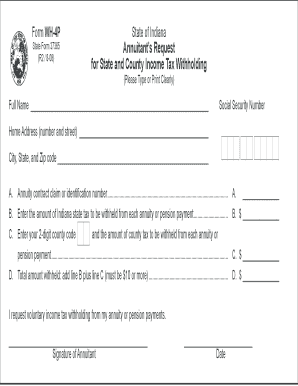

Wh 4p Form

What is the WH-4P?

The WH-4P form, also known as the Indiana WH-4P, is a state-specific document used for withholding exemptions in Indiana. It allows employees to claim exemptions from state income tax withholding based on their specific tax situation. By submitting this form, employees can ensure that the correct amount of state tax is withheld from their paychecks, which can help in managing their overall tax liability.

How to Use the WH-4P

Using the WH-4P form involves several straightforward steps. First, employees need to complete the form by providing personal information, including their name, address, and Social Security number. Next, they must indicate the number of exemptions they are claiming. It is essential to review the form carefully to ensure accuracy before submission. Once completed, the form should be submitted to the employer's payroll department, which will adjust the withholding accordingly.

Steps to Complete the WH-4P

Completing the WH-4P form requires attention to detail. Here are the steps to follow:

- Obtain the WH-4P form from your employer or the Indiana Department of Revenue website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Determine the number of exemptions you qualify for based on your financial situation.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form to your employer’s payroll department.

Legal Use of the WH-4P

The WH-4P form is legally binding once submitted to an employer. It is essential for employees to ensure that they are eligible to claim the exemptions stated on the form. Misrepresentation can lead to penalties or adjustments during tax filing. Employers are required to keep the form on file and adhere to the withholding instructions provided by the employee.

Required Documents

When filling out the WH-4P form, employees may not need to submit additional documents; however, it is advisable to have the following information handy:

- Social Security number

- Proof of income

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

While the WH-4P does not have a specific filing deadline, it is crucial to submit the form to your employer as soon as your tax situation changes or at the beginning of a new tax year. This ensures that the correct amount of state tax is withheld from your paycheck throughout the year, avoiding potential tax liabilities at year-end.

Quick guide on how to complete wh 4p

Complete Wh 4p effortlessly on any gadget

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate format and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Wh 4p on any gadget with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign Wh 4p without any hassle

- Obtain Wh 4p and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Edit and eSign Wh 4p to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wh 4p in relation to airSlate SignNow?

The term 'wh 4p' refers to the versatile features of airSlate SignNow that streamline document management processes. With wh 4p, users can send and eSign documents efficiently, which enhances productivity and reduces turnaround time.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan includes the essential features needed for wh 4p, making it a cost-effective solution for both small and large organizations.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, team collaboration tools, and secure document storage. These features complement the wh 4p functionality, enabling seamless document management and enhanced user experience.

-

How can airSlate SignNow benefit my business?

By utilizing airSlate SignNow, businesses can streamline their workflow, saving time and reducing paper costs. The wh 4p features empower teams to work more efficiently, improving overall productivity and document handling.

-

Does airSlate SignNow integrate with other applications?

Yes, airSlate SignNow offers integrations with a wide array of applications, including CRM systems and project management tools. This flexibility enhances the wh 4p experience, allowing users to combine workflows seamlessly across platforms.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. The affordability and functionality of wh 4p make it an ideal choice for small businesses looking to optimize their document processes.

-

How secure is airSlate SignNow for my documents?

AirSlate SignNow prioritizes security, using industry-standard encryption and compliance with regulations like GDPR. With wh 4p capabilities, you can trust that your sensitive documents are managed securely and efficiently.

Get more for Wh 4p

- Cr3 code sheet form

- Repossession order form 18225

- Convert pdf to jasper report form

- Hydraulic fracturing webquest answer key pdf form

- Cat adoption form stamford animal care control 2

- Continuing education record independent reading video viewing dcf f cfs2114 e form

- North carolina voter registration application form

- Cat adoption forms

Find out other Wh 4p

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent