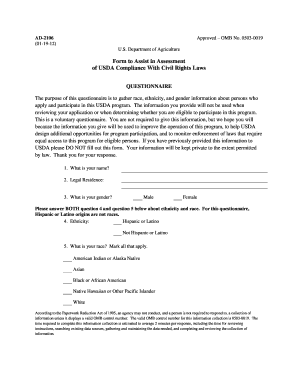

Fsa Ad 2106 Form

What is the FSA AD 2106?

The FSA AD 2106 form, also known as the USDA Form AD 2106, is utilized by businesses and individuals to report specific expenses related to their flexible spending accounts (FSA). This form allows users to claim reimbursements for qualified medical expenses incurred during the tax year. It is essential for ensuring that the reported expenses align with IRS guidelines, providing a clear record of eligible costs for tax purposes.

Steps to Complete the FSA AD 2106

Completing the FSA AD 2106 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including receipts and invoices for medical expenses. Next, fill out the form by entering personal information, including your name, address, and Social Security number. Then, detail each expense by providing the date, type of service, and amount. Finally, review the completed form for any errors before submitting it to your FSA administrator.

How to Obtain the FSA AD 2106

The FSA AD 2106 form can typically be obtained through your employer’s human resources department or benefits administrator. Many employers provide access to the form via their internal websites or employee portals. Additionally, the form may be available on the USDA website or other official government resources. It is advisable to ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the FSA AD 2106

The legal use of the FSA AD 2106 form is governed by IRS regulations, which dictate what qualifies as a reimbursable medical expense. To ensure compliance, users must adhere to these guidelines while completing the form. This includes maintaining accurate records of all expenses claimed and ensuring that the services or products meet the eligibility criteria set forth by the IRS. Failure to comply may result in penalties or disallowance of claims.

Key Elements of the FSA AD 2106

Several key elements are crucial when filling out the FSA AD 2106 form. These include:

- Personal Information: Accurate details such as name, address, and Social Security number.

- Expense Details: Clear documentation of each medical expense, including dates and amounts.

- Signatures: Required signatures to validate the claims and ensure accountability.

These elements help ensure that the form is processed efficiently and in compliance with relevant regulations.

Examples of Using the FSA AD 2106

Examples of using the FSA AD 2106 form include claiming reimbursements for various medical expenses. Common examples are:

- Prescription medications

- Doctor visits and co-pays

- Dental treatments

- Vision care expenses

By accurately reporting these expenses on the FSA AD 2106, users can effectively utilize their flexible spending accounts to manage healthcare costs.

Quick guide on how to complete fsa ad 2106

Complete Fsa Ad 2106 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and without delays. Manage Fsa Ad 2106 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Fsa Ad 2106 with ease

- Locate Fsa Ad 2106 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or obscure sensitive information with the specialized tools offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Fsa Ad 2106 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fsa ad 2106

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ad 2106 feature in airSlate SignNow?

The ad 2106 feature in airSlate SignNow allows users to seamlessly send and eSign documents, enhancing workflow efficiency. This tool is designed to simplify the signing process, making it more accessible for businesses of all sizes. By leveraging ad 2106, you can improve document turnaround times and ensure compliance.

-

How much does airSlate SignNow cost with the ad 2106 feature?

The pricing for airSlate SignNow with the ad 2106 feature varies based on the chosen plan. We offer various tiers, including basic, professional, and business plans, ensuring that there's an option to fit every budget. Each plan provides access to the full suite of features, including ad 2106.

-

What are the main benefits of using airSlate SignNow with ad 2106?

Using airSlate SignNow with the ad 2106 feature provides numerous benefits, such as increased productivity, reduced costs, and enhanced compliance. Your team can quickly send, track, and manage documents from anywhere, minimizing delays and ensuring a smoother signing process. Additionally, ad 2106 helps maintain the integrity of your documents.

-

Can I integrate airSlate SignNow's ad 2106 with other applications?

Yes, airSlate SignNow's ad 2106 feature integrates effortlessly with various applications, including CRMs and productivity tools. This capability allows you to streamline your document workflows by connecting SignNow with the software you already use. Popular integrations include Salesforce, Google Drive, and Zapier.

-

Is there a mobile app for accessing airSlate SignNow and the ad 2106 feature?

Absolutely! airSlate SignNow provides a mobile app that allows you to access the ad 2106 feature on the go. This mobile capability ensures that you can send documents and manage signatures anytime, anywhere, making it perfect for busy professionals. The app is available for both iOS and Android devices.

-

How secure is my data when using airSlate SignNow with ad 2106?

Security is a top priority for airSlate SignNow, especially when using the ad 2106 feature. We implement industry-standard encryption protocols to protect your data both in transit and at rest. Moreover, we comply with various regulatory standards to ensure that your documents and information remain safe.

-

What types of documents can I sign with ad 2106 in airSlate SignNow?

With the ad 2106 feature in airSlate SignNow, you can sign a wide variety of documents, including contracts, agreements, and forms. Whether it's a simple signature request or a complex multi-party agreement, ad 2106 supports all your document signing needs. This versatility is perfect for businesses that handle diverse paperwork.

Get more for Fsa Ad 2106

- Posterit frii com form

- Purchase and sale contract for residential property mcba form

- Dsu housing form

- Orion pension fund form

- Disclosure of financial position ir 590october 20 form

- Change in personal details members forms and datacom gsf

- Berth listing agreement indd bayswater marina form

- Inspection checklist retaining walls form

Find out other Fsa Ad 2106

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease