Insurance Binder Form

What is the Insurance Binder

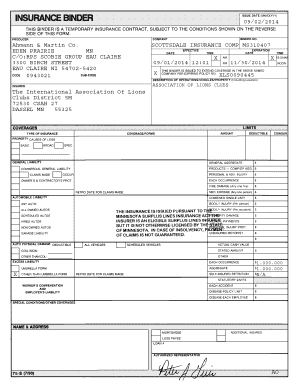

An insurance binder is a temporary document issued by an insurance company that provides proof of coverage until a formal policy is issued. It serves as a bridge between the initial application and the final policy, ensuring that the insured has coverage during this interim period. Typically, an insurance binder will include essential details such as the type of coverage, the effective date, and the names of the insured parties. This document is crucial for individuals and businesses needing immediate protection, especially in situations like purchasing a vehicle or property.

Key Elements of the Insurance Binder

Understanding the key elements of an insurance binder is essential for effective use. These elements typically include:

- Insured Parties: Names of individuals or entities covered under the binder.

- Coverage Types: Specific types of insurance coverage provided, such as auto, home, or liability insurance.

- Effective Dates: The start date of coverage and any expiration dates associated with the binder.

- Policy Limits: Maximum amounts the insurer will pay in the event of a claim.

- Premium Information: Details regarding the payment structure for the insurance coverage.

How to Obtain the Insurance Binder

Obtaining an insurance binder typically involves a few straightforward steps. First, you need to apply for insurance coverage with an insurance provider. This can often be done online or through an agent. After your application is submitted and approved, the insurer will issue the binder. In some cases, you may need to provide additional documentation, such as proof of identity or prior insurance history. Once the binder is issued, it can be sent electronically or via mail, depending on the insurer's practices.

Steps to Complete the Insurance Binder

Completing an insurance binder requires careful attention to detail. Here are the steps you should follow:

- Gather Required Information: Collect all necessary personal and property details needed for the application.

- Fill Out the Application: Complete the insurance application accurately, ensuring all information is current and truthful.

- Review Terms: Carefully read the terms and conditions associated with the binder to understand your coverage.

- Submit the Application: Send your completed application to the insurance provider through the preferred method.

- Receive the Binder: Once approved, obtain your insurance binder, ensuring it includes all key elements.

Legal Use of the Insurance Binder

The legal use of an insurance binder is significant, as it acts as a temporary contract between the insurer and the insured. It is legally binding as long as it contains all the necessary elements and complies with state regulations. The binder provides immediate proof of insurance, which can be crucial in various situations, such as during a property closing or when registering a vehicle. It is important to note that while the binder is valid, it is not a substitute for the final insurance policy, which will provide more comprehensive coverage details.

Examples of Using the Insurance Binder

Insurance binders are commonly used in various scenarios. For instance:

- Auto Insurance: When purchasing a new vehicle, a buyer may need an auto insurance binder to show proof of coverage before driving off the lot.

- Home Purchase: During real estate transactions, buyers often present an insurance binder to lenders as proof of homeowners insurance.

- Business Coverage: Businesses may require an insurance binder to demonstrate coverage for liability or property insurance when entering contracts or leases.

Quick guide on how to complete insurance binder

Handle Insurance Binder effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and smoothly. Manage Insurance Binder on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Insurance Binder without hassle

- Obtain Insurance Binder and click Obtain Form to begin.

- Take advantage of the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Insurance Binder to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the insurance binder

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an insurance binder example?

An insurance binder example is a temporary agreement provided by an insurance company that serves as proof of insurance coverage until the official policy is issued. This type of document can be crucial for individuals or businesses needing immediate coverage. By using an insurance binder example, you can demonstrate to lenders or property owners that you have insurance in place.

-

How can I create an insurance binder example with airSlate SignNow?

Creating an insurance binder example with airSlate SignNow is simple and efficient. You can upload your document, edit it as needed, and use our eSignature feature to finalize agreements quickly. The platform’s intuitive interface ensures that even those unfamiliar with digital signatures can create and send an insurance binder example effortlessly.

-

What features does airSlate SignNow offer for handling insurance binders?

airSlate SignNow provides a range of features specifically designed for managing insurance binders, including customizable templates and easy document sharing. Our workflow automation tools help streamline the process of creating and sending documents like insurance binders. With these features, you can efficiently manage all your essential documents, including multiple insurance binder examples.

-

Is airSlate SignNow cost-effective for insurance businesses?

Absolutely! airSlate SignNow offers various pricing plans that cater to insurance businesses of all sizes. With our cost-effective solutions, you can save money while ensuring your operations run smoothly, especially when dealing with essential documents like an insurance binder example. Overall, the investment will lead to greater productivity and efficiency.

-

Can I integrate airSlate SignNow with other tools for creating an insurance binder example?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM systems and document management tools. This enables you to create an insurance binder example directly from your existing workflow. Our integrations help boost productivity by allowing you to handle multiple tasks related to insurance documents in one place.

-

How can an insurance binder example benefit my business?

An insurance binder example can signNowly benefit your business by providing immediate proof of coverage, which is essential during transactions involving loans or property purchases. By using airSlate SignNow to create these documents swiftly, you can enhance your credibility and improve customer satisfaction. This proactive approach can help prevent delays and smooth out processes in critical transactions.

-

What types of insurance binders can I create with airSlate SignNow?

With airSlate SignNow, you can create various types of insurance binders, including auto, home, and commercial insurance binders. Our customizable templates allow you to tailor each binder to meet specific needs. Whether you need a quick insurance binder example for personal use or business, our platform supports your requirements.

Get more for Insurance Binder

Find out other Insurance Binder

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free