quicker processing times. It is essential to keep a copy of the submitted application for your records.

Steps to complete the Credit Application Hajoca

Completing the Credit Application Hajoca requires careful attention to detail. Follow these steps for a successful submission:

- Gather Information: Collect your business name, address, tax identification number, and financial statements.

- Fill Out the Form: Provide all required information, including trade references and banking details.

- Review: Check the application for accuracy and completeness to avoid delays.

- Submit: Send the application electronically or by mail, depending on your preference.

- Follow Up: Contact Hajoca for confirmation of receipt and inquire about the approval timeline.

Key elements of the Credit Application Hajoca

The Credit Application Hajoca includes several key elements that are vital for the credit assessment process. These elements typically consist of:

- Business Information: Name, address, and contact details of the applicant.

- Financial Statements: Recent financial documents that reflect the applicant's financial health.

- Trade References: Contact information for other businesses that can vouch for the applicant's creditworthiness.

- Banking Information: Details of the applicant's banking relationships, including account numbers and bank contacts.

Legal use of the Credit Application Hajoca

The Credit Application Hajoca is legally binding once it is signed and submitted. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to denial of credit or legal repercussions. The application process adheres to various regulations regarding credit and consumer protection, ensuring that both the applicant and Hajoca are protected under the law. Utilizing a secure platform for submission, such as electronic signing solutions, further enhances the legal standing of the document.

Eligibility Criteria

Eligibility for the Credit Application Hajoca typically requires that the applicant be a registered business entity in the United States. Applicants must provide proof of their business operations and demonstrate financial stability through submitted financial documents. Additionally, businesses seeking credit should have a good credit history and be able to provide trade references. Meeting these criteria is essential for a successful application and credit approval.

Quick guide on how to complete credit application hajoca

Complete Credit Application Hajoca effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the functionality required to create, modify, and eSign your documents promptly without delays. Manage Credit Application Hajoca on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Credit Application Hajoca without hassle

- Find Credit Application Hajoca and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this task.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and eSign Credit Application Hajoca and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit application hajoca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Credit Application Hajoca and how does it work?

The Credit Application Hajoca is a streamlined digital solution for managing credit requests within the Hajoca system. It simplifies the process of applying for credit by allowing users to fill out and submit applications electronically. This not only saves time but also reduces the chances of errors that can occur with paper applications.

-

How does airSlate SignNow enhance the Credit Application Hajoca process?

airSlate SignNow enhances the Credit Application Hajoca process by providing an easy-to-use interface for eSigning and sending documents. It allows users to track application statuses in real-time, ensuring that all stakeholders are informed. This results in a more efficient workflow and a quicker turnaround for credit approvals.

-

What are the pricing options for using the Credit Application Hajoca via airSlate SignNow?

Pricing for using the Credit Application Hajoca through airSlate SignNow is flexible and tailored to your business needs. It typically offers various subscription plans, allowing you to choose one that fits your budget while enjoying all the necessary features. Contact airSlate SignNow for the most current pricing details and to find a plan that works for you.

-

What features does the Credit Application Hajoca include?

The Credit Application Hajoca includes features such as customizable templates, automated workflows, and secure cloud storage for all documents. Additionally, it supports multiple users, making it easy for teams to collaborate on credit applications. All these features are designed to optimize your credit application process and enhance efficiency.

-

What are the benefits of using the Credit Application Hajoca?

Using the Credit Application Hajoca provides numerous benefits, including faster processing times and reduced paperwork. You can expect improved accuracy with automatic data entry and the ability to easily access and manage documents. Overall, it leads to better customer satisfaction and streamlined operations for your business.

-

Can I integrate the Credit Application Hajoca with other software tools?

Yes, the Credit Application Hajoca can be integrated with various software tools such as CRM systems and accounting software through airSlate SignNow’s robust API. This integration enhances workflow efficiency by allowing data to seamlessly pass between platforms. Contact our support team for assistance with integration options that fit your business.

-

Is the Credit Application Hajoca secure for sensitive information?

Absolutely, the Credit Application Hajoca is designed with strong security measures to protect sensitive information. airSlate SignNow employs encryption, secure authentication, and compliance with data protection regulations. This ensures that your credit application data is kept confidential and secure throughout the entire process.

Get more for Credit Application Hajoca

- Dhsr form

- Presentation of documents under export letter of credit form

- Franciscan alliance financial assistance application form

- Lewis and clark question packet form

- Coverdell esa contribution information do not cut or

- Discount tire receipt pdf form

- Founder exit agreement template form

- Founder separation agreement template form

Find out other Credit Application Hajoca

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document