Schedule 8812 Form 1040A or 1040 Child Tax Credit

What is the Schedule 8812 Form for Child Tax Credit?

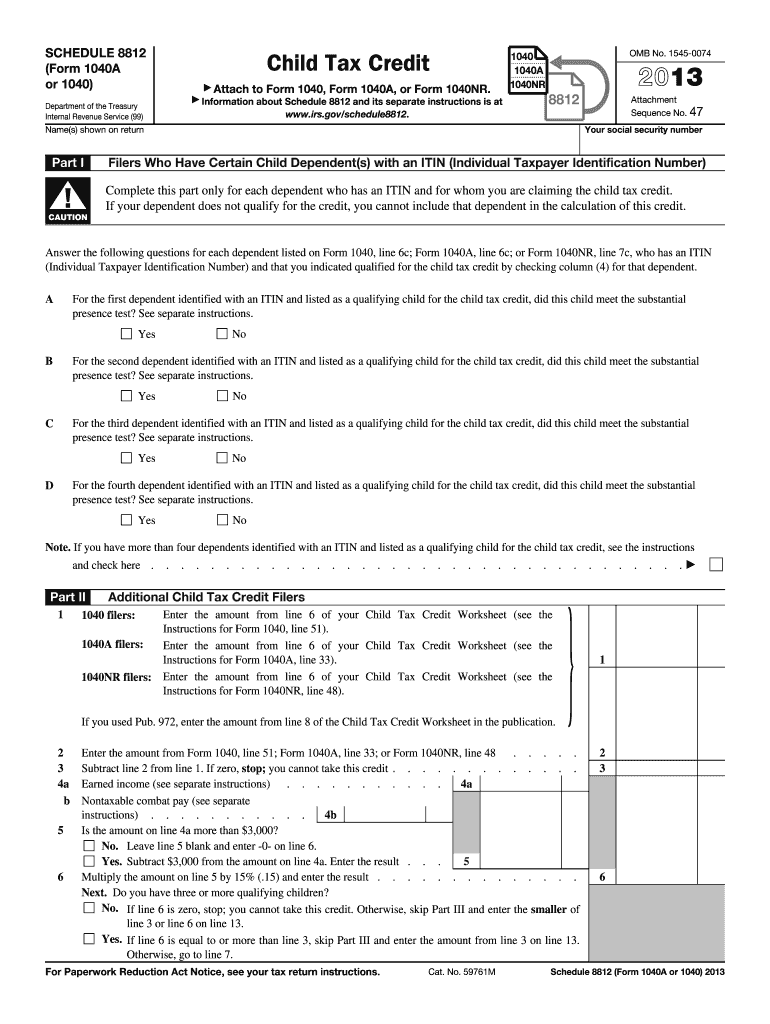

The Schedule 8812 form, also known as the Child Tax Credit form, is used by taxpayers to calculate the amount of Child Tax Credit they are eligible to claim on their federal income tax return. This form is specifically designed for individuals filing Form 1040 or Form 1040A. The Child Tax Credit provides financial support to families with qualifying children, helping to reduce their overall tax liability. The Schedule 8812 allows taxpayers to determine the refundable portion of the credit, which can be beneficial for those who may not owe taxes but still qualify for a refund.

How to Use the Schedule 8812 Form

Using the Schedule 8812 form involves several steps to ensure accurate completion. First, gather all necessary information about your qualifying children, including their names, Social Security numbers, and ages. Next, fill out the required sections of the form, which include calculations for the credit based on your income and the number of qualifying children. It is important to follow the instructions carefully to ensure that all calculations are correct. Once completed, attach the Schedule 8812 to your Form 1040 or Form 1040A when filing your tax return.

Steps to Complete the Schedule 8812 Form

Completing the Schedule 8812 form requires attention to detail. Here are the key steps:

- Start by entering your name and Social Security number at the top of the form.

- List each qualifying child, including their name, Social Security number, and age.

- Calculate the total amount of Child Tax Credit based on the number of children and your income.

- Determine the refundable credit amount, if applicable.

- Review your entries for accuracy before submitting.

Eligibility Criteria for the Child Tax Credit

To qualify for the Child Tax Credit, certain eligibility criteria must be met. Generally, the child must be under the age of 17 at the end of the tax year, a U.S. citizen, national, or resident alien, and must be claimed as a dependent on your tax return. Additionally, the taxpayer's income must fall within specified limits to receive the full credit. For higher earners, the credit may be phased out. Understanding these criteria is crucial for accurately completing the Schedule 8812 form.

IRS Guidelines for Completing Schedule 8812

The IRS provides specific guidelines for completing the Schedule 8812 form. Taxpayers are encouraged to refer to the IRS instructions for the form, which detail how to calculate the credit, eligibility requirements, and any changes from previous tax years. Following these guidelines helps ensure compliance with tax laws and maximizes the potential benefit of the Child Tax Credit. It is advisable to keep updated with any changes that may impact the filing process or credit amounts.

Form Submission Methods for Schedule 8812

Taxpayers can submit the Schedule 8812 form through various methods. The most common way is to file electronically using tax preparation software, which often includes the Schedule 8812 as part of the filing process. Alternatively, taxpayers may choose to print the completed form and mail it along with their Form 1040 or Form 1040A to the appropriate IRS address. It is important to ensure that all forms are submitted by the tax deadline to avoid any penalties.

Quick guide on how to complete 2013 schedule 8812 form 1040a or 1040 child tax credit

Finalize Schedule 8812 Form 1040A Or 1040 Child Tax Credit seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and safeguard it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files quickly without delays. Manage Schedule 8812 Form 1040A Or 1040 Child Tax Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Schedule 8812 Form 1040A Or 1040 Child Tax Credit effortlessly

- Locate Schedule 8812 Form 1040A Or 1040 Child Tax Credit and click Get Form to initiate.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to preserve your changes.

- Select your preferred method to distribute your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule 8812 Form 1040A Or 1040 Child Tax Credit and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

If an undocumented resident wants to pay taxes and she is paid in cash by her employer, how can she file taxes when she applies for an ITIN? Does she use a Schedule C Form 1040 or a Form 4852?

Schedule C is used if the person is self-employed. Form 4852 is used for employment. There is a difference.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the 2013 schedule 8812 form 1040a or 1040 child tax credit

How to generate an electronic signature for the 2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit online

How to make an electronic signature for your 2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit in Chrome

How to generate an electronic signature for putting it on the 2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit in Gmail

How to create an electronic signature for the 2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit from your smartphone

How to generate an electronic signature for the 2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit on iOS devices

How to create an eSignature for the 2013 Schedule 8812 Form 1040a Or 1040 Child Tax Credit on Android OS

People also ask

-

What is the Schedule 8812 Form 1040A Or 1040 Child Tax Credit?

The Schedule 8812 Form 1040A Or 1040 Child Tax Credit is a tax form used to calculate the amount of Child Tax Credit and Additional Child Tax Credit you may be eligible for when filing your federal tax return. This form is essential for parents and guardians seeking tax relief based on their dependents.

-

How can airSlate SignNow help me manage the Schedule 8812 Form 1040A Or 1040 Child Tax Credit?

airSlate SignNow simplifies the process of managing your Schedule 8812 Form 1040A Or 1040 Child Tax Credit by allowing users to create, edit, and securely eSign their documents online. This ensures that all necessary forms are completed accurately and submitted on time, streamlining your tax preparation process.

-

Is there a cost associated with using airSlate SignNow for the Schedule 8812 Form 1040A Or 1040 Child Tax Credit?

Yes, airSlate SignNow offers various pricing plans tailored to suit different needs, including features for managing the Schedule 8812 Form 1040A Or 1040 Child Tax Credit. Our cost-effective solutions provide excellent value for businesses and individuals looking to simplify their document management and eSigning needs.

-

What features does airSlate SignNow offer for handling taxes like the Schedule 8812 Form 1040A Or 1040 Child Tax Credit?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking to enhance your experience with the Schedule 8812 Form 1040A Or 1040 Child Tax Credit. These tools make it easier to prepare, sign, and store your tax documents securely.

-

Can I integrate airSlate SignNow with other tax software for the Schedule 8812 Form 1040A Or 1040 Child Tax Credit?

Yes, airSlate SignNow integrates seamlessly with various tax software and financial applications, making it easier to manage the Schedule 8812 Form 1040A Or 1040 Child Tax Credit alongside your other tax-related tasks. This integration helps streamline your workflow and ensures consistency across your documents.

-

What benefits does eSigning my Schedule 8812 Form 1040A Or 1040 Child Tax Credit offer?

eSigning your Schedule 8812 Form 1040A Or 1040 Child Tax Credit with airSlate SignNow offers numerous benefits, including faster processing times, enhanced security, and reduced paperwork. eSignatures are legally binding, which helps ensure your forms are valid and accepted by tax authorities.

-

How secure is my information when using airSlate SignNow for the Schedule 8812 Form 1040A Or 1040 Child Tax Credit?

airSlate SignNow prioritizes the security of your information, employing advanced encryption and security measures to protect your data while handling documents like the Schedule 8812 Form 1040A Or 1040 Child Tax Credit. You can confidently manage your sensitive tax information knowing it is safeguarded.

Get more for Schedule 8812 Form 1040A Or 1040 Child Tax Credit

Find out other Schedule 8812 Form 1040A Or 1040 Child Tax Credit

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy