Salary Sacrifice Super Form Template 2016-2026

What is the salary sacrifice form template

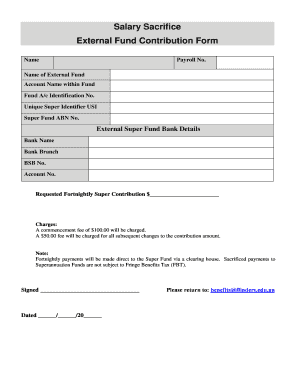

The salary sacrifice form template is a structured document that outlines an agreement between an employee and employer regarding the arrangement to sacrifice a portion of the employee's salary in exchange for non-cash benefits. This can include contributions to retirement funds, additional leave, or other perks. The template ensures that both parties understand the terms of the sacrifice, including the impact on taxable income and benefits eligibility.

How to use the salary sacrifice form template

Using the salary sacrifice form template involves several straightforward steps. First, both the employee and employer should review the terms of the agreement. Next, the employee fills out the necessary details, including the amount of salary to be sacrificed and the specific benefits to be received. Once completed, both parties should sign the document to formalize the agreement. It is advisable to keep a copy for personal records and ensure that the employer files it appropriately.

Steps to complete the salary sacrifice form template

Completing the salary sacrifice form template requires careful attention to detail. Follow these steps:

- Read the template thoroughly to understand all terms and conditions.

- Fill in personal information, such as name, employee ID, and department.

- Specify the percentage or amount of salary to be sacrificed.

- Indicate the benefits or services that will be received in exchange.

- Review the completed form for accuracy.

- Sign and date the form, and ensure the employer does the same.

Legal use of the salary sacrifice form template

The legal use of the salary sacrifice form template is crucial to ensure compliance with tax regulations and employment laws. The agreement must adhere to the guidelines set forth by the Internal Revenue Service (IRS) and other relevant authorities. This includes ensuring that the sacrificed salary does not reduce the employee's pay below minimum wage and that the benefits received are compliant with tax laws. Proper execution of the form, including signatures and dates, is necessary for it to be legally binding.

Key elements of the salary sacrifice form template

Several key elements should be included in the salary sacrifice form template to ensure clarity and legality:

- Employee details: Full name, employee ID, and contact information.

- Employer details: Company name and contact information.

- Salary sacrifice amount: Clear indication of the percentage or dollar amount being sacrificed.

- Benefits received: Detailed description of the non-cash benefits provided in return.

- Effective date: When the salary sacrifice arrangement begins.

- Signatures: Both employee and employer signatures to validate the agreement.

Eligibility criteria for the salary sacrifice form template

Eligibility for using the salary sacrifice form template typically depends on several factors. Employees must be full-time or part-time staff members, as temporary or contract workers may not qualify. Additionally, the employer must offer salary sacrifice arrangements as part of their benefits package. Employees should also consider their financial situation, as sacrificing salary may affect their take-home pay and tax obligations. Understanding these criteria is essential for both parties to ensure a smooth process.

Quick guide on how to complete salary sacrifice super form template

Complete Salary Sacrifice Super Form Template effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely archive them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without complications. Manage Salary Sacrifice Super Form Template on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to modify and electronically sign Salary Sacrifice Super Form Template effortlessly

- Obtain Salary Sacrifice Super Form Template and click Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Salary Sacrifice Super Form Template to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salary sacrifice super form template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a salary sacrifice form template?

A salary sacrifice form template is a document that allows employees to agree to reduce their salary in exchange for non-cash benefits. This template typically outlines the terms and conditions of the salary sacrifice arrangement, ensuring that both the employer and employee are clear on their commitments. Utilizing a salary sacrifice form template can streamline the process and reduce administrative burdens.

-

How can I create a salary sacrifice form template using airSlate SignNow?

Creating a salary sacrifice form template with airSlate SignNow is simple. You can use our user-friendly drag-and-drop interface to customize your template, adding the necessary fields and instructions for employees. Once completed, you can save the template for future use, ensuring consistency in your salary sacrifice processes.

-

What are the benefits of using a salary sacrifice form template?

Using a salary sacrifice form template helps in simplifying the documentation process for both employers and employees. It ensures all necessary information is collected systematically, minimizes errors during the submission, and promotes compliance with relevant regulations. Moreover, it can enhance employee satisfaction through clear communication of benefits.

-

Are there any costs associated with using the salary sacrifice form template from airSlate SignNow?

airSlate SignNow offers various pricing plans, which include access to the salary sacrifice form template. The cost will depend on the specific plan you choose, but our solution is designed to be cost-effective for businesses of all sizes. You can explore different plans to find one that matches your needs and budget.

-

Can I integrate the salary sacrifice form template with other applications?

Yes, airSlate SignNow supports integration with various applications that your business may already be using. You can seamlessly connect our salary sacrifice form template with solutions like CRM systems and HR platforms, ensuring that your document workflows are efficient and connected. This integration streamlines data entry and enhances overall productivity.

-

How secure is the salary sacrifice form template on airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform ensures that all salary sacrifice form templates are stored securely with advanced encryption protocols. You can trust that sensitive employee information is protected, complying with relevant data protection regulations while still allowing for seamless e-signatures and document sharing.

-

Can I customize the salary sacrifice form template for different employee needs?

Absolutely! airSlate SignNow allows for full customization of the salary sacrifice form template to cater to different employee needs. You can add or modify fields, change the layout, and include specific terms that fit your company's policies. This flexibility ensures that each template meets the unique requirements of your workforce.

Get more for Salary Sacrifice Super Form Template

Find out other Salary Sacrifice Super Form Template

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online