2304 Form

What is the 2304?

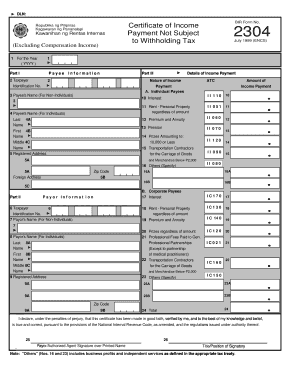

The 2304 form, also known as the BIR Form 2304, is a tax document used in the Philippines. It serves as a declaration of income by individuals and businesses that are subject to withholding tax. This form is essential for taxpayers who need to report their income and the corresponding taxes withheld by their employers or clients. Understanding the purpose and requirements of the 2304 form is crucial for ensuring compliance with tax regulations.

How to obtain the 2304

To obtain the 2304 form, individuals can visit the Bureau of Internal Revenue (BIR) website or their local BIR office. The form is typically available in both physical and digital formats, allowing taxpayers to choose the method that best suits their needs. Additionally, many tax preparation software programs may offer the option to download or generate the 2304 form, streamlining the process for users.

Steps to complete the 2304

Completing the 2304 form involves several steps to ensure accuracy and compliance:

- Gather necessary information, including personal details, income sources, and tax withheld.

- Download the 2304 form from the BIR website or use tax software.

- Fill out the form with the required information, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate BIR office or through designated online channels.

Legal use of the 2304

The 2304 form is legally binding when completed and submitted according to the guidelines set by the BIR. It is important for taxpayers to understand that this form serves as an official record of income and taxes withheld. Failure to comply with the requirements associated with the 2304 can lead to penalties or legal issues. Therefore, ensuring that the form is filled out correctly and submitted on time is essential for maintaining compliance.

Key elements of the 2304

When filling out the 2304 form, certain key elements must be included to ensure its validity:

- Taxpayer Information: Personal details, including name, address, and Tax Identification Number (TIN).

- Income Details: A breakdown of all income sources and the corresponding amounts.

- Withholding Tax: The total amount of tax withheld by employers or clients during the reporting period.

- Signature: The taxpayer's signature is required to validate the form.

Form Submission Methods

The 2304 form can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines set by the BIR:

- Online Submission: Taxpayers can submit the form electronically through the BIR's online portal, which simplifies the process and provides immediate confirmation.

- Mail: The completed form can be mailed to the designated BIR office, ensuring that it is sent well before any deadlines.

- In-Person: Taxpayers may also choose to submit the form in person at their local BIR office, allowing for any questions to be addressed directly.

Quick guide on how to complete 2304

Complete 2304 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 2304 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign 2304 with ease

- Obtain 2304 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you would like to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Edit and eSign 2304 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2304

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2304 bir form and how can I download it?

The 2304 bir form is a tax-related document required for certain financial filings in your jurisdiction. You can easily access and download the 2304 bir form via airSlate SignNow's platform, which provides a straightforward interface for finding and retrieving necessary documents.

-

Is there a cost associated with the 2304 bir form download through airSlate SignNow?

Downloading the 2304 bir form through airSlate SignNow is included in our subscription service. Our pricing plans are designed to be cost-effective, ensuring that businesses can manage their documentation needs without breaking the bank.

-

What features does airSlate SignNow offer for the 2304 bir form download?

AirSlate SignNow simplifies the process of the 2304 bir form download by providing easy access to the form, electronic signature capabilities, and document management tools. These features allow users to complete and send their forms securely and efficiently.

-

Can I integrate airSlate SignNow with other software for easier 2304 bir form management?

Yes, airSlate SignNow offers various integrations with popular software applications, making it easier to manage your 2304 bir form download and other documents. These integrations enhance workflow efficiency and help streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the 2304 bir form download?

Using airSlate SignNow for the 2304 bir form download provides several benefits, including improved accessibility, enhanced security features, and the ability to eSign documents swiftly. This service saves time and ensures compliance with filing requirements.

-

Is there customer support available if I encounter issues while downloading the 2304 bir form?

Absolutely! AirSlate SignNow offers dedicated customer support to assist you with any issues related to the 2304 bir form download. Our team is available through various channels to ensure you can complete your forms without hassle.

-

How quickly can I get my 2304 bir form after downloading it from airSlate SignNow?

After downloading the 2304 bir form from airSlate SignNow, you can fill it out and submit it immediately. Our platform is designed for quick processing, allowing you to manage your tax documents efficiently.

Get more for 2304

Find out other 2304

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT