Nevada Tax Exempt Certificate 2013

What is the Nevada Tax Exempt Certificate

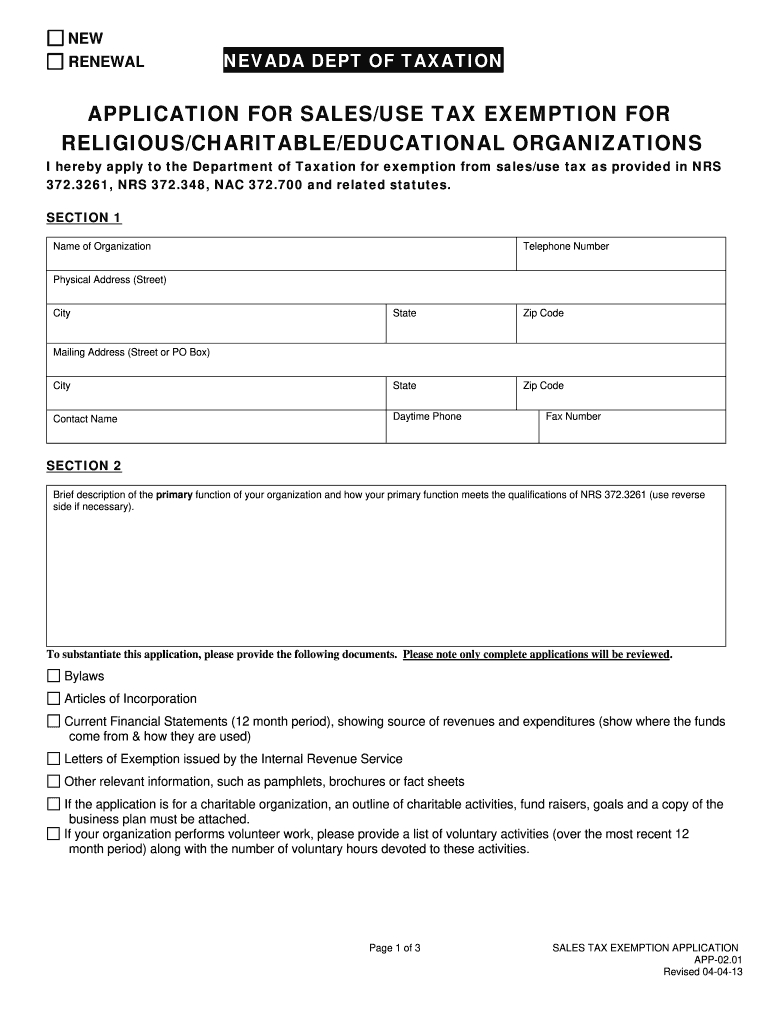

The Nevada Tax Exempt Certificate is a legal document that allows eligible individuals and organizations to make purchases without paying sales tax. This certificate is essential for those who qualify for tax exemptions under specific categories defined by Nevada state law. Commonly, this includes non-profit organizations, government entities, and certain educational institutions. By utilizing this certificate, eligible parties can save on costs associated with taxable purchases, thereby supporting their financial sustainability.

How to Obtain the Nevada Tax Exempt Certificate

To obtain the Nevada Tax Exempt Certificate, applicants must complete the necessary application process. This typically involves filling out the appropriate form, which can be found on the Nevada Department of Taxation's website. Applicants need to provide detailed information about their organization, including its legal status and purpose. Once the form is completed, it should be submitted to the relevant state authority for review. Approval times may vary, so it is advisable to apply well in advance of any planned purchases.

Steps to Complete the Nevada Tax Exempt Certificate

Completing the Nevada Tax Exempt Certificate involves several key steps:

- Gather necessary documentation, such as proof of tax-exempt status and identification.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the Nevada Department of Taxation, either online or by mail.

- Wait for confirmation of approval, which may take several weeks.

Legal Use of the Nevada Tax Exempt Certificate

The legal use of the Nevada Tax Exempt Certificate is strictly regulated. Only eligible organizations and individuals may use the certificate for qualifying purchases. Misuse of the certificate, such as using it for personal purchases or for items that do not qualify for exemption, can result in penalties. It is important to understand the specific guidelines set forth by the Nevada Department of Taxation to ensure compliance and avoid legal issues.

Eligibility Criteria

Eligibility for the Nevada Tax Exempt Certificate is determined by several factors. Generally, organizations must be recognized as tax-exempt under federal law, such as 501(c)(3) non-profits. Other qualifying entities may include government agencies and certain educational institutions. Additionally, applicants must demonstrate that their purchases will be used in a manner consistent with their tax-exempt status. It is advisable to consult the Nevada Department of Taxation for detailed eligibility requirements.

Required Documents

When applying for the Nevada Tax Exempt Certificate, several documents are typically required. These may include:

- Proof of tax-exempt status, such as a 501(c)(3) determination letter.

- Identification documents for the authorized representative of the organization.

- Any additional documentation that supports the application, such as organizational bylaws or mission statements.

Having these documents ready can streamline the application process and improve the chances of timely approval.

Quick guide on how to complete application for salesuse tax exemption app 0201 nevada

Your assistance manual on how to prepare your Nevada Tax Exempt Certificate

If you’re wondering how to fill out and submit your Nevada Tax Exempt Certificate, here are a few brief recommendations on how to simplify tax filing.

To get started, simply create your airSlate SignNow profile to change the way you manage documents online. airSlate SignNow is an intuitive and powerful document solution that enables you to edit, draft, and finalize your income tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures, and revert to modify details as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Nevada Tax Exempt Certificate in no time:

- Set up your account and start handling PDFs within a few minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to open your Nevada Tax Exempt Certificate in our editor.

- Provide the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding eSignature (if needed).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this guide to file your taxes online with airSlate SignNow. Remember that paper filing can lead to more mistakes on returns and delay refunds. It’s advisable to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct application for salesuse tax exemption app 0201 nevada

Create this form in 5 minutes!

How to create an eSignature for the application for salesuse tax exemption app 0201 nevada

How to generate an eSignature for the Application For Salesuse Tax Exemption App 0201 Nevada in the online mode

How to make an eSignature for the Application For Salesuse Tax Exemption App 0201 Nevada in Chrome

How to create an electronic signature for putting it on the Application For Salesuse Tax Exemption App 0201 Nevada in Gmail

How to generate an electronic signature for the Application For Salesuse Tax Exemption App 0201 Nevada from your smart phone

How to generate an eSignature for the Application For Salesuse Tax Exemption App 0201 Nevada on iOS devices

How to make an eSignature for the Application For Salesuse Tax Exemption App 0201 Nevada on Android devices

People also ask

-

What is an NV tax exemption form?

The NV tax exemption form is a document used by eligible businesses and organizations in Nevada to claim exemptions from certain state taxes. This form is essential for entities that qualify under specific categories set by the state tax authorities. Understanding how to complete and submit the NV tax exemption form correctly is crucial for ensuring compliance and maximizing tax benefits.

-

How can airSlate SignNow help with the NV tax exemption form?

AirSlate SignNow provides a streamlined platform for completing and eSigning the NV tax exemption form. With its user-friendly interface, businesses can easily upload necessary documents, fill in required information, and obtain signatures in a secure and efficient manner. This saves time and reduces the frustration associated with traditional paper-based processes.

-

Is airSlate SignNow a cost-effective solution for eSigning the NV tax exemption form?

Yes, airSlate SignNow offers a cost-effective solution for managing the NV tax exemption form and other documents. With competitive pricing options, businesses can enjoy unlimited eSigning capabilities without breaking the bank. This affordability makes it accessible for small to medium-sized businesses looking for efficient tax compliance solutions.

-

What features does airSlate SignNow offer for managing the NV tax exemption form?

AirSlate SignNow includes a range of features tailored for managing the NV tax exemption form, such as customizable templates, secure storage, and audit trails. Users can also track the status of their eSignatures in real-time, ensuring that all parties involved are up-to-date. These features enhance productivity and streamline workflows for businesses.

-

Can I integrate airSlate SignNow with other tools for handling the NV tax exemption form?

Absolutely! AirSlate SignNow offers seamless integrations with various CRMs, cloud storage, and productivity tools, which can signNowly enhance the process of handling the NV tax exemption form. By connecting your existing tools, you can improve collaboration and data management, making the eSigning process even more efficient.

-

What are the benefits of using airSlate SignNow for the NV tax exemption form?

The benefits of using airSlate SignNow for the NV tax exemption form include increased efficiency, reduced turnaround times, and improved compliance. By digitizing the signing process, businesses experience fewer delays and potential errors associated with paper forms. This leads to a smoother experience when claiming tax exemptions.

-

Is there customer support available for issues related to the NV tax exemption form?

Yes, airSlate SignNow provides robust customer support to assist users with any issues related to the NV tax exemption form. Whether you have questions about the platform's functionality or need help with a specific document, their support team is readily available through various channels. This ensures you receive the assistance you need promptly.

Get more for Nevada Tax Exempt Certificate

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497427453 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497427454 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497427455 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497427456 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497427457 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497427458 form

- Letter from landlord to tenant for failure to use electrical plumbing sanitary heating ventilating air conditioning and other 497427459 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497427460 form

Find out other Nevada Tax Exempt Certificate

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement